As things stand right now, once every five or six weeks the stock market stops whatever it is doing and waits for the Federal Open Market Committee (FOMC) to end its meeting and report their decision on interest rates, along with their view of the economy and their intentions for the next meeting or two. Today is one of those waiting days, so what can investors expect from the Fed and, more importantly, from the market after the announcement?

Over the last few meetings, most people have gone into "Fed Day" with a pretty clear idea of what to expect from both the prepared remarks and from Fed Chair Jay Powell’s comments afterwards. After all, he had pretty much told us what the Fed intended to do each time, namely, raise rates by 75 basis points, or three quarters of a percent. There was some speculation in July that they might go for an even larger increase, and in September that they might point to smaller hikes to come. Neither of those things really materialized. Rather, Jay Powell stuck to his guns, raising rates by the expected amount, and indicating that they would stay the path while watching the data.

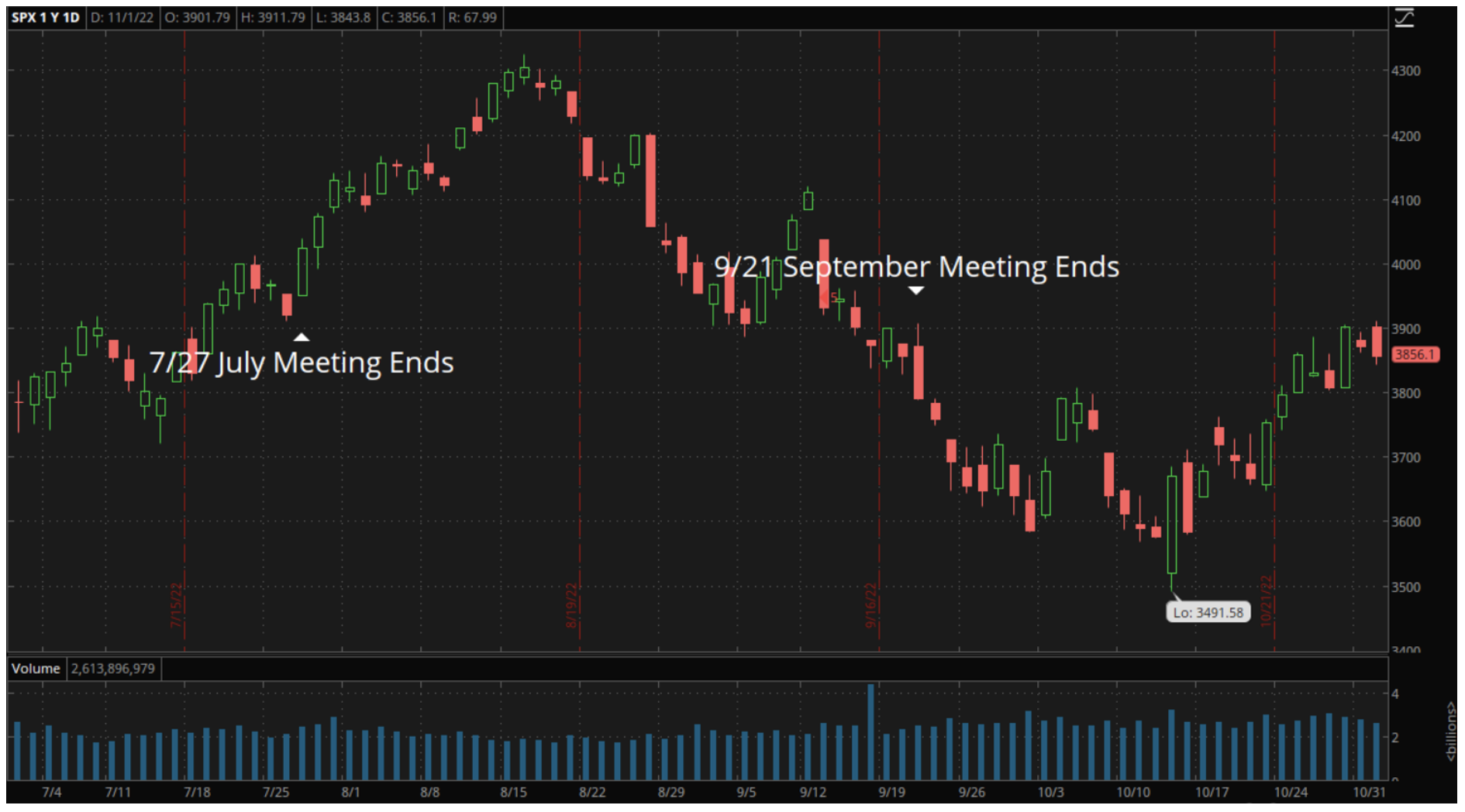

You might reasonably assume that “as expected” would produce little or no reaction in stocks in both cases, but you would be wrong:

Each announcement was followed by a two-week period of consistent movement, but in opposite directions, up in July and down in September. Looking back, it may seem a little strange that the same decision and basically the same outlook on each occasion would result in two opposite reactions from the market, but that just shows that the reaction of traders and investors wasn’t really about what was said, but what wasn’t said. In each case, there had been speculation about what might be said, and Powell disappointed. The reaction was about speculative positions being closed out, not about the actual outcome of the meeting.

So, how does that inform us about what to expect today?

Well, according to Bank of America's Chief U.S. Economist, Michael Gapen, as quoted in a report from CNBC, they, and the market, are expecting 75 basis point this time around, with an indication of 50 next month, then a slowing of the pace to 25 early next year to end up with short-term rates at 5%. Those are a pretty precise set of expectations, so there is a lot of room for disappointment or even a surprise.

The market bounced off the low on October 13, indicating that traders are expecting (or at least hoping for) a slightly more dovish stance from the FOMC this afternoon. That would indicate that the risk to stocks is to the downside and the data, such as this morning’s ADP private sector jobs report, which showed continued strength in the labor market and a 7.7 per cent increase in wages, seems to make that even more likely.

However, there has been at least a slowing in the rate of increase in inflation, which is the Fed’s main concern, so there are those who believe that they will at least sound a little more dovish this time around so as not to spook markets. That, though, presupposes that the Fed is opposed to further declines in stocks and that hasn't been the case. They are aware that a rising market creates a wealth effect that serves to further fuel demand, and therefore upward pressure on prices in an economy that is still seeing supply constraints.

On balance, a report and comments that produce an immediate negative response in stocks is more likely than one that prompts a rally, but for those still sitting with cash, that will be a buying opportunity if it materializes. The immediate disappointment will be followed by an increasing realization that the Fed does have an endpoint in mind, and will slow or even stop rate hikes early next year at the latest. Given that, continued jobs market strength raises hopes that they will be able to do what they set out to do without plunging the U.S. into a deep recession, and that could cause quite a strong rally once the dust settles.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.