It’s been a rocky few years for the average American. While we all felt the pinch of the pandemic in our day-to-day lives, it particularly hit the finances of lower- and middle-income Americans who were met with periods of unemployment or the need to lean heavily on lines of credit.

Such financial stress continues for many: Nearly 65% of Americans say inflation has affected their saving and spending habits, and 46% don’t feel they could last a single month on their existing savings, according to Finder’s Consumer Confidence Index, an ongoing quarterly survey on household finances.

Although we’re all feeling the weight of inflation, savings rates are on the rise, making it the perfect time to implement a savings plan. Here are five popular savings strategies to integrate into your financial plan and goals in 2023.

1. The 50/30/20 rule

The 50/30/20 rule is a way of saving by means of budgeting. This might sound like a simple answer for a complex problem, but it’s true: creating a budget goes a long way toward helping you save your money.

The 50/30/20 rule divides your spending into three categories:

- 50% of your income toward your needs, such as housing, bills, food or insurance

- 30% of your income toward your wants, such as travel or entertainment

- 20% of your income toward savings for short and long term goals

How this rule plays out in practice varies. Not everyone has the means to budget to the exact percentages, and even those with higher debts may need to adjust where their money goes.

If the 50/30/20 rule ultimately isn’t realistic for your goals, try a different budgeting method. After all, creating a list of your spending needs and wants can go a long way toward identifying areas of financial savings and improvements.

2. CD laddering

Certificates of deposit (CD) lock in rates for the full duration of a specific term, from three months to five years or longer, which can protect your rate of savings from shifts in the fed rate. This makes CDs a powerful tool for growing savings.

CD laddering is a popular savings strategy that mitigates the main weakness of CDs — the inability to access funds and potentially missing out on a higher rate — while taking advantage of its strength in immutable APYs.

The strategy is straightforward: Deposit an equal amount of money into CDs of varying term lengths, and reinvest in those terms as needed. Say, $3,000 in a 6-month CD, a 12-month CD, a 24-month CD and a 48-month CD.

This strategy accomplishes two main goals over putting all of your money into a single-term CD:

- It offers access to your funds. Breaking up your deposit into several CDs ensures you always have a certain amount of savings at your disposal. Which helps you avoid the hefty withdrawal fees of long-term CDs if you face an unplanned emergency.

- You aren’t locked in when rates go up. While a CD’s locked rate can be a strength, it’s a drawback if rates increase within your term, as they’re expected to in the next year. With laddering, you can take advantage of the new higher rates by reinvesting your money after your shorter terms mature.

Take care to not put all of your savings into a CD laddering strategy. You still want to keep some funds easily accessible, such as in a high-yield savings account, in the event of emergencies.

3. Automated savings

You might feel the full weight of inertia in your effort to start saving, but what if someone could start saving on your behalf? That is – loosely speaking – the idea behind automated savings. Many banks offer a way for you to automate how often and how much you want to put into your savings account.

Plus, many digital banks are offering other automated savings tools, such as savings roundups. For example, popular fintech Chime lets users opt-in to automatically round up any debit card purchases you make through your app to the next dollar. This extra change is then automatically scuttled into your Chime savings account.

While you may save a smaller amount with savings roundups, automated savings can grow your savings even faster. For example, if you save $200 a month, which is about $7 a day, you would have saved $2,500 by the end of the year. This isn’t even taking into account interest and how often it’s compounding.

4. 52-week money challenge

For those who enjoy gamifying their savings journey, the next two strategies offer a fun way to motivate yourself toward a nest egg.

The first is the 52-week money challenge, which is a savings plan that calls for depositing an increasing amount of money into your savings account weekly, starting with $1.

The second week, you deposit $2; the third week, $3; and so on. By the end of the 52 weeks, your savings should total $1,378 — a healthy enough savings to result in solid returns when invested into a top-earning high-yield savings account.

The beauty of the 52-week challenge is the relatively low impact to your wallet, what with saving a small amount each week. If an additional dollar a week doesn’t work with your income or budget, you can change the amount to give more or less.

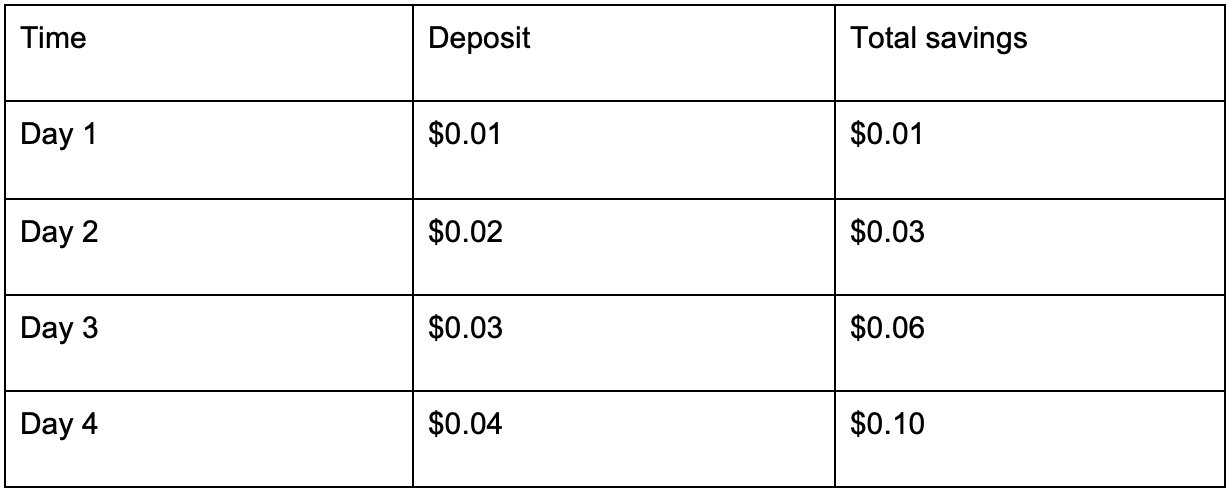

5. The penny challenge

The penny challenge carries the same benefits as the 52-week challenge — diligent financial practices and solid, low-effort savings. Yet instead of saving an increasing number of dollars each week, the penny challenge requires saving an increasing number of cents each day for a whole year. On the first day, you save 1 penny; on the second day, 2 pennies; and so on. By the end of the year, your savings should total $667.95.

Given the low stakes to start, it’s easy to rope a few friends into the challenge to help with accountability. The hardest part is likely finding the number of pennies required for this challenge.

After you’ve plumbed the depths of your couch cushion, you could compromise by moving to dollar increments every 100 days.

Bottom line

These strategies offer a great launchpad into creating a financial safety net for 2023 and beyond. Even saving pennies a day is a positive step toward protecting your finances and achieving your savings goals. No one strategy will work for everyone, so if one doesn’t work with your financial lifestyle or habits, try or tweak another one to meet your needs.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.