A Simple, High Yield Strategy for Income Investors

Summary

• The Nasdaq-100 Index® (NDX) has proven to be one of the most efficient ways to invest in the new economy, generating impressive returns over the past decade.

• The CBOE Nasdaq-100 Buy-Write V2 Index (BXNT) is based on the Nasdaq-100 Index with the added benefits of providing income and downside protection.

• BXNT is a unique index that offers exposure to technology stocks along with high monthly income and reduced risk. The ETF that tracks the index is the Global X Nasdaq-100 Covered Call ETF (Nasdaq: QYLD1).

Update from the last edition

Since the first edition of this research published in 2017, we have witnessed a few dramatic market developments that have altered our macroeconomic inputs and outlook.

For starters, Jerome Powell became the 16th Chairman of the Federal Reserve in February 2018. Unlike his predecessor Janet Yellen, Powell is facing a more challenging economic environment with a late cycle US economic recovery amidst a more fragile global economy, largely triggered by the trade war.

Powell’s initial Fed policy was to continue Yellen’s goal of normalizing interest rates. But the Fed’s normalization policy eventually met resistance from both fixed income and equity investors. The US Treasury Yield Curve continued to flatten, with the 10Y 2Y spread becoming inverted by August 2019 and driving fears of recession. Equity markets have also been on a roller coaster, with the correction in the fourth quarter of 2018 the most severe post-Financial crisis. In addition to financial market turmoil, there has also been weakness in the real economy, with the weakest PMI reading in a decade during October 2019. Powell seems to have bowed to these pressures and has reversed course in the Fed’s normalization policy – at least temporarily - in order to “sustain growth.” The Fed has enacted two rounds of rate cuts already, and many market participants are expecting a third one in December. Additionally, the Fed is expanding its balance sheet once again with a goal of easing tensions in the repo markets – in a sense restarting “quantitative easing” – while assuring the public that it’s not meant to be “QE4.” But it’s still too early to tell if Powell’s tactics will be sufficient to stabilize the broader stock market and sustain the aging economic expansion.

Meanwhile, globally, most major central banks continue to miss their inflation targets despite low unemployment rates – a phenomenon that economists widely refer to as the “Death of the Phillips Curve.” Powell’s recent policy shifts, coupled with those of his global counterparts, support the theory that interest rates will remain lower for much longer. This makes BXNT’s high distribution yield very attractive in the current late-cycle, but still-dovish, Fed environment.

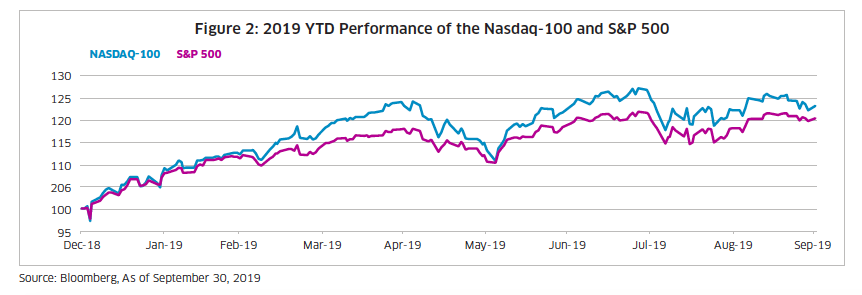

The Decade of the Nasdaq-100

Despite the fact that we are in a very different environment now than in 2017, the overall story for the Nasdaq-100 – now a full decade in the making – remains the same. The index has fully recovered from the Q4 2018 selloff, returning 23% year-to-date through September 30, 2019 (Figures 2). The Nasdaq-100 Index has consistently outperformed another major large cap equity market index, S&P 500, over a long time horizon (Figures 3). The underlying story for the rise in the Nasdaq-100 is that economic growth continues to shift from the traditional industries (e.g. Basic Materials and Oil & Gas) to the newer sectors (e.g. Health Care and Technology) (Figures 4 & 5). Consumer Services has also experienced exceptional growth, largely driven by a recovering US consumer coupled with industry leaders embracing the transformative trend of online shopping. Notably, Amazon (AMZN) is the largest Consumer Services holding in the Nasdaq-100.

A Structured, High Yield Nasdaq-100 Index

Growth strategies are often eschewed by income-oriented investors, who prefer regular dividend distributions. The Nasdaq-100 Index is currently paying a 1.04% annual dividend, and while growing significantly, it is still too low to meet many income investors’ needs.

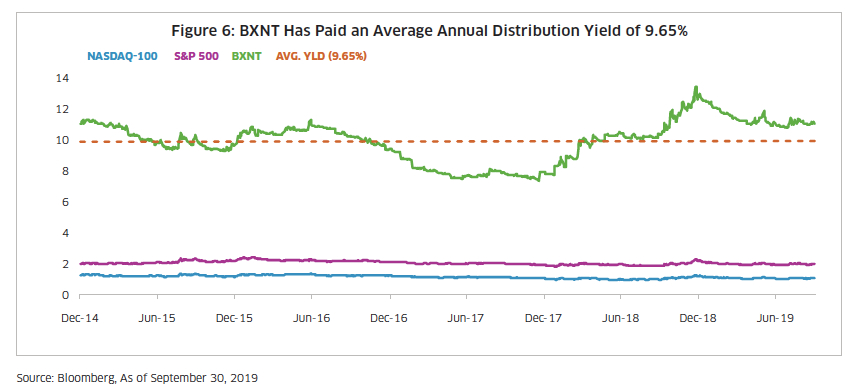

Income-oriented investors may instead consider integrating the CBOE Nasdaq-100 Buy-Write V2 Index (BXNT) into their current portfolios. BXNT tracks the performance of the Nasdaq-100 plus the returns on written (or sold) call options on the Nasdaq-100 Index. Buy-Write (or covered call) is an investment strategy used to enhance risk-adjusted returns and reduce volatility. With the added income from selling call options, BXNT investors have received an annual distribution yield of 9.65% since December 2014 (Figure 6).

Who should consider using the CBOE Nasdaq-100 Buy Write V2 Index? According to CBOE, a buy-write strategy is suitable for an investor who is neutral to moderately bullish and willing to limit upside potential in exchange for some downside protection. For example, the Nasdaq-100 closed at 7749 at the end of September. If an investor thinks the Nasdaq-100 has a minor probability to either advance or decline more than 5% in the next six months, then they should probably consider BXNT, which has generated a distribution yield of about 10.75% over the last 12 months. The following payoff analysis shows how a buy-write strategy can help investors protect against downside risk and still harvest a sizeable 5.37% income payoff by March 2020 (Figure 7). Even with a 5% decline in the underlying index, BXNT would still generate a slightly positive return of 0.37%. Of course, under an extreme scenario that sees the Nasdaq-100 (NDX) rising another 500 points to 8249 within six months, NDX would return 7% including dividends, whereas BXNT's returns would still be capped at 5.37%, thus underperforming its underlying index.

Click here to continue reading the full article.

Interested in learning more about the Nasdaq-100 Index? Visit www.Nasdaq.com/Nasdaq-100 or fill out the form below to receive NDX-related news and updates.

1. https://www.globalxetfs.com/funds/qyld/

Contact Us

Global Indexes