As always, let’s start with a recap of my prediction track record:

2022: 3 for 4 (one incomplete)

2023 marks the 30th anniversary for the US ETF industry (more on that in a moment) and I plan on going five for five this year. I can feel it. Following a highly impressive 2022, what will happen in the ETF world this year? First, a quick note: several of my predictions are more contingent than usual on financial market conditions. Obviously, forecasting markets is extremely difficult, if not impossible. Nothing here should be construed asinvestment advice– do your own homework! With that, my 2023 ETF predictions…

1) SPY Turns 30… and Loses its ETF Crown

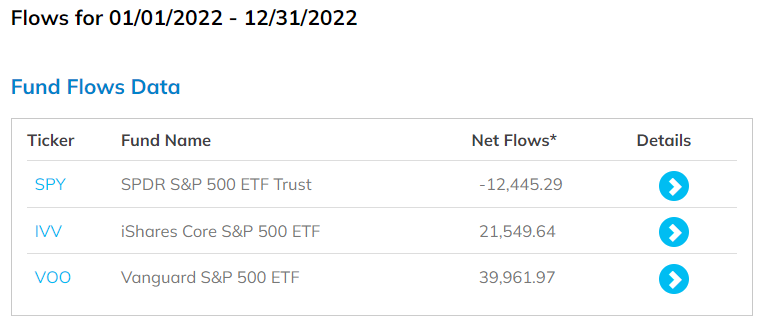

Later this month, the US ETF industry turns 30 years old. The first US-listed ETF, the SPDR S&P 500 ETF (SPY), launched on January 22nd, 1993. The ETF that started it all never looked back and currently sits atop the ETF throne with $353 billion in assets. The next two largest ETFs also happen to track the S&P 500. The iShares Core S&P 500 ETF (IVV) holds $288 billion in assets and the Vanguard S&P 500 ETF (VOO) has $279 billion. My first prediction is that one of these ETFs (my money is on VOO) captures SPY’s ETF crown by the end of the year. While that may seem like an enormous stretch, consider 2022 flows (in billions):

I believe a combination of another potentially rocky year for US stocks, continued massive inflows for IVV and VOO, and substantial SPY outflows will be enough to close the gap by year-end (though just barely).SPY is the undisputed liquidity king and won’t be ceding that crown anytime soon. However, it acts more like the court jester when it comes to fees. SPY’s expense ratio is 0.0945% compared to 0.03% for both IVV and VOO. If you don’t think this miniscule fee difference matters, consider that “mini-SPY” – the SPDR Portfolio S&P 500 ETF (SPLG) – took in $4 billion last year despite having less than $15 billion in assets. Why? It charges a 0.03% fee. IVV and VOO offer the same fee and aren’t exactly slouches when it comes to liquidity.My prediction is that money will continue flowing out of expensive, underperforming active mutual funds and find its way into the cheapest, core beta exposure out there. That means IVV and VOO, not SPY. I’ll feel even more confident in this prediction if markets have another tough year, where further drawdowns will unlock opportunities for investors with taxable accounts to switch out of suboptimal investment vehicles and move into ETFs. Vanguard, in particular, usually cleans-up in these environments.SPY will always be the grandaddy of ETFs, but even a respected king has to pass the crown eventually.

2) ETF Inflows Surpass $1 Trillion

While ETFs have been around for nearly three decades, it feels as though the industry is still accelerating. In 2022, the S&P 500 was down over 18%, US broad bonds experienced a historic 13% loss, and nearly every other major asset class was in the red. Despite that, ETFs still posted around $600 billion in inflows – their second-best year ever. In 2021, ETFs knocked on the door of $1 trillion with over $900 billion in inflows. I predict 2023 will be the year ETF inflows surpass $1 trillion for the first time.

