Bitcoin’s latest surge in price and popularity has once again made the world’s largest cryptocurrency a hot conversation topic among advisors and their clients.

Just like in 2017, when the USD value of one Bitcoin briefly neared $20,000, its astronomical performance that is driving the conversation. With Bitcoin having nearly reached $65,000 per coin in April 2021, and despite price volatility since then, the IRA-friendly Grayscale Bitcoin Trust (GBTC) is welcoming advisor assets with open arms.

Need a quick Bitcoin refresher? Click here if you endured your nephew’s holiday tirade about cryptocurrencies being the future, but didn’t learn a thing.

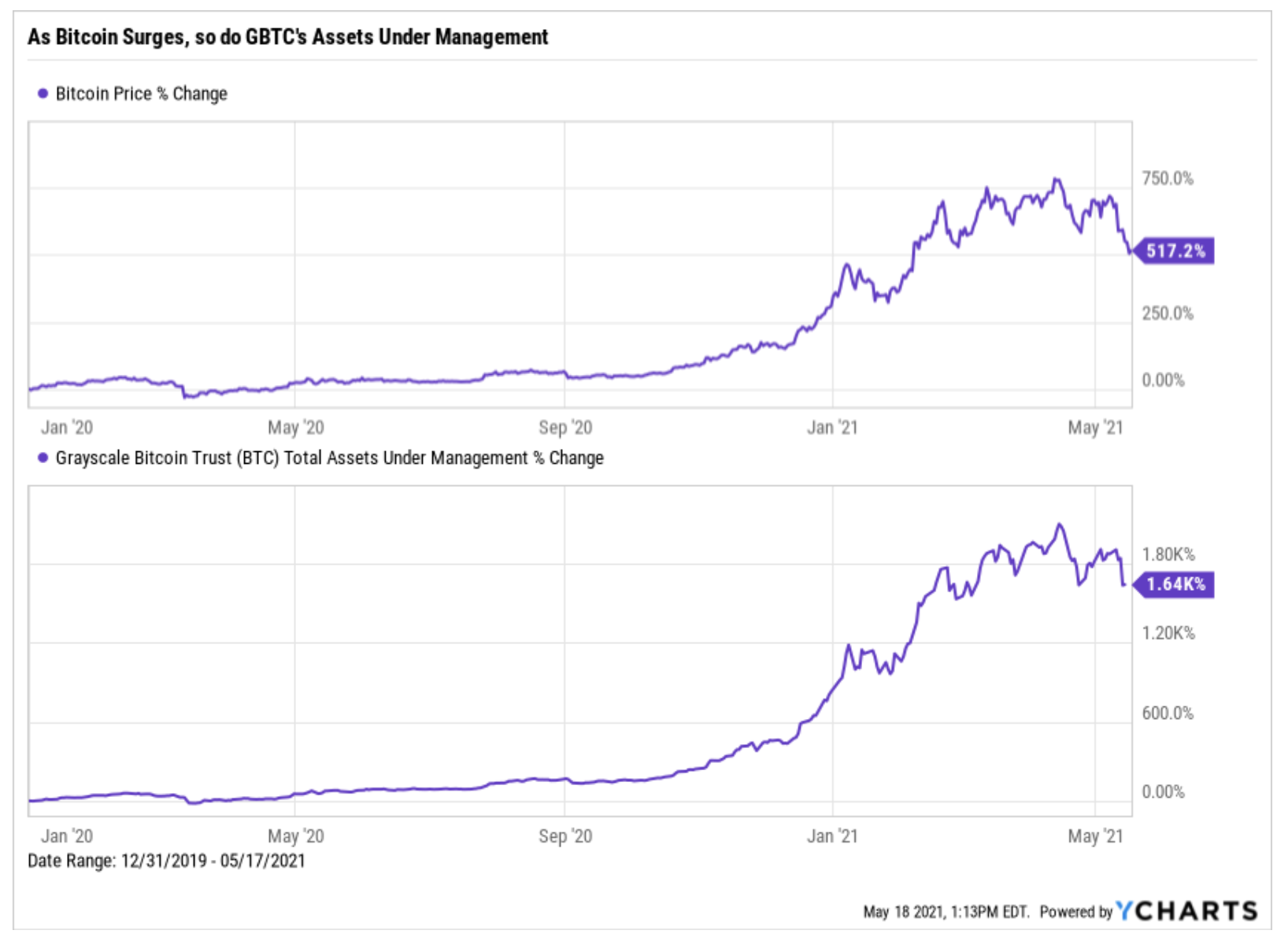

Bitcoin’s performance is driving demand for cryptocurrency products

Though it suffered a catastrophic 50% drawdown in March 2020 (like most assets), Bitcoin’s performance since then has been nothing short of spectacular (also like most assets). Early crypto adopters were rewarded with a 517% return through mid-May, but the timeframe was even better for asset manager Grayscale, whose Bitcoin Trust grew assets under management by 1,640%.

Download Visual | Modify in YCharts

Even if you can stomach Bitcoin’s famous volatility—just look at the price trend above since 2021 began—two mountain-sized hurdles have made it difficult for traditional financial advisors and their clients to invest in Bitcoin or any cryptocurrencies.

The first hurdle is custody, due to the decentralized exchanges on which Bitcoin and other cryptos trade, and the second is regulation—without clear and complete guidance from the SEC or FINRA, why dip your toes into the boiling hot lava?

So what utility does Bitcoin serve? Store of value, payment facilitator, speculative asset… There is no shortage of opinions about Bitcoin’s current, future, or ideal function in the world. But the use case for the Grayscale Bitcoin Trust is much more clear: it provides Bitcoin exposure to institutional investors.

Advisors’ options for accessing Bitcoin

Understandably, many advisors are on the fence about Bitcoin (or they’ve hopped the fence and are sprinting away fast), but there’s a growing contingency of investment professionals who are coming around to the idea of digital assets in their clients’ portfolios. Other cryptocurrencies like Ethereum, Cardano, and Dogecoin have also attracted interest.

