It’s fair to say investors were pretty satisfied when on Thursday, 3D Systems (DDD) released 4Q20 preliminary results alongside some news of latest developments.

Shares more than doubled after the 3D printer maker said it expects Q4 revenue to come in between $170 million and $176 million, some distance above the $140 million analysts were estimating.

Non-gaap operating income is anticipated to meaningfully improve, too. The company expects it will be in the range of $11 million to $19 million compared to the $5.6 million earned in the same period last year.

3D Systems also said it has concluded the sale of non-core software businesses Cimatron and GibbsCAM for roughly $64 million, of which $21 million was used to pay down debt.

J.P. Morgan analyst Paul Coster calls the results “very encouraging.” The company has now delivered two consecutive quarters of 20% sequential growth, and Coster points out there could be “pent-up demand ahead relating to elective surgery and dental procedures, and industrial activity.”

However, while the uptick could be put down as simply a bounce back from the pandemic driven woes in last year’s first half, Coster sees a more specific reason for the rebound.

CEO Jeffrey Graves took over the reins in May, and the analyst notes how quickly the new appointment has made an impact.

“Dr. Graves has done a terrific job as new CEO,” Coster said. “He has right-sized, restructured, divested and overseen growth in very short order. We think he is taking a very pragmatic view of the role of 3D technology in manufacturing that should mean the company avoids the speculative and conceptual detours that have plagued other companies in this sector over the last few years.”

As a result, Coster upgraded DDD’s rating from Underweight (i.e. Sell) to Neutral (i.e. Hold), while boosting his price target to $14. However, following Thursday’s gravity defying gains, the figure now suggests shares will drop ~42%. (To watch Coster’s track record, click here)

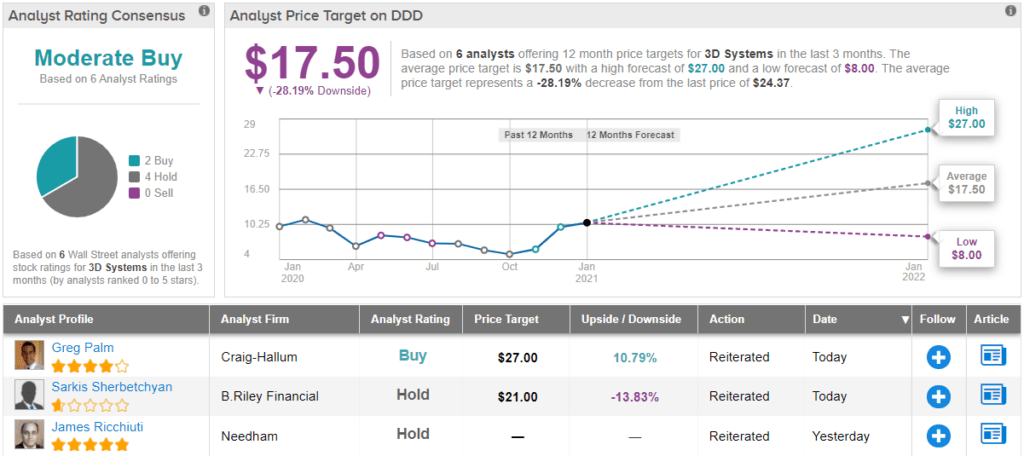

All in all, the market’s current view on DDD is a mixed bag. The stock has a Hold analyst consensus rating based on 2 recent Buys and 3 Holds. Meanwhile, the $17.50 price target indicates there will be a sharp 30% pullback over the next 12 months. That said, it will be interesting to see, if following the latest positive developments, other analysts adjust their DDD models shortly. (See DDD stock analysis on TipRanks)

To find good ideas for growth stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.