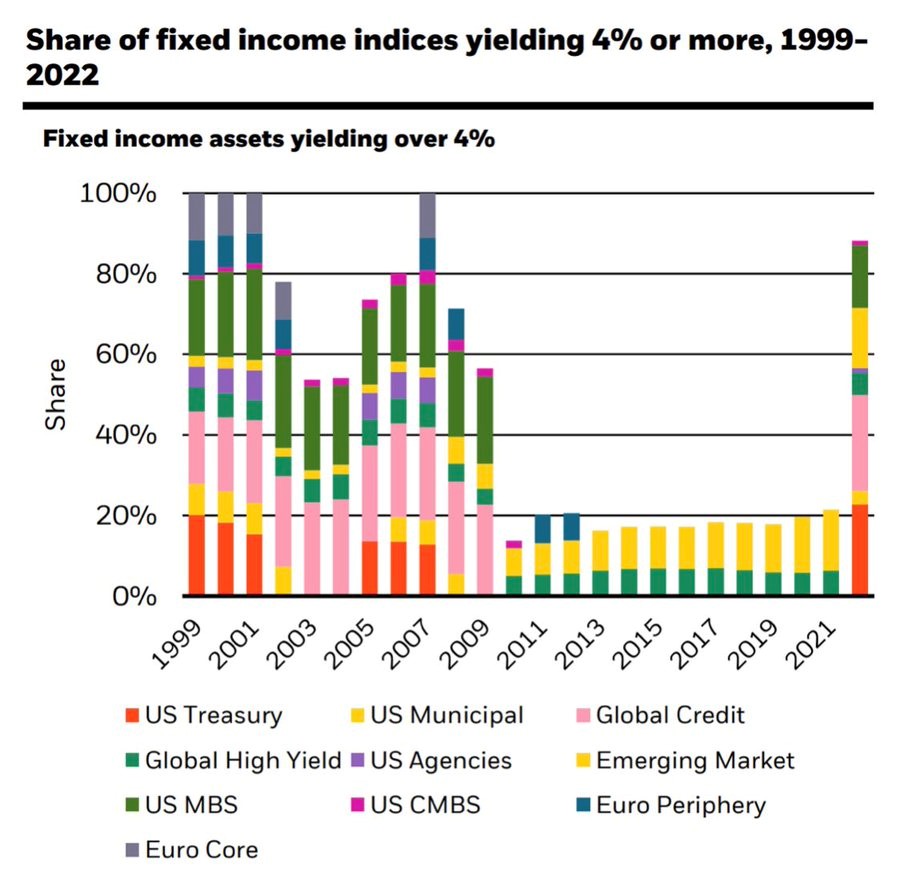

I’ll go one step further on this prediction. As I just mentioned, it’s certainly possible that stocks have another tough year. That could put a cap on the upside of equity ETF inflows (though, again, it should be noted that equity ETFs took in nearly $400 billion last year). Even if that happens, I’m not expecting a repeat of the carnage bonds experienced in 2022. While I realize that’s not exactly going out on a limb, the point is that I believe fixed income ETFs are setup to have a historic year. Fixed income, on the whole, looks MUCH more attractive than it did at the beginning of 2022. There’s actually now… you know, INCOME… in “fixed income”. Given everything else going on in the markets, I think investors will be perfectly content scooping-up 4%, 5%, 6%+ with relatively minimal risk.

Consider the timing here as well. Institutional money was still rather skittish on bond ETFs prior to the March 2020 Covid crash. There were concerns regarding “liquidity mismatches” and how bond ETFs might handle a credit crunch. The Covid crash alleviated many of those concerns. Bond ETFs functioned admirably as price discovery vehicles and continued trading despite underlying bond markets seizing-up. That episode helped bring a tremendous amount of confidence to the bond ETF structure (not to mention the Fed buying bond ETFs). The problem was that fixed income wasn’t very attractive in the back half of 2020, and certainly into 2021 and 2022. Bonds appear much more attractive now and I’m expecting a wave of institutional money flowing into the fixed income ETF category.I suspect there may also be elevated flows into international equity ETFs (in anticipation of a weaker dollar), along with alternative ETFs (as investors contemplate the death of the 60/40 portfolio). I expect physical gold ETFs (more on these in a moment), commodity ETFs, managed futures ETFs, and the like to continue drawing interest. All of this will be enough to push total ETF flows past $1 trillion. The bottom line is that there’s been a format change. While it’s been going on for a while, I think we’ll look back on 2022 as the year mutual funds formally passed the baton to ETFs. There was something like a $1.6 trillion dollar gap between ETF inflows and mutual fund outflows last year, which was a record. The mutual fund is now dying as an investment vehicle. The time of the ETF has arrived.

3) Physical Gold ETFs Regain Luster

In 2019, I predicted gold ETFs would shine. I was correct as the category unearthed over $10 billion in new assets and the price of gold surged 18%. I’m going back down the mine shaft for this call. Last year, physical gold ETFs saw over $3 billion in outflows despite gold’s solid relative performance (only down 1%). I found the lack of interest in gold ETFs a bit puzzling given the growing concerns over an economic slowdown (which could pressure the US dollar) and inflation remaining elevated. I get the negative impact of rising rates and a stronger dollar on gold. I just thought more investors would be looking ahead and seeking refuge from stocks and bonds by hiding out in historically uncorrelated assets. Better late, than never. I think that happens this year.