Based on some impressive number crunching and thought experiments, Nick Magguilli of Ritholtz Wealth Management is a born-again Bitcoin believer. His math led him to a general recommendation of 2% portfolio exposure for those who want to test the waters, but he notes some caveats in his blog.

So how can advisors add Bitcoin exposure to client portfolios? Here are five routes you can take, listed from easiest to most difficult to implement:

#1 — Grayscale Bitcoin Trust (GBTC) or Osprey Bitcoin Trust (OBTC) — often confused for ETFs, GBTC and OBTC are actually IRA-friendly trusts that invests in, and seeks to track the performance of, Bitcoin. Grayscale has a longer track record and more assets under management than Osprey, but Osprey’s expense ratio is less than half of the former’s.

#2 — Retail crypto custodians like Coinbase — there are a number of crypto custodians that also offer wallet and exchange services, like Coinbase (COIN), and charge a transaction fee for converting coins to USD (setting up an account on a client’s behalf is easy, but that process isn’t very scalable to if establishing a relatively small position for many clients).

#3 — Institutional custodians like Fidelity Digital Assets — Fidelity offers “enterprise-grade custody and execution services” for digital assets if you can meet the $100,000 minimum investment. There’s an expectation for other big names to foray into digital asset custody soon.

#4 — Digital wallet and exchange — hardcore cryptocurrency traders value security above all else. As such, they purchase coins on exchanges and self-custody them using “cold storage” (non-internet connected) hard drives.

#5 — Alternative Bitcoin plays, including mining and blockchain companies — Bitcoin Services (BTSC) offers Bitcoin escrow, Bitcoin mining and blockchain software development services, Marathon Digital Holdings (MARA) mines several crypto assets, and Coinbase operates the platform for exchanging cryptocurrencies, all of which are ways to gain Bitcoin exposure without owning actual coins.

Investors can also take advantage of Bitcoin ETFs via Canadian-listed companies such as the Bitcoin ETF CAD (EBIT.TO), Bitcoin ETF USD (EBIT.U.TO), BetaPro Bitcoin ETF (HBIT.TO), and 3iQ CoinShares Bitcoin ETF (BTCQ.TO).

