Russia's ongoing attack on Ukraine and the following sanctions to punish the country continue to result in market turmoil. The S&P 500 fell 1.55% yesterday, while the Dow Jones Industrial Average tumbled 1.76%. The widening array of sanctions imposed by the West is leading to a number of larger economic implications, which are spilling over to U.S banks as well.

While U.S. banks’ direct exposure to Russia is anticipated to be minimal, the sanctions being imposed on Russia may hurt financial institutions in Europe and the overall global recovery. Also, there are high uncertainties in the U.S. capital markets, with the volatile movements in bond yields.

Amid such uncertainties, banks like Citizens Financial Group CFG, Webster Financial WBS and Hope Bancorp, Inc. HOPE should be favored, given their fundamental strength.

Last weekend, a number of new sanctions were imposed on Russia by the United States, Britain, Europe and Canada, including restricting certain Russian banks' access to the main global payments system — SWIFT international payment system. These moves could affect the value of Russian assets held by banks.

While the global uncertainties are likely to continue to weigh on investor sentiment, it is difficult to estimate the indirect impacts of these developments on U.S. banks. Despite the Russian banks being locked out of the global banking system, the country’s relative size and limited dealings with U.S. banks pose a minuscule risk from a likely economic collapse.

Per a Reuters article, U.S. banks have so far disclosed $14.7 billion exposure in Russia. When compared with Italian, French and Austrian banks, which combined have $42.5 billion in exposure to Russia, U.S. banks seem to have lesser likely risk.

With the rising inflation, there are increasing prospects of a bigger hike in interest rates in March. Per the CME FedWatch Tool data, at present, there is a 94.4% chance that the Fed will raise the interest rates by 25-50 basis points in March. Also, market participants are predicting as many as seven rate hikes this year. Thus, thriving in a higher interest rate environment, banks are likely to remain in investors’ favor.

Further, robust job growth and improving consumer confidence are expected to support economic expansion. Hence, banks, witnessing shrinking net interest margin and net interest income (NII) since March 2020, are expected to benefit. An improving economy, an increase in demand for loans and efforts to diversify operations will also support banks’ financial performance, going forward.

Given these tailwinds, the U.S. banks seem well-poised to navigate through the storms caused by the Russia-Ukraine conflict.

Our Picks

On the back of the favorable developments, this is the right time to focus on fundamentally-strong bank stocks. The short-listed banks have a market cap of not less than $1 billion. Also, these banks currently sport a Zacks Rank #1 (Strong Buy) or #2 (Buy) and have a Value Score of B.

Our research shows that stocks with a Style Score of A or B, when combined with a Zacks Rank #1 or 2, offer the best upside potential. You can see the complete list of today's Zacks #1 Rank stocks here.

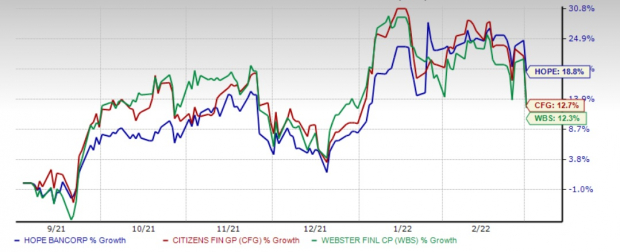

Before discussing the handpicked companies in detail, let’s check how these stocks fared in the past six months in terms of share price movement.

Image Source: Zacks Investment Research

Headquartered in Stanford, CT, Webster Financial had $34.9 billion worth of assets, $22.3 billion of loans, $29.8 billion as deposits and $3.4 billion in shareholders' equity as of Dec 31, 2021. It has a market cap of $10 billion.

The company’s NII and non-interest income witnessed a compounded annual growth rate (CAGR) of 3.1% and 5.7%, respectively, over the last five years (2017-2021). In February 2022, Webster Financial completed its merger with Sterling Bancorp, leading to one of the largest commercial banks in the Northeast. This is expected to expand selected commercial lending portfolios, HSA Bank and digital banking offerings. This will help diversify and unlock revenue-growth opportunities.

Deposits and loans recorded a five-year (2017-2021) CAGR of 9.2% and 6.2%, respectively, indicating a healthy balance-sheet position. We believe that deposit and loan balances, supporting the company’s strong capital position, will grow further from an improving economic backdrop.

The consolidation of banking centers and corporate facilities, process automation, ancillary spend reduction, and other organizational actions have aided WBS in reducing its operating expenses, thereby alleviating pressure from the bottom line.

The Zacks Consensus Estimate for 2022 earnings has been revised marginally upward over the past 30 days to $5.20. This indicates year-over-year growth of 7%. This Zacks Rank #1 company has a Value Score of B.

Citizens Financialis one of the largest retail bank holding companies in the United States, with around 940 branches and 3,000 Automated Teller Machines in 11 states across the New England, Mid-Atlantic and Midwest regions. It has a market cap of $20.5 billion.

This February, it acquired 80 East Coast branches and the national online deposit business from HSBC Bank, thereby strengthening its balance sheet position. In July 2020, the company announced a definitive agreement to acquire Investors Bancorp ISBC in a bid to strengthen its banking franchise and boost the consumer customer base. The acquisitions of ISBC, combined with the HSBC branches, create a strong franchise in the greater New York City and Philadelphia Metro areas, and New Jersey by adding 234 branches. Apart from this, the acquisitions are expected to add $29 billion of deposits and $24 billion of loans, creating a strong foundation for revenue growth. The buyout efforts enable the company to expand its product capabilities and geographic reach.

Apart from inorganic growth moves, solid loan and deposit balances are likely to aid the company’s financials.CFG’s loans and deposits recorded a CAGR of 3.7% and 11%, respectively, over the last three years (2019-2021). The company has been enhancing its deposit base by advancing its deposit-gathering capabilities and digital-first model focused on national expansion.

The Zacks Consensus Estimate for CFG’s 2022 earnings has been revised marginally upward over the past 30 days to $4.52. The consensus estimate for 2023 earnings of $5.16 indicates year-over-year growth of 14.2%. This Zacks Rank #2 company carries a Value Score of B.

Hope Bancorp is the only super-regional Korean-American bank in the United States with $17.9 billion in total assets as of 2021 end. The company has been making expansion moves and reentered the Georgia market with a full-service branch in Duluth, the heart of Atlanta’s growing Korean American community. With this, the company has branches across the nation.

HOPE has been focusing on its deposits mix and core growth, with fourth-quarter 2021 marking the ninth consecutive quarter of decreasing deposit costs. In the fourth quarter, loan originations increased 23%, sequentially, to a record $1.24 billion. Given the improvement in the lending environment, the momentum is likely to continue.

In January, Hope Bancorp’s board of directors approved a new stock buyback program, authorizing the company to repurchase up to $50 million of its common stock. With $316.3 million of cash and due from banks, such capital deployment moves make the HOPE stock an attractive pick.

The Zacks Consensus Estimate for 2022 earnings has been revised marginally upward over the past 30 days to $1.67. This indicates year-over-year growth of 0.6%. This Zacks Rank #2 stock has a Value Score of B.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Webster Financial Corporation (WBS): Free Stock Analysis Report

Investors Bancorp, Inc. (ISBC): Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG): Free Stock Analysis Report

Hope Bancorp, Inc. (HOPE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.