An environment where the economy is slowing and inflation remains sticky should be a decent one for gold. There also exists the possibility that the bottom falls out (not my base case, but there is clearly some bearish sentiment out there). That would seem to bode well for gold too. Another factor to consider is the crypto meltdown. In my opinion, gold has acted rather odd over the past several years. It always marches to the beat of its own drummer, but I’ve often wondered whether crypto – specifically bitcoin (aka “digital gold”) – was impacting gold’s behavior. With bitcoin down 65% last year and 75% from its November 2021 high, the crypto “store of value” claims aren’t looking so good. Meanwhile, gold has a 5,000-year track record.

My prediction is that investors lean back into gold’s lengthy track record to hedge against a potentially weaker dollar, sticky inflation, continued geopolitical strife, and market volatility. Toss-in growing questions over whether bitcoin/crypto is “digital gold” and I think there’s a pool of capital that jumps into gold (the entire above ground supply of which fits into three or four Olympic swimming pools by the way). It also appears central banks such as China and Russia are accumulating gold – another potential tailwind. Look for ETFs such as the SPDR Gold Trust (GLD), SPDR Gold MiniShares Trust (GLDM), iShares Gold Trust (IAU), iShares Gold Trust Micro (IAU), GraniteShares Gold Trust (BAR), and others to see a big uptick in investor interest.

4) Still. No. Spot. Bitcoin. ETF.

I’ve gone back and forth on this over the past several weeks. There is a part of me that believes a spot bitcoin ETF will be approved this year because… well, it SHOULD exist. Grayscale agrees and actually sued the SEC last year over converting the Grayscale Bitcoin Trust (GBTC) into an ETF. I fully agree with the thrust of Grayscale’s lawsuit, which is basically this...

Still waiting for intelligent explanation on how bad actors could manipulate spot btc w/out it impacting CME btc futures…

Proposed spot btc ETFs would take pricing cues from exact same crypto exchanges as CME futures.

If spot subject to fraud/manipulation, then so are futures.

— Nate Geraci (@NateGeraci) June 30, 2022

Before proceeding with my prediction, let me be crystal clear on something I’ve said repeatedly in the past: my advocacy for a spot bitcoin ETF has nothing to do with the investment merit of bitcoin itself. I’ve said from the beginning that bitcoin could be a homerun or it could go to zero. This is an asset that should occupy only a small satellite position in a portfolio, if at all. Period. The issue is that some investors want exposure to bitcoin and they’re going to find a way to get it no matter what. Why not offer that exposure in a properly functioning, regulated investment vehicle?

GBTC is currently trading at a nearly 50% discount, a problem an ETF would quickly solve. FTX customers appear to have lost “their” bitcoin due to fraud, another problem an ETF would solve. There are countless examples of bitcoin owners misplacing private keys or having their exchange hacked, again problems an ETF would solve. I could go on… but the point is that if the SEC’s mission is to protect investors, then a spot bitcoin ETF would help accomplish that. Before you say, “Well, Nate – you just said bitcoin could go to zero”, let me remind you that the SEC allowed ETFs such as these to come to market last year:

ETFs launched this yr…

B-BBB CLO ETF ✅

2x leveraged fintech ETF ✅

Psychedelics ETF ✅

2x VIX futures ETF ✅

Inverse VIX futures ETF ✅

2x ARKK ETF ✅

Breakfast commodity ETF ✅

CCC-rated high yield bond ETF ✅

10+ metaverse/blockchain/etc ETFs ✅

Spot bitcoin ETF ❌

— Nate Geraci (@NateGeraci) June 9, 2022

In any event, while I believe the SEC should approve a spot bitcoin ETF, my prediction is that they won’t in 2023. The SEC filed a brief in December, their first response to Grayscale’s lawsuit. It basically regurgitated the same messaging SEC Chair Gary Gensler has provided from day one of his tenure, which is that spot crypto exchanges need to come under his regulatory purview before the SEC will approve a spot bitcoin ETF.

There are several proposals floating around Congress to regulate crypto. The issue is there is significant disagreement over who should actually regulate crypto and whether certain cryptos should be classified as securities or commodities. Add-in the FTX debacle and some of the other shenanigans we’ve seen in crypto recently and it seems highly unlikely this all gets sorted out over the next 12 months (politicians love grandstanding). The only wild card here is if Grayscale were somehow able to prevail in their lawsuit against the SEC and do so faster than people are expecting. That could certainly change the calculus, but I’m just not optimistic on that.

Still. No. Spot. Bitcoin. ETF.

5) Morgan Stanley is ETF Issuer of Year

Morgan Stanley is set to enter the ETF space any day now. ETF nerds know that Morgan was actually a pioneer in international ETFs via their World Equity Benchmark Series (WEBS) ETFs, which launched in 1996 with Barclays as subadvisor. Morgan ended-up selling the WEBS to Barclays in 2000. Barclays later rebranded to iShares and sold to BlackRock in 2009. The rest, as they say, is history and Morgan has had no further ETF presence.

