This week we saw the Aadi Bioscience, Inc. (NASDAQ:AADI) share price climb by 12%. But that's small comfort given the dismal price performance over the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 52% in that time. Some might say the recent bounce is to be expected after such a bad drop. Of course, it could be that the fall was overdone.

While the last year has been tough for Aadi Bioscience shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

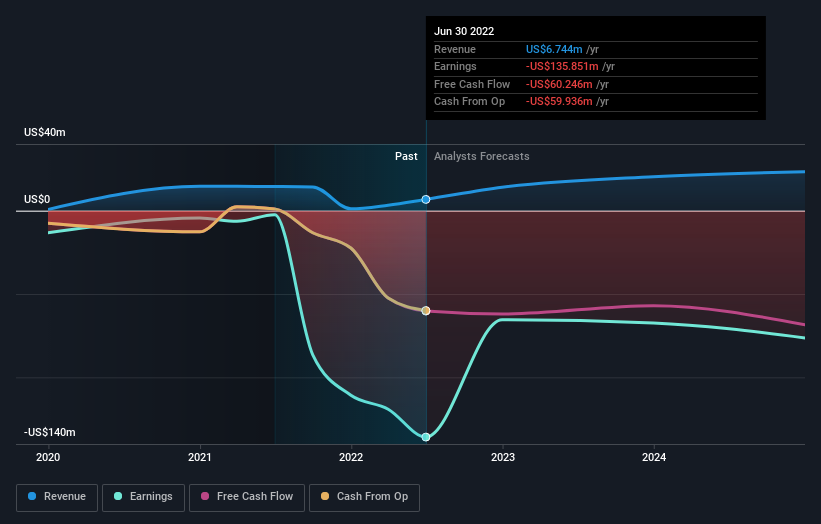

Because Aadi Bioscience made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Aadi Bioscience saw its revenue fall by 53%. If you think that's a particularly bad result, you're statistically on the money It's no surprise, then, that investors dumped the stock like it was garbage, sending the share price down 52%. Buying shares in loss making companies with falling revenue is often called speculation, not investing. So we'll be looking for strong improvements on the numbers before getting excited.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Aadi Bioscience's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Aadi Bioscience shareholders are happy with the loss of 52% over twelve months. That falls short of the market, which lost 19%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 4.2%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Aadi Bioscience that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.