It so happens that the very first piece I contributed to Nasdaq.com, back in June of 2012, was about an internet-inspired short squeeze of silver. There were rumors back then that Wall Street had a massive short position and were trying to manipulate the market to protect it. If only all the little guys could get together and buy, they could put pressure on the big traders and force them to unwind and push the price of silver rapidly higher...

Sound familiar?

While a lot has changed in the nine years or so that I have been a contributor to Nasdaq.com, some things remain the same.

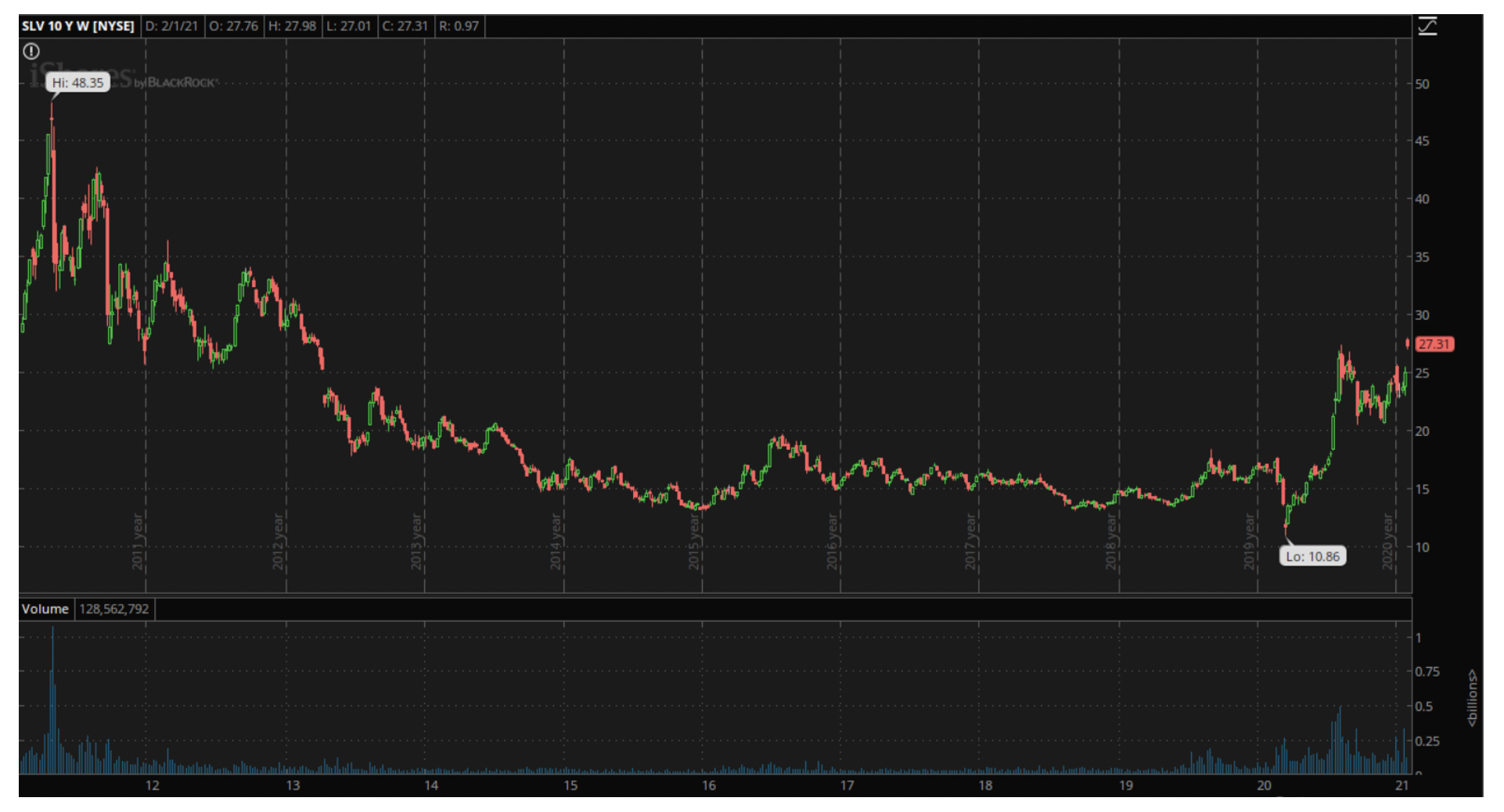

So, how did that effort nine years ago work out? On the day my article was published, the largest Silver ETF (SLV) closed at 33.36. It did move significantly higher over the next few weeks as all those “little guys” piled in, hitting a high of 42.78 two months later, so I guess the article did highlight a potentially profitable trade.

However, three weeks after hitting that high, SLV collapsed to a low of 27.41, and then continued to decline for another four years to around 13 dollars.

The thing is, those rumors may not have been 100% accurate, but the general idea that there were significant short positions out there was definitely true. There were some special circumstances that I talked about then that made it difficult for one particular player to give even the appearance of any kind of manipulation and increased the chance that if silver started to climb, they would be squeezed out. That set up a short-term, broader market squeeze, but ultimately, those short sellers were right. Silver was oversupplied at the time and once all the volatility ended, was inevitably headed lower.

Silver’s supply and demand characteristics often make it seem as if demand is about to jump, sending prices higher. In some people’s minds, silver is linked to gold, but their demand characteristics are very different. I have said in the past that gold is the Kardashian of investments: it is beautiful to look at and fascinating to follow, but is of very little fundamental use to society. Silver, on the other hand, is actually useful.

It is one of the best-known conductors of heat and electricity. That means that it is traditionally used in a vast array of technological devices, from cell phones to solar panels. Logically, because of that, you would have expected it to have appreciated massively in price since 2012 as all of those things took off. In 2012, for example, there were just over 680 million cell phones sold, versus over 1.5 billion last year. The growth in solar panels has been even more spectacular, and when other electronics are added in, you would have thought that the demand for silver would have exploded and price to have gone with it.

You would be wrong.

That is because of something very important: innovation. As output of electronics and solar panels has increased, so have production techniques improved to reduce the usage of silver, one of the most expensive components of the items concerned. According to the Silver Institute, industrial demand for silver increased by only around 25 million ounces, or just over 5%, from 2012 to 2020, despite the exponential growth in production of cell phones and solar panels. At the same time, demand in another previously significant area, photography, collapsed. Overall, supply increased to meet an expected increase in demand.

That’s why the 10-Year chart for SLV looks like this:

The point is that then, like now, there was an opportunity for a short-term squeeze, but for those that took part in that squeeze, the timing of the exit was at least as important as the timing of the entry. The long-term case for silver looked strong back then, as it does now, but once the squeeze was over, the price still collapsed. It could well do the same again.

So, assuming that you are aware of the risk of joining in the squeeze and can readily bear the potential losses, have at it. If you do, though, understand that it is a trade, not an investment, and as with any trade, you must have a clear exit strategy, and stick to it.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.