Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Advanced Micro Devices (NASDAQ:AMD) are among the widely discussed stocks on the social media platform Reddit. While these top technology stocks are buzzing on Reddit and have significantly gained mentions, they have appreciated quite a lot on a year-to-date basis. Despite the rally in their prices, analysts’ average price targets indicate further upside in these stocks.

Against this backdrop, let’s delve into these trending Reddit stocks.

Can Apple's Stock Keep Going Up?

Apple stock has gained about 47.56% year-to-date. However, its stock is down over 2% in after-hours trading following its third-quarter financial results. Though its earnings came ahead of the Street’s projection, the decline in sales of the iPhone, iPad, and Mac didn’t go well with investors.

The decline in sales reflects tough year-over-year comparisons and macro uncertainty. Nonetheless, its Services revenue reached $21.2 billion, driven by more than one billion paid subscriptions.

Following Q3 earnings, Goldman Sachs analyst Mike Ng reiterated a Buy recommendation on Apple stock on August 3. The analyst said that “certain elements of F3Q23 results were disappointing vs. Consensus.” Nevertheless, the company’s growing installed base of paid subscriptions will drive “secular growth in Services” and support its premium valuation.

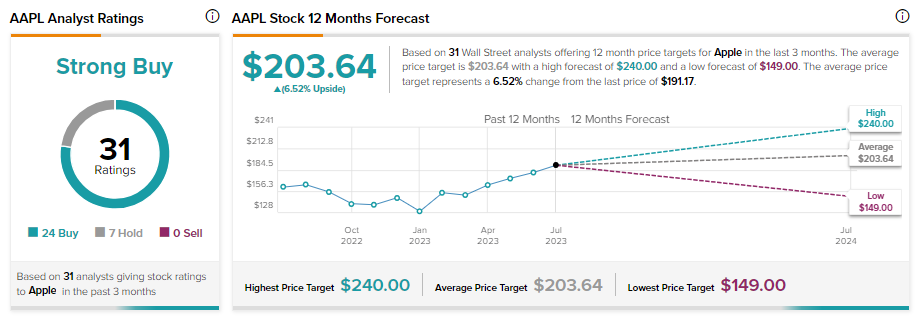

Overall, Apple stock has received 24 Buy and seven Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $203.64 implies 6.52% upside potential from current levels.

Is Amazon Stock Expected to Rise?

Amazon stock has gained over 53% year-to-date. Further, the stock is up about 8.73% in after-hours trading following its solid second-quarter results. AMZN Q2 earnings crushed Wall Street’s estimates. Meanwhile, analysts’ average price target indicates that Amazon stock could rise more.

The increase in the e-commerce business, led by macro improvement and cost reduction measures, supported AMZN’s Q2 performance. Moreover, signs of stabilization in the cloud business (AWS) and ongoing momentum in its advertising segment position it well to deliver solid growth in the coming quarters.

Eric Sheridan of Goldman Sachs maintained his bullish view of Amazon stock following Q2 earnings results. The analyst expects the company to benefit from improving margins in the e-commerce business. Further, the ongoing digital transformation will support its AWS segment. At the same time, Amazon will also benefit from the growing scale of its advertising business.

Along with Sheridan, Jefferies analyst Brent Thill, Bernstein analyst Mark Shmulik, and Nicholas Jones of JMP Securities reiterated the Buy rating on AMZN stock following Q2 financial results.

Amazon stock has received a Buy recommendation from all 29 analysts who have recently rated it. Collectively, their 12-month average price target of $86.20 implies an upside of nearly 16%.

What is the Future of AMD Stock?

Shares of Advanced Micro Devices will likely benefit from the solid demand for chips that power AI (Artificial Intelligence) applications. At the same time, the recovery in PC demand will support its financials, in turn, its stock.

AMD recently delivered better-than-expected earnings. The company’s management expects the PC market to grow in the second half of 2023, which is encouraging. Additionally, the growing AI deployments in the data center market augur well for growth.

As AI presents a multibillion-dollar growth opportunity for the company, Tristan Gerra of Robert W. Baird reiterated a Buy on AMD stock on August 1. The analyst expects AMD’s gross margins to expand significantly in 2024, led by “the ramp of AI” and easier year-over-year comparisons in the Embedded segment (which includes embedded CPUs and GPUs).

Overall, AMD stock has a Strong Buy consensus rating on TipRanks, reflecting 25 Buy and six Hold recommendations. Analysts’ average price target of $142.51 implies 25.95% upside potential.

The Bottom Line

AAPL, AMZN, and AMD stocks are trending on Reddit and have multiple growth engines to drive their stock prices higher. In addition, analysts’ Strong Buy consensus rating supports the bull case. As these stocks appear to be attractive long-term bets, Wall Street analysts’ average price targets show that AMD offers the highest upside potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.