Bumble, the online dating company led by Tinder co-founder Whitney Wolfe Herd, recently filed its IPO paperwork. I recently highlighted Bumble as one of my top IPO picks for 2021, and a deeper dive into its prospectus reveals five clear reasons to be bullish.

1. A female-oriented platform that goes beyond dating

Bumble's namesake app is similar to Match's (NASDAQ: MTCH) Tinder, but it only lets women make the first move. Women have made 1.7 billion first moves since its launch in 2014, and it hosts approximately 30% more female users than male users.

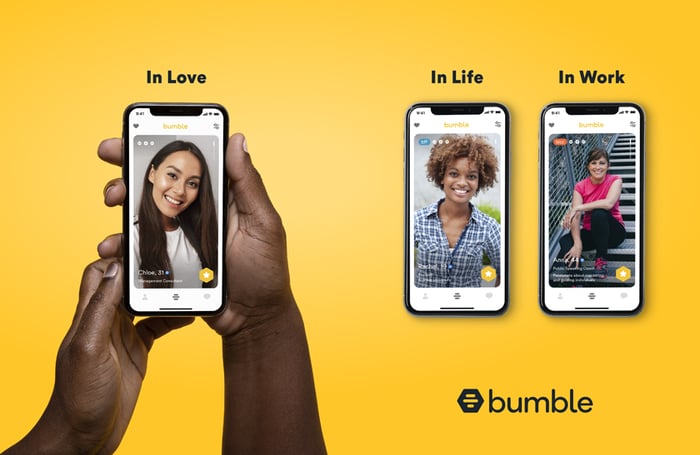

Bumble has also expanded its platform beyond dating with Bumble BFF, a matching service for platonic friendships, and Bumble Bizz, a mode for professional connections. Those features could further differentiate Bumble from Tinder and transform it into a diversified female-oriented social network.

Image source: Bumble.

2. It owns another major dating platform

Wolfe Herd co-founded Bumble with the Russian billionaire Andrey Andreev, who previously founded the older dating app Badoo. Blackstone Group (NYSE: BX), Bumble's biggest backer, subsequently bought out Andreev's stake and handed control of both platforms to Wolfe Herd.

Badoo is popular in Europe and Latin America, while Bumble is more widely used in the U.S., U.K., Canada, and Australia. Together the two apps are present in more than 150 countries. Bumble is currently one of the top five highest-grossing iOS lifestyle apps across 30 countries, according to Sensor Tower, while Badoo is a top-five app in 98 countries.

3. A growing audience

Bumble ended the third quarter of 2020 with 42.1 million monthly active users (MAUs), including 12.3 MAUs on Bumble and 28.4 million MAUs on Badoo. It didn't disclose its MAU growth rates, but it did reveal its year-over-year growth in paid users, who pay for perks such as unlimited swipes, overseas swipes, and the ability to see who likes you right away.

Bumble's paid users rose 49% to 855,600 in 2019, then grew another 30% year over year to 1.1 million in the first nine months of 2020. Its paid users from Badoo dipped 9% to 1.2 million in 2019 but rebounded 10% year over year to 1.3 million in the first nine months of 2020.

Its total number of paid users increased 19% year over year to 2.4 million during those nine months. By comparison, Tinder's number of paid users rose 16% year over year to 6.6 million in Match's latest quarter.

4. Stable revenue and rising EBITDA margins

Bumble's total revenue rose 36% to $488.9 million in 2019, with 70% growth at Bumble and 8% growth at Badoo, but grew just 4% year over year to $376.6 million in the first nine months of 2020.

|

Revenue |

2018 |

2019 |

9M 2020 |

|---|---|---|---|

|

Bumble |

$162.4 million |

$275.5 million |

$231.5 million |

|

Badoo and Other |

$197.7 million |

$213.4 million |

$145.1 million |

|

Total |

$360.1 million |

$488.9 million |

$376.6 million |

Source: Bumble S-1 filing.

Bumble's revenue still rose 14% year over year during those nine months, but Badoo's revenue fell 9%. Its average revenue per paying user (ARPPU) also declined across both apps. That slowdown was likely caused by the same pandemic-related headwinds that throttled Tinder's growth throughout 2020, so Bumble's growth could accelerate after the crisis ends.

Bumble generated a profit of $85.8 million in 2019, compared to a loss of $23.7 million in 2018. But in the first nine months of 2020, it posted a net loss of $84.1 million, compared to a profit of $68.6 million a year earlier.

However, Bumble's adjusted EBITDA, which excludes stock-based compensation and other variable expenses, rose 55% to $101.6 million in 2019, then grew 24% year over year to $98.9 million in the first nine months of 2020. Its adjusted EBITDA margin also expanded year over year from 22.1% to 26.3% during those nine months.

5. Plenty of room to grow

Bumble's growth decelerated during the pandemic, but it believes its namesake app -- which generates roughly twice as much revenue per paid user as Badoo -- has only reached a "fraction of the total addressable market" in North America.

It also notes it's still in the "early stages" of expanding Bumble globally, and that successful tests in new markets across Europe, Asia, and Latin America bode well for its international growth. The company generated 47% of its total sales from outside of North America last year.

If Bumble can replicate the female-friendly strategies that made it Tinder's top rival in the U.S., U.K., Canada, and Australia in other markets, it could gain millions of new users. Its early-mover advantage will also give it an edge against latecomers like Facebook (NASDAQ: FB), which rolled out its own dating features over the past year.

A promising IPO ... at the right price

Bumble looks like a promising alternative for investors who missed out on Match's multibagger gains over the past five years. However, investors should wait to see if the company offers its shares at a reasonable price.

Bloomberg claims Bumble could seek a valuation of $6 billion to $8 billion, which would value the company at just over 20 times last year's sales. That would be an acceptable price, but anything higher might be too speculative.

10 stocks we like better than Match Group

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Match Group wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Leo Sun doesn't own any shares of the companies mentioned. The Motley Fool owns shares of and recommends Facebook and Match Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.