Nasdaq Q-50 Index (NXTQ) was launched in October 2007 as an advanced tool to track the securities that are next in line for inclusion in the Nasdaq-100 Index. Over the last12 years, it has emerged as an index which focuses on innovation and growth as its two key elements, successfully bringing forth some of the world’s high-growth advanced companies.

Here’s a closer look at the Nasdaq Q-50 Index.

During the launch of Nasdaq Q-50, Steven Bloom, senior vice president of Nasdaq, had said, “The Nasdaq Q-50 index is a new benchmark for some of the world's most up-and-coming growth companies. The index arms investors with a portfolio of some of Nasdaq's fastest growing companies in a diverse range of industries. The launch of the Nasdaq Q-50 Index represents a significant extension of Nasdaq's success in bringing attention to its largest and most liquid innovative growth companies.”

Nasdaq Q-50 Index is home to 50 of the most ‘eligible’ securities, which are likely to make their way into the Nasdaq-100 Index over time. The index combines high-growth, global-appeal, diversity, advancement and liquidity in one basket and could be considered as the ‘feeder index’ for the Nasdaq-100 Index, which constitutes companies such as Apple, Microsoft, Netflix, Starbucks, Tesla, Alphabet, Amazon, Intel, Facebook, PepsiCo, Cisco, NVIDIA, Adobe, Amgen, and Qualcomm, among others.

The Nasdaq Q-50 Index was launched with a base value of 150. It deploys the same methodology as the Nasdaq-100 Index for selecting its constituents, laying a special emphasis on companies that best represent innovation in their respective industries.

The process to become a part of the index begins by scrutinizing all the companies listed on the Nasdaq Stock Market. The companies which are included in Nasdaq Q-50 are screened using a similar criterion followed for Nasdaq-100 Index. However, there is a deeper focus to find the next-generation market leaders. Some of the criteria followed are exclusion of any companies which are classified as financials from eligibility according to the Industry Classification Benchmark (ICB). Further, the security should not be issued by an issuer currently in bankruptcy proceedings and should have an average daily trading volume of at least 200,000 shares. Based on such criteria, the top 50 names by market capitalization that are not currently in the Nasdaq-100 are included in this index.

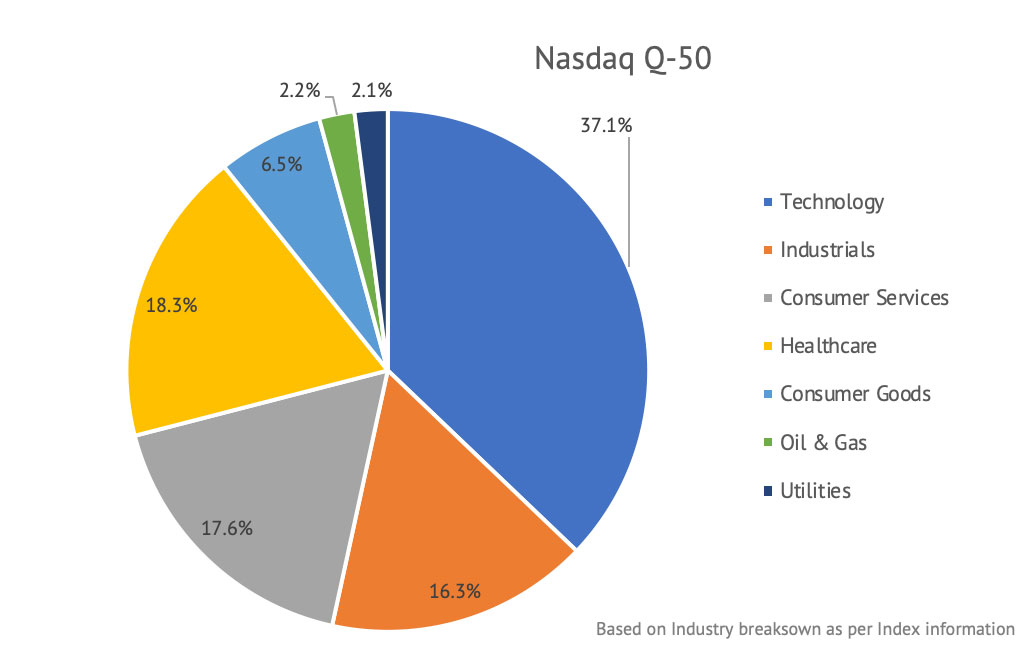

The Nasdaq Q-50 Index reflects companies across industries such as technology, industrials, consumer services, healthcare, consumer goods, oil & gas and utilities. While the financial industry is excluded, some other industries such as basic materials and telecommunications do not currently have an allocation. The weightage of the top four industries—technology, healthcare, consumer services and industrials—adds up to 89.2% of the index.