5 things to know about Grayscale Bitcoin Trust – GBTC

Any of the four paths above will give advisors and their clients exposure to Bitcoin, but only GBTC can be held in an existing IRA account. If that factor alone makes GBTC your best option, here are five things to know before you or your clients invest in GBTC. You can also head to Grayscale’s website for more info or view their PDF investor presentation.

#1 — Beware of the Premium to NAV

The most important thing to know about GBTC is the disparity between its market price and net asset value (NAV) per share. Plenty of investment products, especially those that track commodities, trade at a discount or premium to the value of their underlying assets—but none do it quite like cryptocurrency trusts.

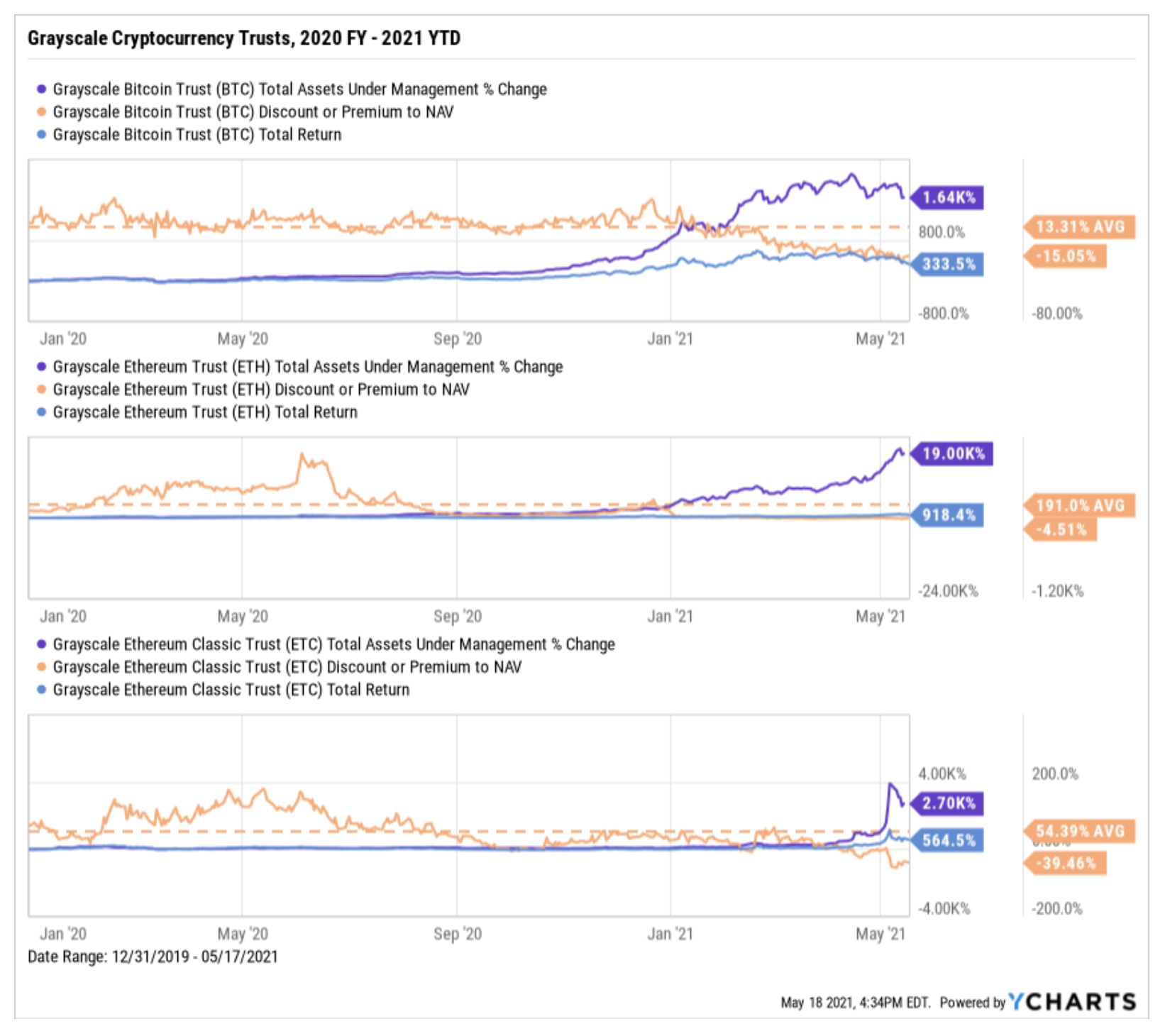

GBTC and two other products from the asset manager, Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Classic Trust (ETCG), traded at a large premium to NAV throughout 2020 due to relatively high volatility in cryptocurrency prices, the pace of asset flows into these products, and expenses associated with managing the trusts.

