AECOM ACM, a global leader in infrastructure, has been selected by Austin Transit Partnership ("ATP") as the delivery partner for Phase 1 of the citiy’s first light rail transit system. The project will introduce a 10-mile light rail system with 15 stations, enhancing connectivity and mobility across the region. AECOM will manage key aspects, including program oversight, environmental services, design management, rail activation and operational readiness.

The company will also lead a technical team of sub-consultants that includes Disadvantaged Business Enterprise (“DBE”) firms. By partnering with DBE firms, AECOM aims to provide opportunities for socially and economically disadvantaged individuals to participate in the project.

AECOM’s Leadership in Advancing Austin’s Light Rail Project

Global transportation leader, AECOM plays a key role in advancing Austin's first light rail transit system in partnership with ATP. Cities across the United States are making significant investments in rail infrastructure and Austin is leading the way. This project is set to improve connectivity, stimulate economic growth, protect the environment and promote a sustainable future.

The company's program management expertise will support the growth of Austin’s transit network. AECOM’s proven experience in managing large-scale global transit programs will help meet the city's growing need for reliable and accessible transportation, benefiting both residents and surrounding communities.

AECOM’s Contribution to Austin’s Strategic Mobility Goals

The Austin Light Rail is an essential component of the City’s broader Austin Strategic Mobility Plan, which aims to improve the accessibility and connectivity of the local transportation network. The new rail system will connect key locations across the city, including Lady Bird Lake, downtown Austin and the University of Texas. Plans for future expansion will extend the rail to major hubs in the north and to Austin's airport in the south.

AECOM's role in this project supports the city’s growing population and mobility needs. Its selection indicates shared values and a strong partnership, reinforcing the company's commitment to enhancing Austin's transportation infrastructure.

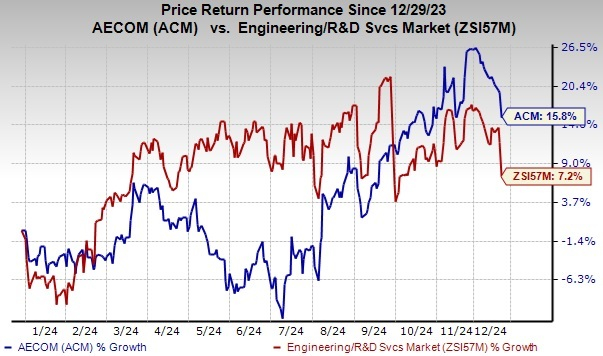

AECOM Stock’s Price Performance

Image Source: Zacks Investment Research

Shares of this solutions provider for supporting professional, technical and management solutions have gained 15.8% in the year-to-date period, outperforming the Zacks Engineering - R and D Services industry’s 7.2% growth. With the $1.2 trillion IIJA funding accelerating in the United States and the U.K. government prioritizing investments in infrastructure, led by the transportation and water markets, the company’s growth prospects in the market seem encouraging.

As of the fourth quarter of fiscal 2024-end, the total backlog was $23.86 billion compared with $23.16 billion in the prior-year period. The current backlog level includes 50.8% contracted backlog growth. AECOM’s ability to consistently secure large, complex projects underpins its competitive advantage. The company maintains a win rate of more than 50% for large pursuits, which rises further for projects exceeding $25 million.

AECOM’s Zacks Rank & Other Key Picks

Currently, AECOM carries a Zacks Rank #2 (Buy).

Here are some other top-ranked stocks from the Construction sector.

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It delivered a trailing four-quarter earnings surprise of 21.5%, on average. Shares of STRL have gained 50.3% in the past six months. The Zacks Consensus Estimate for STRL’s 2025 sales and EPS implies an increase of 7.3% and 8.1%, respectively, from the prior-year levels.

Comfort Systems USA, Inc. FIX currently sports a Zacks Rank of 1. FIX delivered a trailing four-quarter earnings surprise of 14.7%, on average. The stock has gained 37.6% in the past six months.

The consensus estimate for FIX’s 2025 sales and EPS indicates an increase of 7.9% and 20.8%, respectively, from a year ago.

MasTec, Inc. MTZ presently sports a Zacks Rank of 1. MTZ delivered a trailing four-quarter earnings surprise of 40.2%, on average. The stock has gained 18.3% in the past six months.

The Zacks Consensus Estimate for MTZ’s 2025 sales and EPS indicates an increase of 8.6% and 45.5%, respectively, from a year ago.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAECOM (ACM) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.