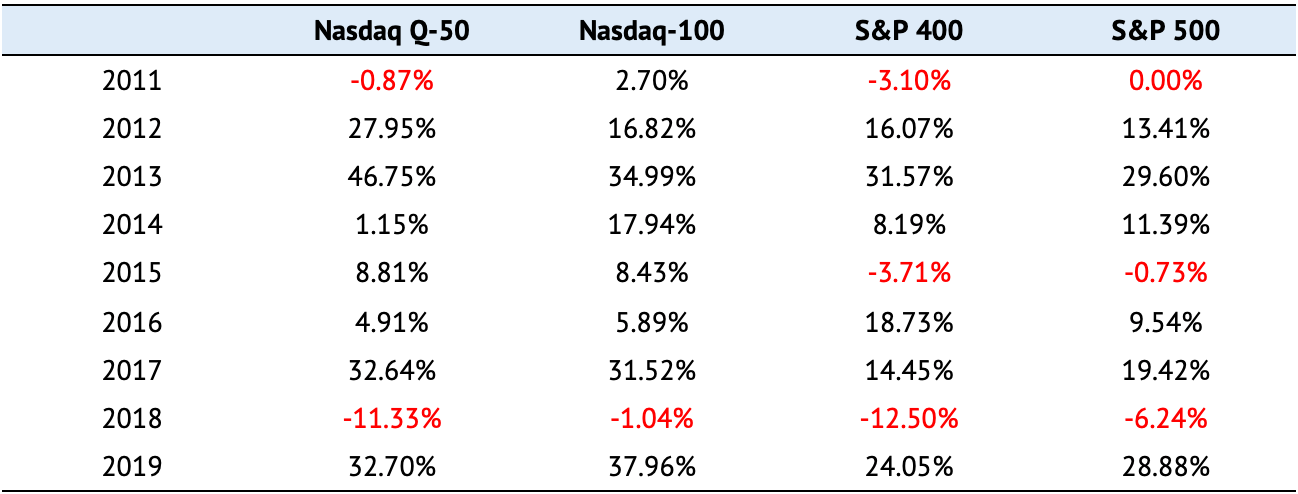

Mark Marex and Efram Slen at Nasdaq Global Information Services studied the cumulative performance of the Nasdaq Q-50 Index, alongside the Nasdaq-100 Index (NDX), S&P 500 (SPX), and S&P Midcap 400 (MID) Indexes, for the period from June 30, 2010 to June 30, 2019. They concluded that during that 9-year period, “the Nasdaq Q-50 outperformed the S&P 500 by 104% on a price basis, and its midcap cousin, the S&P Midcap 400, by 116%. While the Nasdaq Q-50’s price performance trailed the Nasdaq-100 over this period by 52%, the key benefit of the Nasdaq Q-50 is diversification into additional disruptive companies beyond the established, mega cap and large cap leaders in the Nasdaq-100.”

The table below reflects the yearly performance of Nasdaq Q-50 vis-à-vis the three Indices-Nasdaq-100, S&P 500 and S&P 400.

Facebook (FB) was part of the Nasdaq Q-50 before entering the Nasdaq-100 Index. It was originally added as a Nasdaq Q-50 constituent in September 2012, before it moved to the Nasdaq-100. Likewise, NXP Semiconductors (NXPI), Western Digital Corporation (WDC), American Airlines Group, Inc. (AAL), Electronic Arts, Inc. (EA), Expedia Group, Inc. (EXPE), JD.com, Inc. ADR (JD), MercadoLibre, Inc. (MELI), and Maxim Integrated Products, Inc. (MXIM) were part of Nasdaq Q-50 Index before moving to Nasdaq-100 Index.

Some of the top companies that constitute the Nasdaq Q-50 in terms of market capitalization currently are:

- Sanofi ADR (SNY)

- Pinduoduo Inc. (PDD)

- Atlassian Corporation Plc (TEAM)

- Liberty Broadband Corporation (LBRDK)

- IAC/InterActiveCorp (IAC)

- DexCom, Inc. (DXCM)

- Fortinet, Inc. (FTNT)

- DISH Network Corporation (DISH)

- Garmin Limited (GRMN)

- Marvell Technology Group Limited (MRVL)

A list of all stocks constituting Nasdaq Q-50 can be found here.

Disclaimer: The author has no position in any stocks mentioned. Investors should consider the above information not as a de facto recommendation, but as an idea for further consideration. Index returns based on historical data from respective websites of Indices. Industry break-up as on January 14, 2020. The report has been carefully prepared, and any exclusions of names or errors in reporting are unintentional.

Notes: The Nasdaq Q-50 Index is subjected to a quarterly evaluation and the review for eligible Nasdaq-100 Index Securities is performed on a monthly basis. Under this scenario, it is possible that a security may be added to the Nasdaq-100 Index intra-quarter without being a constituent of the Nasdaq Q-50 Index at the time of addition to the Nasdaq-100 Index.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.