The S&P 500 inched slightly higher on Thursday to hover just below its all-time highs. The bulls appear ready to send the benchmark index to new highs during the Santa Claus rally period.

That said, stocks will likely face selling pressure at some point in the coming weeks after the market-wide December surge capped off a fantastic 2023.

Stocks and indexes always come back down to key moving averages. Thankfully, the dips might be scooped up quickly as more investors big and small chase returns in 2024 as rates fall.

The three top-ranked growth tech stocks we explore today are trading at least 50% below their all-time highs heading into 2024. Investors might want to consider these three stocks as many big tech stocks sit near fresh records.

Upwork (UPWK)

Upwork is a standout in the world of freelance work, connecting businesses of all shapes and sizes with people around the world. Upwork is a former remote-work and Covid rally superstar that’s slowly making a comeback as the economy and interest rate environment normalize.

Despite a return to a more regular, pre-pandemic working environment, office building occupancy rates remain at a fraction of what they once were. A massive chunk of the economy and workforce function in a mostly digital world. Upwork helps freelancers and clients connect for jobs across development and IT, finance and accounting, design and creative, and beyond.

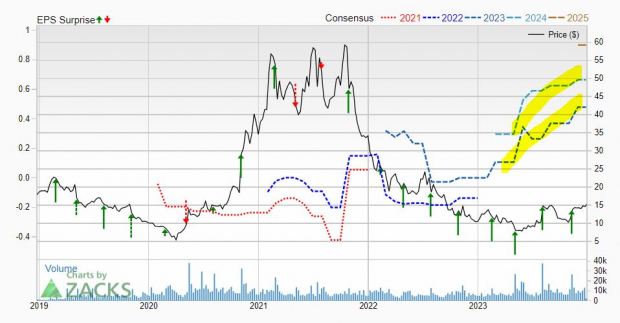

Image Source: Zacks Investment Research

Upwork like many former growth-at-all-cost firms is focusing more on the bottom line. The firm has topped our adjusted earnings estimates in the trailing four quarters, including a 91% Q3 beat. Upwork is projected to swing from an adjusted loss of -$0.06 per share last year to +$0.48 a share FY23 and then surge 39% higher in FY24. The company is projected to grow its revenue by 11% this year and 12% next year, following 23% sales expansion last year.

The firm’s total marketplace take rate in the third quarter climbed to 17.1%, up from 15.4% in the year-ago period and 14.2% in Q3 FY21, driven by the simplification of its freelancer pricing structure and ads products. UPWK’s positive earnings revisions activity helps it land a Zacks Rank #1 (Strong Buy) right now. Upwork’s EPS outlook began trending higher in the early part of 2023 for FY23 and FY24.

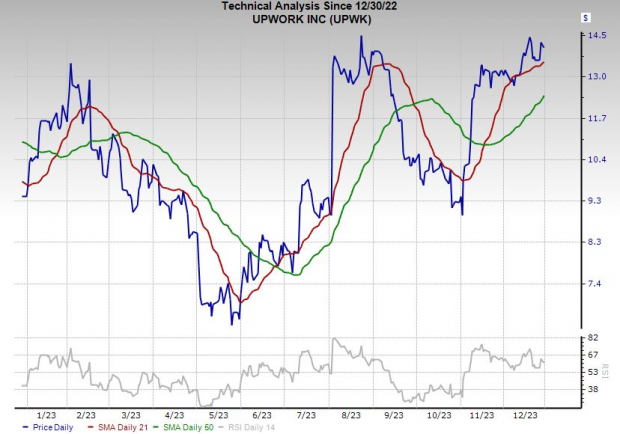

Image Source: Zacks Investment Research

Upwork stock climbed 45% in 2023, including some huge swings. UPWK is trading above its 21-day, 50-day, and 200-day moving averages right now. Yet it has pulled back from overbought RSI levels and it trades roughly 75% below its record highs at around $15 per share. Upwork’s Internet – Services unit lands in the top 14% of over 250 Zacks industries and its balance sheet is strong.

Shopify (SHOP)

Shopify provides what it has dubbed the “essential internet infrastructure for commerce.” The firm helps companies with everything from site design and sales to marketing, payments, shipping, and more. Shopify makes money from recurring subscription fees and various add-ons. Shopify grew its revenue by an average of 65% between FY17 and FY21 as companies, small businesses, entrepreneurs, and other entities clamored to catch up to the new age of retail.

Shopify’s days of 60% growth are over, which makes sense because those figures are unsustainable as its yearly revenue starts inching toward $10 billion and its customer acquisitions slow in a more saturated market. Shopify made up for slowing expansion by raising its prices in 2023 for the first time in over a decade.

