A Practitioner’s Guide to Multi-Factor Portfolio Construction

- By Richard Lin, CFA, Nasdaq Global Information Services

Summary

- Diversifying with multi-factor approaches can better help factor investors harvest more robust, long-term alpha.

- There are three common approaches to construct multi-factor portfolios: Heuristic, Optimized or Risk-Based.

- The Heuristic approach uses equally weighed factor scores to pick stocks. It is the simplest construction; however it may have higher tracking errors, is not as efficient in generating alpha, and has the worst risk-adjusted performance.

- The Optimized approach tries to solve a security-based large-scale mean-variance optimization. It can lead to a black-box problem due to the model complexity. Modeling security correlation is also very difficult and can significantly lower the reliance of optimization process.

- The Risk-Based approach models the portfolio expected return on a weighted basket of factor risk premiums. The factor loadings are time-varying and selected based on portfolio managers’ views about the factor performance, risk budget and internal / external investment resources.

- In the last section of the paper, we presented a Risk-Based Multi-factor model portfolio that outperformed both the benchmark and the equal factor weighted model. If managing with beta exposure, the enhanced model can improve the total return with only marginal increase of volatility, and hence further improve the risk-adjusted performance.

Introduction to Factor Investing

Investors are increasingly adopting an alternative weighted indexing approach to traditional capital weighting. Factor Investing, a.k.a. Smart Beta based strategies, are growing at a tremendous pace and have won investors’ hearts.

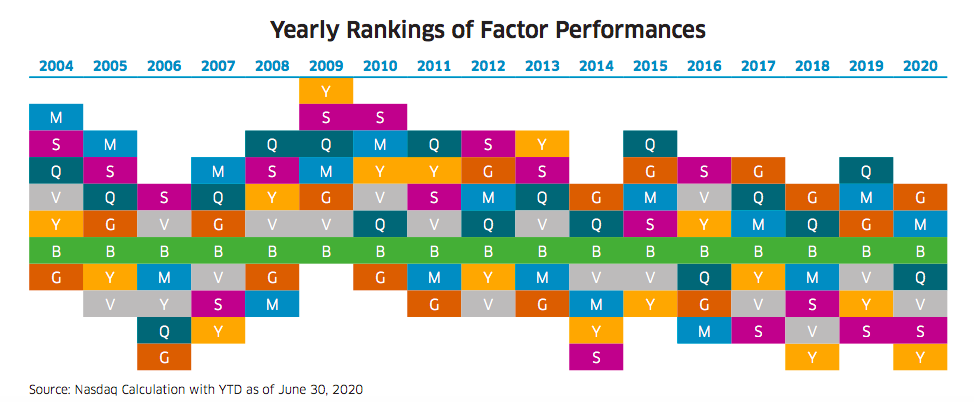

Mark Marex, CFA, my colleague at Nasdaq, recently published an excellent article to explain what factors are and how to invest in them.1 He describes factors as the “drivers of success” and building blocks in investment returns. Just like in many team sports, coaches need to pick the “right” players for the “right” game, investors shouldn’t expect any one single factor to win every time, but should consider employing a multi-factor approach for a more persistent, long-term outperformance over the benchmark.

In this paper, we try to summarize the best practices of multi-factor portfolio construction given Nasdaq’s more than a decade’s dedication to the smart beta indexing business and our continuous collaborations and partnerships with industry’s leading asset managers.

1. Factor 101: What is a Factor, and How/When/Why to Invest in One? Mark Marex, CFA (2019).

2. Since Dorsey Wright Technical Leaders Index history starts from 2007, we used another similar Dorsey Wright Index, Dorsey Wright Dynamic Focus Five Total Return Index (DWANQDFFT), to extend the return history.

Other Topics

IndexesContact Us for More Information

Index Licensing