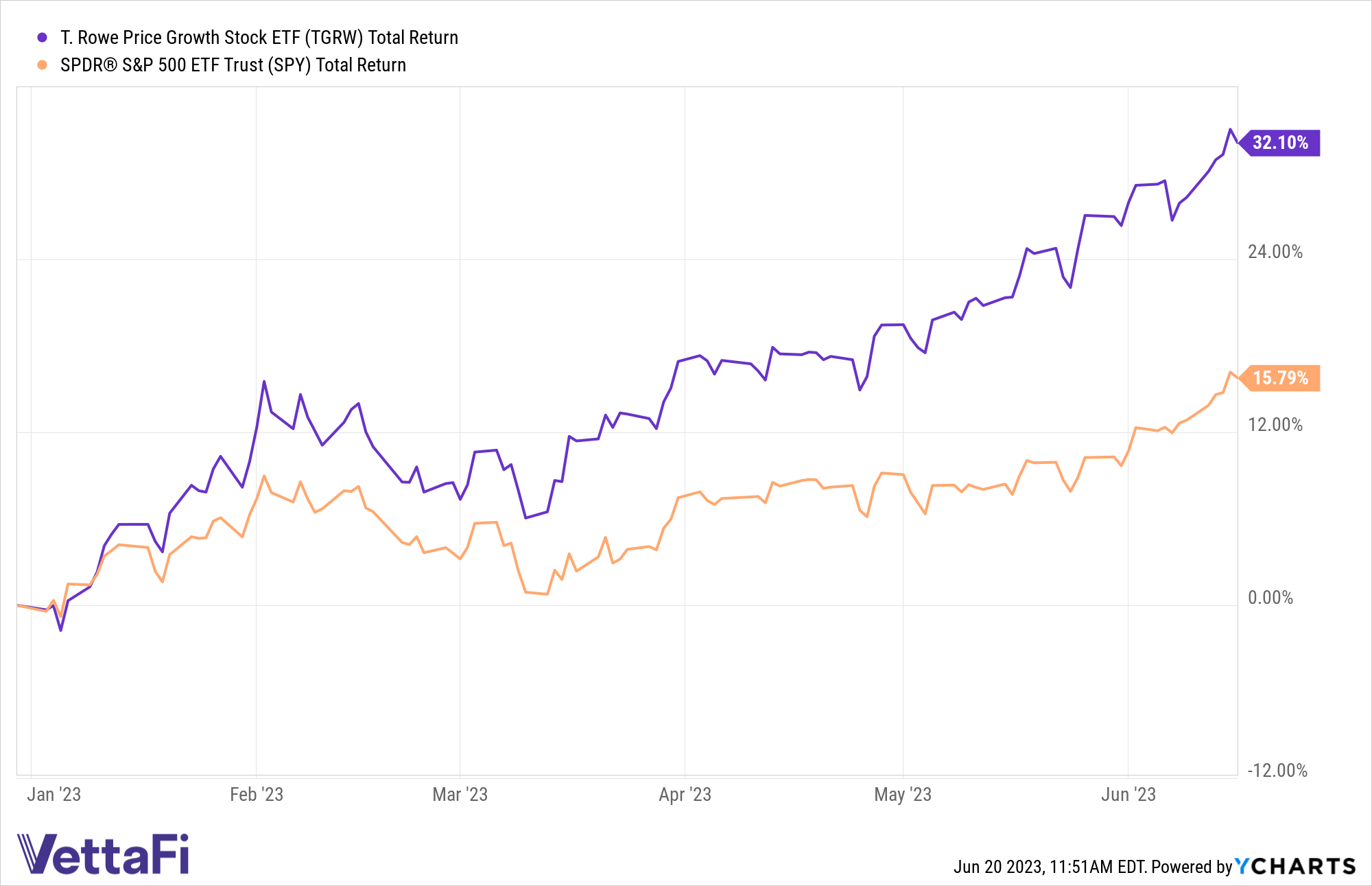

With half of 2023 already in the books, active ETFs are still performing well among advisors, likely due to strong returns. Whether thanks to managers helping active ETFs outperform or their ability to navigate volatility, actives are riding a popular wave. Perhaps no ETF exemplifies the year in actives more than the T. Rowe Price Growth Stock ETF (TGRW). The active growth ETF has doubled up on the performance of the SPDR S&P 500 ETF Trust (SPY) YTD.

See more: “T. Rowe Launches 5 Active Transparent ETFs”

It has done so by returning a healthy 32.1% YTD compared to just 15.8% for SPY, according to YCharts. TGRW has also outperformed SPY over the last year on a percentage basis, too, returning 28.6% to SPY’s 22.1%. Those kinds of returns come with TGRW not even operating for three years yet. TGRW is set to hit its three-year milestone this coming August, nearly at $50 million in AUM.

[caption id="attachment_523419" align="aligncenter" width="625"] TGRW has more than doubled SPY's YTD normalized returns.[/caption]

TGRW has more than doubled SPY's YTD normalized returns.[/caption]

With ETFs that hit that three-year mark sometimes adding flows, now may be the time to look closer. TGRW has already grown its AUM by nearly $11 million over six months thanks to both flows and price influence.

So how does it work? TGRW invests in firms that meet some important growth characteristics. Those include strong cash flow, above-average earnings growth rate, earnings momentum stability, and more. Based on the last proxy portfolio information, TGRW includes mega-cap names as well as 2023 stars like Nvidia (NVDA).

All of this comes at the competitive cost of 52 basis points. TGRW also can boast a staggering tech chart. The active growth ETF cost $27.18 as of Tuesday and sat well above both of its Simple Moving Averages (SMA). That price sits higher than the $25.17 50-day SMA and the $22.82 200-day SMA. While that has lifted the ETF into “overbought” territory if viewing the ETF as a standalone security on the Relative Strength Index, those tech indicators can also suggest solid momentum for the overall portfolio.

For more news, information, and analysis, visit the Active ETF Channel.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.