We are in the initial stages of the first-quarter 2024 earnings season. The earnings results and management guidance will be crucial for market participants to gauge the health of the U.S. economy.

As of Apr 12, 30 companies on the S&P 500 Index have reported their financial numbers. Total earnings for these 30 index members are up 21% from the same period last year on 5.8% higher revenues, with 80% beating EPS estimates and 56.7% beating revenue estimates.

At present, total earnings of the S&P 500 Index in first-quarter 2024 are expected to be up 2.9% on 3.8% higher revenues. This follows the 6.8% earnings growth on 4% higher revenues in fourth-quarter 2023 and 3.8% earnings growth on 2.2% higher revenues in third-quarter 2023.

Meanwhile, several large-cap stocks are set to beat on first-quarter 2024 earnings this week. A handful of them currently carry a favorable Zacks Rank. The combination of a favorable Zacks Rank and an earnings beat should drive their stock prices in the near-term.

Our Top Picks

We have narrowed our search to five large-cap stocks that are poised to beat on earnings results this week. Each of these stocks carries a Zacks Rank #3 (Hold) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

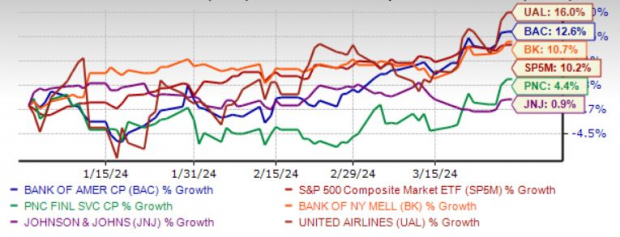

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Bank of America Corp. BAC sees improvement in capital market activities. However, the current challenging macroeconomic environment will likely continue to weigh on the Investment Banking (IB) business to an extent. While we expect BAC’s IB revenues to rise in 2024 but fall thereafter.

Higher rates and decent loan demand should aid net interest income (NII) growth of BAC, while higher funding costs would weigh on it. We expect NII to fall in 2024 and rise in 2025. The opening of financial centers and improved digital capabilities should support the top line. We project total revenues of BAC to grow 1% in 2024.

Bank of America has an Earnings ESP of +0.72%. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days. The company is set to release earnings results on Apr 16, before the opening bell.

Johnson & Johnson’s JNJ Innovative Medicine unit is performing at above-market levels. Its growth is being driven by existing products like Darzalex, Stelara, Tremfya and Erleada, and the continued uptake of new launches, including Spravato, Carvykti and Tecvayli.

The MedTech unit of JNJ is showing improving trends, driven by a recovery in surgical procedures and contribution from new products. JNJ is making rapid progress with its pipeline and line extensions.

Johnson & Johnson has an Earnings ESP of +1.95%. It has an expected earnings growth rate of 7.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days. The company is set to release earnings results on Apr 16, before the opening bell.

United Airlines Holdings Inc. UAL is burdened with expenses on the fuel as well as non-fuel front. The recent spike in oil prices does not bode well for UAL. The non-fuel unit cost for the March quarter is expected to increase in mid-single digits from the first-quarter 2023 levels due to high labor costs and low capacity.

Mainly due to high costs, UAL expects to incur loss in first-quarter 2024. Loss per share is expected between 35 cents and 85 cents. UAL’s efforts to modernize its fleet, however, bode well. Moreover, upbeat air travel demand in the post-COVID era, particularly on the domestic front, is aiding UAL.

United Airlines has an Earnings ESP of +8.20%. The company is set to release earnings results on Apr 16, after the closing bell.

The PNC Financial Services Group Inc.’s PNC solid loan and deposit balances and its strategic buyouts are likely to aid its financials. We expect total loans and deposits of PNC to witness a three-year CAGR of 3.5% and 1.1%, respectively, by 2026.

PNC’s sustainable capital distributions are likely to stoke investors’ confidence in the stock. Further, high rates will support NII but high funding costs will weigh on PNC. Though we expect the metric to dip 4.2% in 2024, it will rise 1.7% in 2025.

The PNC Financial Services has an Earnings ESP of +0.45%. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last seven days. The company is set to release earnings results on Apr 16, before the opening bell.

The Bank of New York Mellon Corp. BK may be hurt by elevated expenses, mainly due to technology upgrades. While we expect total non-interest expenses to fall in 2024, it will rise thereafter. Concentration risk arising from BK’s significant dependence on fee-based revenues is a woe.

Global expansion efforts, robust assets under management balance, digitization of operations and solid balance sheet will likely keep aiding revenues of BK. The business transformation plans of BK will bolster market share, leading to higher profit margins.

The Bank of New York Mellon has an Earnings ESP of +0.44%. It has an expected earnings growth rate of 5.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.8% over the last seven days. The company is set to release earnings results on Apr 16, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpBank of America Corporation (BAC) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.