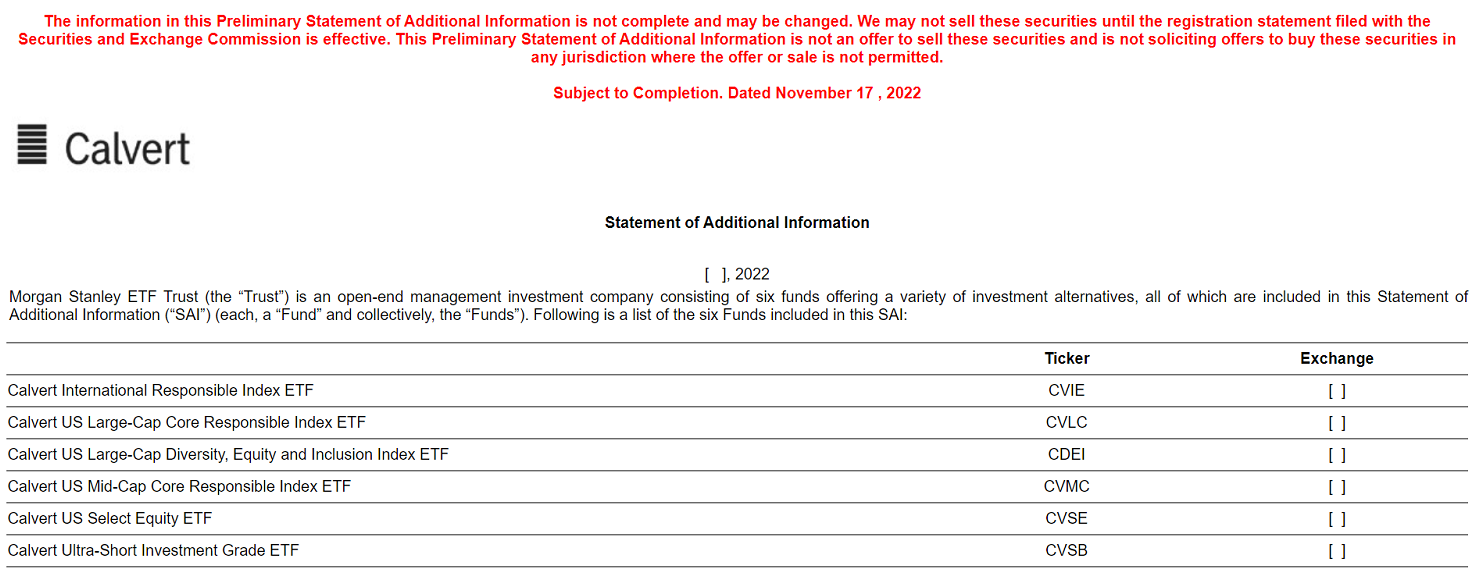

That is set to change with the launch of their initial suite of ETFs, which includes four index-based ETFs and two actively managed ETFs – all in partnership with Calvert, a highly respected name in ESG.

Despite my overall bearishness on ESG ETFs, Morgan Stanley has something most new ETF issuers don’t: distribution. Morgan has a sizeable army of financial advisors and a brokerage platform in E*Trade. Their wealth management division has something like $5 trillion in client assets and another $1.3 trillion resides in their investment management division. Morgan also has billions of dollars invested in other issuers’ ETFs. Add this all up and, as Bloomberg’s Eric Balchunas likes to say, Morgan has huge BYOA (bring your own assets) potential. Distribution is king and it doesn’t matter that Morgan is showing-up late to the ETF party. Plus, I fully expect Morgan to branch out from ESG ETF offerings.

As an aside, I think it’s worthwhile to mention that Morgan Stanley is getting involved in ETFs despite their 2020 acquisition of Eaton Vance. Eaton Vance owned Parametric, the leader in direct indexing. In my opinion, this shows you what Morgan thinks about direct indexing being an “ETF killer”. But I digress.

Consider some of the huge names to enter ETFs and pretty quickly find success over the past five to ten years: JPMorgan, Goldman Sachs, Dimensional Fund Advisors, Capital Group. They all had distribution, strong pedigree, and a well-known brand… just like Morgan. It should also be noted that Morgan has a highly qualified and experienced ETF leadership team, led by Global Head of ETFs Anthony Rochte. Morgan Stanley will be 2023’s ETF issuer of the year, nearly three decades after coining the term “exchange traded fund”.

For more news, information, and analysis, visit VettaFi | ETF Trends.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.