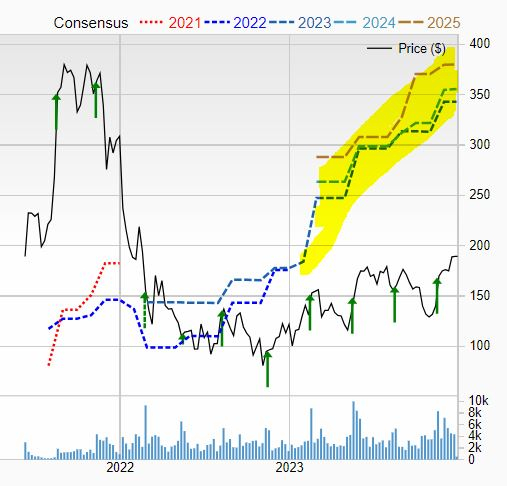

Image Source: Zacks Investment Research

Shopify’s sales climbed 21% in FY22 and its revenue is projected to jump 25% higher in FY23 from $5.60 billion to $6.98 billion and then post 19% growth next year to pull in $8.31 billion. As is the case with Amazon (AMZN) and most of tech, Shopify is committed to boosting its bottom line. SHOP’s adjusted earnings are projected to climb from $0.04 a share last year to $0.70 in 2023 and then surge another nearly 50% next year.

Shopify’s earnings revisions have soared in the back half of 2023 for FY23, FY24, and FY25 to help it capture that Zacks Rank #1 (Strong Buy). SHOP shares have skyrocketed 200% off their October 2022 lows, including a 125% run in 2023.

Image Source: Zacks Investment Research

Despite the huge comeback, Shopify still trades over 50% below its all-time highs. The stock currently trades above its 21-day, 50-day, and 200-day moving averages. SHOP is on the cusp of retaking its 200-week moving average, having found support near its 50-week level in late October.

Shopify’s valuation levels are still sky-high compared to the broader tech sector. But SHOP’s balance sheet is stellar, with nearly $5 billion in cash and equivalents and $10.5 billion in total assets vs. $852 million in current liabilities and $2.2 billion in total. And its outlook is impressive in an essential area of the economy.

monday.com (MNDY)

Monday.com’s core work operating system or Work OS is a “low code-no code” platform that helps its customers build work management tools and software applications across various industries. On top of that, Monday.com operates a sales CRM segment and a Dev unit.

Monday.com has amassed around 190K global customers, most of which are smaller businesses. The firm operates in a key growth segment of the economy since every business needs to digitalize their workflows to succeed. MNDY posted a big beat-and-raise Q3 in November, helping boost its consensus earnings estimate by 64% for FY23 and 62% for FY24. Monday.com’s recent upward earnings revisions prolong an impressive streak of improving earnings that lands it a Zacks Rank #1 (Strong Buy).

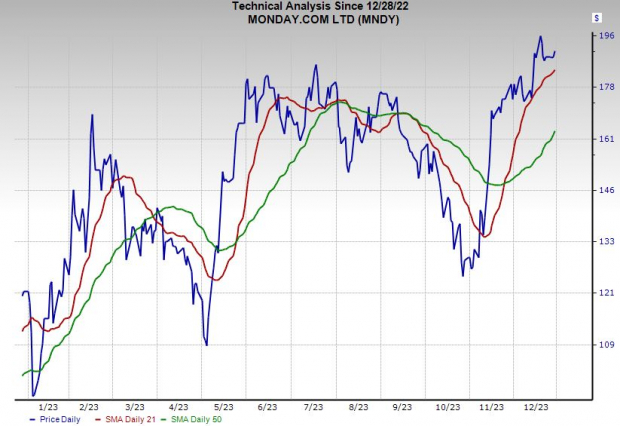

Image Source: Zacks Investment Research

Monday.com is projected to post 40% revenue growth this year and 28% higher sales next year to climb from $519 million in FY22 to $925 million in FY24. It is also projected to swing from an adjusted loss of -$0.73 per share to +$1.49 FY23 and then reach $1.73 a share next year. Plus, MNDY has topped our quarterly EPS estimates by an average of 200% in the trailing four quarters, including a 256% Q3 beat.

MNDY shares have climbed 57% in 2023 vs. the Zacks Tech sector’s 53%. Yet it currently trades 55% below its 2021 peaks and 12% under its average Zacks price target. On the technical front, Monday.com trades above its 21-day and 50-day moving averages and below overbought RSI levels.

Image Source: Zacks Investment Research

As is the case with SHOP and Upwork, Monday.com’s valuation levels are high. Thankfully, MNDY is improving its bottom line, and 10 of the 15 brokerage recommendations Zacks has are “Strong Buys.” On top of that, its balance sheet is in great shape.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Upwork Inc. (UPWK) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.