On the flip side, a fund’s premium to NAV can become a discount when returns taper or a price correction happens. Grayscale Bitcoin Trust’s premium to NAV quickly morphed into a large discount to NAV in 2021 as Bitcoin’s rapid ascension stalled out. The same happened to Grayscale Ethereum Classic Trust’s premium to NAV in Q2 2021, as both the fund’s total AUM and the price of Ethereum sharply corrected.

Download Visual | Modify in YCharts

#2 — GBTC’s stated investment objective

Reading the fine print is always recommended, especially for new investment products:

“The investment objective of the Trust is for the Shares (based on Bitcoin per Share) to reflect the value of Bitcoins held by the Trust, as determined by reference to the Bitcoin Index Price (as defined herein), less the Trust’s expenses and other liabilities. The Shares are designed to provide investors with a cost-effective and convenient way to invest in Bitcoin.”

The same filing defines its Bitcoin Index Price as: “The U.S. dollar value of a Bitcoin derived from the Bitcoin Exchanges that are reflected in the Index, calculated at 4:00 p.m., New York time, on each business day.”

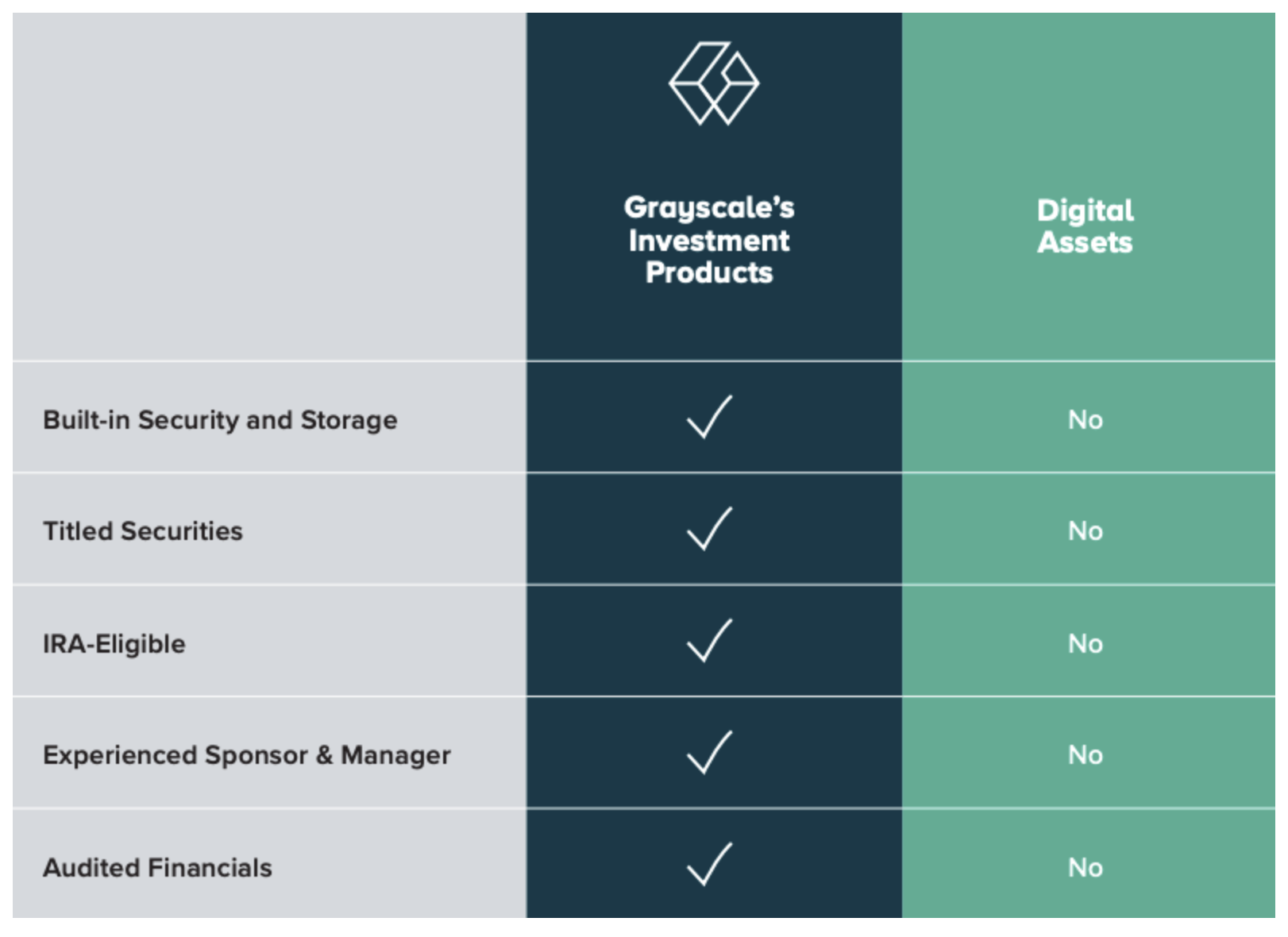

#3 — GBTC really is the path of least resistance

GBTC is the fastest way to access Bitcoin, especially if you or your clients want to see exposure and performance data within their existing account reporting. According to Grayscale, there are a number of benefits to purchasing shares in their trusts versus investing directly into cryptocurrencies or digital assets.

Image taken from Grayscale.com

#4 — Bitcoin trades 24/7, but GBTC doesn’t

Grayscale Bitcoin Trust trades on the OTCQX market, whose market hours are 6:00am ET to 5:00pm ET on weekdays. But Bitcoin, like all cryptocurrencies, trades 24 hours per day, 7 days a week around the globe.

If Bitcoin prices crash while OTCQX is closed, investors in GBTC could face an hours or weekend-long liquidity crisis.

#5 — Performance leads to Popularity leads to Premiums

Whenever there’s a surge in Bitcoin’s USD price, performance-chasers flood into GBTC and in turn, further unhinge its market price and NAV per share.

