Wall Street is reeling under extreme volatility since the beginning of 2022. Investors are highly concerned about soaring inflation. Moreover, the uncertainty regarding the pace and magnitude of interest rate hikes by the Fed to contain inflation has injected severe fluctuations in day-to-day trading.

The day-to-day fluctuations of the major indexes are higher than what we saw in February-March 2020, during the coronavirus outbreak. The Nasdaq Composite has been in a bear market since Mar 7. The S&P 500 entered the bear market on Jun 13. The Dow is knocking on the same door, while the small-cap benchmark Russell 2000 has also entered the bear market.

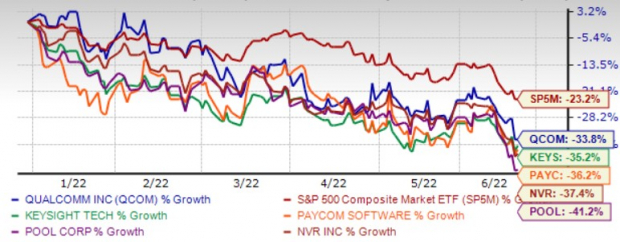

Most of the stocks have corrected significantly year to date. Despite this gloomy scenario, a handful of beaten down S&P 500 stocks are currently available with a favorable Zacks Rank. Investment in these stocks should be fruitful going forward. Five such stocks are — Pool Corp. POOL, QUALCOMM Inc. QCOM, Paycom Software Inc. PAYC, Keysight Technologies Inc. KEYS and NVR Inc. NVR.

S&P 500 in Bear Market

On Jun 13, the S&P 500 Index entered the bear territory after falling 22.2% from its recent high recorded on Jan 5. Thereafter, the benchmark has declined 31.5% as of Jun 17. The broad-market index entered the bear market for the first time since March 2020, at the onset of the pandemic. The index is down 22.9% year to date.

On Jun 15, in his post-FOMC statement, Fed Chairman Jerome Powell said that the central bank has decided to raise the benchmark lending rate by 75 basis points effective immediately. With this, the Fed funds rate increased to 1.5-1.75% compared with 0-0.25% at the beginning of this year.

Powell hinted that the Fed could raise the interest rate by another 50 to 75 basis points in July. According to the “dot plot” — which gives individual Fed members expectations — the median value of the benchmark interest rate can go up to 3.4% at the end of 2022 compared with 1.9% projected in March FOMC.

The Fed Chairman has reiterated his commitment to fight inflation aggressively and to bring it down close to the central bank’s targeted 2% without forcing the economy to go into recession. However, the Fed cut its outlook for 2022 GDP growth to 1.7% from 2.8% in March. The unemployment rate, which is currently at 3.6%, is expected to climb to 4.1% in 2024. The Fed fund rate is expected to rise to 3.8% at the end of 2023.

The projection for the PCE price index — the Fed’s favorite gauge of inflation — was raised to 5.2% from 4.3% in March. Core PCE inflation was projected to rise to 4.3% from 4.1% in March. However, PCE and core PCE inflation are expected to come down to 2.6% and 2.7%, respectively, in 2023.

Fed Chairman’s post-FOMC statement significantly dented market participants’ confidence as the fear of an imminent recession due to tougher monetary stances of the Fed looms large. Consequently, the S&P 500, the Dow and the Nasdaq Composite tumbled 5.8%, 4.8% and 4.8%, respectively, last week, marking their worst weekly performance since March 2020.

The S&P 500 is currently well below its 50-days and 200-days moving averages of 4,117.17 and 4,420.60, respectively. Since the 50 DMA is currently running below the 200 DMA, chances are high that the benchmark will decline further in the near-term.

A Silver Line

Not all things are hopeless for the S&P 500 index. A handful of stocks within the benchmark currently have a favorable Zacks Rank, indicating near-term possibilities for shares of these companies to move northward.

We have narrowed our search to five of them with strong potential for the rest of 2022. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) and 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

QUALCOMM is focused on retaining its leadership in 5G and the chipset market, delivering low-power resilient multi-gigabit connectivity with best-in-class security. QCOM is witnessing a healthy traction in EDGE networking solutions across diverse sectors.

The buyout of Arriver will bolster QUALCOMM’s ability to deliver fully integrated Advanced Driver Assistance System solutions to automakers. QCOM is well-positioned to benefit from solid 5G traction with greater visibility and diversified businesses to meet its long-term revenue targets.

Zacks Rank #2 QUALCOMM has an expected earnings growth rate of 46.8% for the current year (ending September 2022). The Zacks Consensus Estimate for the current-year earnings has improved 7% over the last 60 days.

Pool is the world's largest wholesale distributor of swimming pool supplies, equipment and related products. POOL is benefitting from the solid performance of its base business, large market presence and strategic expansions through acquisitions.

Solid demand across heaters, pumps, filters, lighting, automation and pool remodeling also benefitted it. POOL remains optimistic courtesy of its products (such as automation and the connected pool), the continuation of the de-urbanization trends and the strengthening of the southern migration.

Zacks Rank #1 POOL has an expected earnings growth rate of 21.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.5% over the last 60 days.

Paycom is a provider of cloud-based human capital management software as a service solution for integrated software for both employee records and talent management processes.

PAYC’s differentiated employee strategy, measurement capabilities and comprehensive product offerings are helping it win new customers. Further, solutions like Ask Here and Manager on-the-Go, both focusing on employee usage and efficiency, are tailwinds.

Zacks Rank #1 Paycom has an expected earnings growth rate of 23.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.3% over the last 60 days.

Keysight is witnessing growth in both Communications Solutions Group and Electronic Industrial Solutions Group. KEYS is likely to gain from solid demand for semiconductor measurement solutions, as semiconductor companies are increasingly developing chips based on process technology.

Accelerated 5G deployments, 6G-related research applications and investments in 400G/ 800G Ethernet for data centers bode well for Keysight. Moreover, rising demand for power management applications is the key catalyst for growth.

Zacks Rank #2 Keysight has an expected earnings growth rate of 13.5% for the current year (October 2022). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days.

NVR operates as a homebuilder in the United States. NVR is benefiting from a solid housing market backdrop. Also, a disciplined business model and focus on maximizing liquidity and minimizing risks add to the positives. The gross margin of NVR improved a whopping 880 basis points, buoyed by higher ASP and lower lumber prices.

Zacks Rank #2 NVR has an expected earnings growth rate of 68.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 20.4% over the last 60 days.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Pool Corporation (POOL): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Paycom Software, Inc. (PAYC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.