With multiple COVID-19 vaccines being distributed across the world, companies focused on other medical conditions are now grabbing the Street's attention. One such disorder is diabetes, which is growing rapidly worldwide—sedentary lifestyles being a key reason for that. A recent report by the World Health Organization (WHO) revealed that deaths from diabetes surged 70% globally between 2019 and 2020.

Abbott and Dexcom are some of the names that are developing diabetes monitoring systems. Using the TipRanks Stock Comparison tool, we will place Abbott and Dexcom alongside each other and pick the stock reflecting a more compelling play.

Abbott Laboratories (ABT)

Abbott has a diversified business that includes four segments: Medical Devices, Diagnostics, Nutrition and Established Pharmaceutical Products (which generates revenue from the sale of branded generic pharmaceutical products outside of the US).

Since the pandemic's onset, Abbott has been in the news for the multiple COVID-19 tests developed by the company. Most recently, BinaxNOW COVID-19 Ag Test Card was granted the FDA’s emergency use authorization for virtually guided at-home use.

Coming to diabetes, Abbott sees tremendous growth in the area, especially through its FreeStyle Libre technology, which is a sensor-based continuous glucose monitoring system. Sales of FreeStyle Libre systems grew 37.9% in 3Q 2020.

Moreover, in 3Q 2020, the company’s FreeStyle Libre 3 system secured CE Mark for use by diabetic patients in Europe. The FreeStyle Libre 3 provides real-time glucose readings automatically delivered to the user’s smartphone every minute, offering unsurpassed 14-day accuracy and real-time glucose alarms. The company also won CE Mark for its Libre Sense Glucose Sport Biosensor, which helps athletes “better understand the efficacy of their nutritional choices on training and athletic performance.”

Furthermore, Abbott’s FreeStyle Libre 2 received approval in December 2020 by Health Canada for adults and children (4 and older) with diabetes. (See ABT stock analysis on TipRanks)

Last month, Raymond James analyst Jayson Bedford reiterated a Buy rating for Abbott following a call with the company’s management. Bedford stated that the company is working through the reimbursement channels in Europe and expects to launch Libre 3 in the “coming months,” while the analyst had anticipated a December launch.

Bedford also specified that management did not lay out a timeline for Libre 3 roll out in the US, but he estimates the launch could happen in 2021. The analyst also noted that the app for the Libre 2 system has not yet been approved, but management is optimistic about the submission.

Commenting on the prospects of the COVID-19 testing portfolio, Abbott’s management anticipates the testing market to remain strong into mid-2021 and then start to decline in the second half of this year.

To back his bullish stance on Abbott, the analyst concluded, “The 'third wave' of CV-19 has raised the near-term uncertainty level (for the group), but ABT remains well positioned given its diversified portfolio, and the CV-19 testing tailwind, which lessens the near-term risk profile. Management is executing well, and enters 2021 with momentum.”

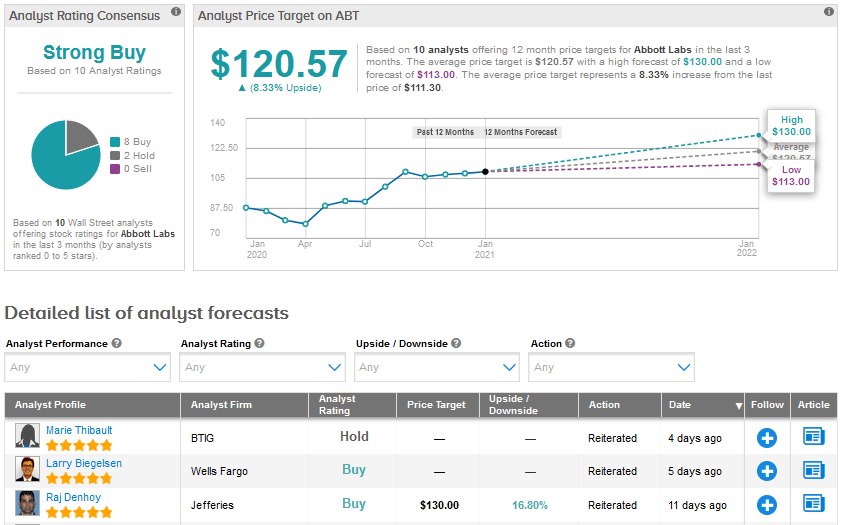

Overall, consensus among analysts is a Strong Buy based on 8 Buys versus 2 Holds. Abbott shares have risen 25.1% over the past year and the average price target of $120.57 suggests upside potential of 8.3% in the months ahead.