This narrative shouldn’t be too concerning for current GBTC shareholders (after all, the dynamic implies that during a Bitcoin boon, GBTC appreciates to an even greater extent); however, “overpaying” for Bitcoin may leave a bad taste in the mouths of new investors. That said, buying when GBTC is trading at a discount to NAV might be an even more attractive prospect.

Download Visual | Modify in YCharts

Should you recommend investing in GBTC?

Well, that’s the 25 Bitcoin question! (25 Bitcoins x $40,000 per coin = $1 million… funny, right?)

As the shortest path to Bitcoin exposure, GBTC is well positioned to meet the needs of financial advisors and their clients. But encouraging clients to walk down a path is different from simply knowing that path exists.

Matt Bacon, an advisor at Maryland-based RIA Carmichael Hill, said to InvestmentNews of his firm that “we don’t recommend crypto assets to clients but do purchase them upon request.”

Matt’s take on Bitcoin and other cryptocurrencies seems like a reasonable one: focus on assets with more history or fundamentals, and less volatility or speculation, but know the steps to take when a client insists on investing in cryptocurrencies.

Bitcoin & Cryptocurrency Data on YCharts

YCharts features almost seventy different data series related to Bitcoin and other cryptocurrencies. Click here to see all crypto data on YCharts.

Our high quality crypto data and high horsepower research tools enable advisors, asset managers, and their clients to have better conversations about cryptocurrencies and make smarter investment decisions.

Cryptocurrency data sets are accessible alongside other economic data on YCharts, and can be used in tools like Fundamental Charts or Timeseries Analysis. A few popular and valuable crypto data points available on YCharts include: Bitcoin market cap, Bitcoin price, Bitcoin supply, Bitcoin transactions per day, Ethereum price, Ethereum market cap, Ethereum average transaction fee, Ethereum average gas price, and Bitcoin average transaction fee.

Connect With YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

This article was originally published on YCharts.com.

Disclaimer

©2021 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.