We are in the first busy week of the first-quarter 2024 earnings season as more than 1,000 companies are slated to report their quarterly financial numbers. While market participants will keenly watch the reports and guidance of technology behemoths and the “magnificent 7” companies, several other corporate bigwigs will also report their quarterly results.

Some of these companies have a good chance of beating on earnings, which should drive their stock prices in the near term.

Q1 Earnings Results So Far

As of Apr 24, 139 companies on the S&P 500 Index reported their financial numbers. Total earnings for these index members are up 4.6% from the same period last year on 3.4% higher revenues, with 78.4% beating EPS estimates and 59.7% beating revenue estimates.

At present, total earnings of the S&P 500 Index in first-quarter 2024 are expected to be up 4.4% on 3.9% higher revenues. This follows the 6.8% earnings growth on 4% higher revenues in fourth-quarter 2023 and 3.8% earnings growth on 2.2% higher revenues in third-quarter 2023.

Our Top Picks

We have narrowed our search to five large-cap stocks (market capital > $20 billion) that are set to beat on earnings today after the closing bell. Each of these stocks carries a Zacks Rank #3 (Hold) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

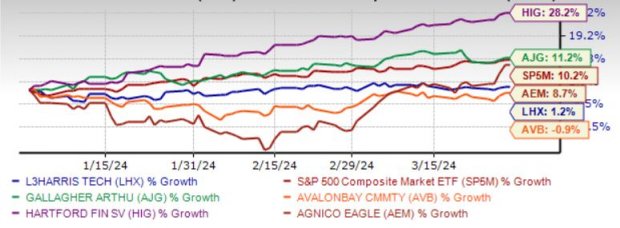

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

L3Harris Technologies Inc. LHX continues to witness strong demand for its defensive solutions. The increased U.S. defense budget is expected to boost its performance. LHX has a strong international presence.

With a three-year pipeline opportunity of $20 billion in Space, there's immense scope for LHX’s growth backed by its electronics capabilities. Positive synergies from its Aerojet Rocketdyne acquisition should boost LHX’s future growth.

L3Harris Technologies has an Earnings ESP of +0.53%. It has an expected earnings growth rate of 3% for the current year. L3Harris Technologies recorded earnings surprises in three out of the last four reported quarters, with an average beat of 1.5%.

Arthur J. Gallagher & Co. AJG is on track to generate both organic (particularly international) and inorganic growth. AJG’s focus on tapping opportunities across the globe bodes well for growth.

AJG expects organic revenue growth in 2024 in the Risk Management and Brokerage segment to be better than the 2023 level. This solid performance is expected to lead to an increase in cash flows, facilitating the return of wealth to shareholders via share buybacks and dividends.

Arthur J. Gallagher has an Earnings ESP of +0.14%. It has an expected earnings growth rate of 14.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 90 days. AJG recorded earnings surprises in the last four reported quarters, with an average beat of 1.8%.

AvalonBay Communities Inc. AVB is well-poised to gain from the healthy renter demand for its residential properties in the high barrier-to-entry regions of the United States. Favorable demographic trends and rising home ownership costs are likely to keep driving AVB’s demand.

AVB’s efforts to leverage technology and scale to drive margin expansion and operational efficiency seem encouraging. Strategic buyouts and development projects, backed by a healthy balance sheet position, augur well for long-term growth. For 2024, we expect a year-over-year increase of 3.4% in total revenues.

AvalonBay Communities has an Earnings ESP of +0.59%. It has an expected earnings growth rate of 1.6% for the current year. AVB recorded earnings surprises in the last four reported quarters, with an average beat of 1.2%.

The Hartford Financial Services Group Inc. HIG is gaining from lower excess mortality losses, an improved Commercial Lines expense ratio and a rise in earned premiums. HIG’s divestitures are enhancing financial flexibility by freeing up capital. It is expected to widen its underwriting strength and undertake measures to de-risk HIG’s balance sheet, which should increase financial strength.

HIG’s total debt to equity is much lower than the industry average. HIG partners with other firms to enhance product offerings. HIG’s cost-reduction initiatives are likely to aid margins in the future.

The Hartford Financial Services Group has an Earnings ESP of +0.81%. It has an expected earnings growth rate of 14.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.4% over the last 30 days. The Hartford Financial Services Group recorded earnings surprises in the last four reported quarters, with an average beat of 11.8%.

Agnico Eagle Mines Ltd. AEM is actively bolstering its exploration and asset investments. By prioritizing sustainability and operational efficiency, AEM aims to boost both production levels and cash flow generation.

The merger with Kirkland Gold solidifies AEM’s standing as a premier gold producer, backed by enhanced financial resources and a robust project pipeline. AEM is strategically diversifying its operations to mitigate risks and maintain financial resilience.

Agnico Eagle Mines has an Earnings ESP of +3.15%. It has an expected earnings growth rate of 13% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last seven days. Agnico Eagle Mines recorded earnings surprises in the last four reported quarters, with an average beat of 13.3%.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.