Dexcom (DXCM)

Diabetes is growing rapidly and so is the need for continuous glucose monitoring (CGM) systems, which Dexcom specializes in. The company's G6 CGM system is FDA-permitted for use by people with Type 1 and Type 2 diabetes.

Last week, the company announced better-than-anticipated preliminary results for 4Q 2020, which calls for revenue to meet or exceed $567 million. This implies year-over-year growth of 23%, with U.S. revenue expected to rise about 20% to $451 million and international revenue to grow about 33% to $116 million. (See DXCM stock analysis on TipRanks)

Overall, the company expects to meet or exceed revenue of $1.925 billion in 2020, reflecting a gain of over 30%. As for the initial 2021 outlook, Dexcom calls for top-line growth in the range of 15%-20%. The company’s outlook is based on an increase in its sensor volumes, driven by the growing CGM awareness for people with Type 1 and Type 2 diabetes, continued expansion beyond the US, shifting channel mix and overall market dynamics.

Covering Dexcom for Oppenheimer, analyst Steven Lichtman notes that the company’s international business was the primary driver of the revenue beat, owing to new initiatives including direct-to-consumer and e-commerce channel.

Indeed, Dexcom is pursuing international growth and has extended its G6 CGM offering to additional markets, including the rollout in Belgium and Turkey in 4Q 2020.

Commenting on the 2021 outlook, Lichtman noted that the company has maintained a conservative stance when it comes to its guidance in the past two years. The analyst assumes that the impact of competition from Abbott's Libre franchise is factored into the forecast. He believes that growth drivers for 2021 include “big new opportunities in T2 [Type 2 diabetes] and international expansion along with the G7 launch.”

On the 3Qearnings call Dexcom stated that it expects to launch G7 in several key markets in the second half of 2021, and then expand its reach into all of its core markets in 2022.

Overall, Lichtman continues to be bullish on Dexcom and maintained a Buy rating with a $445 price target.

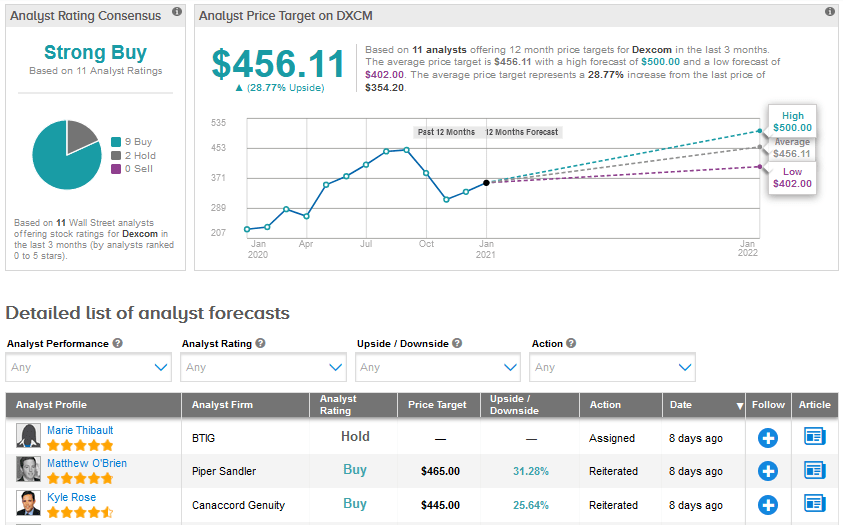

Currently, Dexcom scores a Strong Buy analyst consensus based on 9 Buys and 2 Holds. The average price target stands at $456.11, indicating upside potential of 28.8% from current levels. Shares have already risen 53.5% over the past 52 weeks.

Bottom line

Abbott’s diversified business model and exposure to major growth areas like diabetes are its key strengths. Dexcom is completely focused on meeting the growing need for its CGM systems in the domestic as well as international markets. While the Street is bullish on both companies, right now, the average price target indicates a higher upside potential for Dexcom stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.