Artificial intelligence (AI) has been the hottest market topic of 2023. And it’s easy to understand why, as the technology allows us to achieve digital feats that otherwise felt impossible.

To little surprise, several big-tech players, including Microsoft MSFT, NVIDIA NVDA, and Alphabet GOOGL, have been scurrying to become the leader.

Let’s take a closer glance at each company's AI developments and a few other aspects.

Microsoft

Microsoft has gained widespread attention following its new AI-powered Bing search engine and Edge browser announcements.

The new search engine and Edge browser are expected to deliver enhanced search results, complete answers, a unique chat experience, and an overall much easier experience when exploring the web.

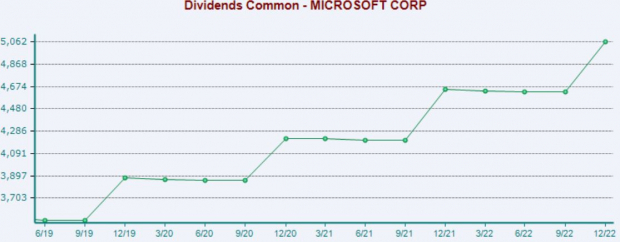

MSFT shares provide exposure to red-hot AI technology paired with an income stream; MSFT’s annual dividend presently yields 1.1%. Impressively, the company has grown its payout by more than 10% over the last five years.

Image Source: Zacks Investment Research

Alphabet

Alphabet has recently unveiled its new conversational AI service, Bard, powered by its next-generation LaMDA (language model for dialogue applications).

Bard is expected to deliver high-quality responses drawn from the web, pairing the globe’s knowledge with the power of Alphabet’s LaMDA.

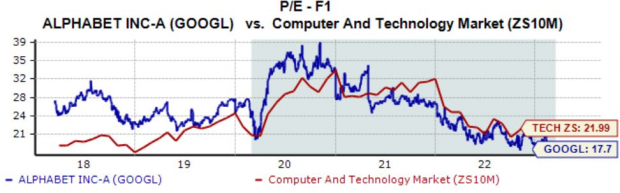

GOOGL shares have gotten much cheaper following rough price action in 2022, with the company’s 17.7X current forward earnings multiple sitting well beneath the 26.1X five-year median.

Image Source: Zacks Investment Research

NVIDIA

A big focus point of NVDA’s latest release was its Data Center results, which include its AI operations; Data Center revenue totaled $3.6 billion, growing 11% from the year-ago quarter.

There were also several strategic highlights within the Data Center segment, including a partnership with Deutsche Bank DB to further the use of AI within financial services.

The market was impressed with its latest quarterly results, sending shares soaring. This is illustrated by the green arrows in the chart below.

Image Source: Zacks Investment Research

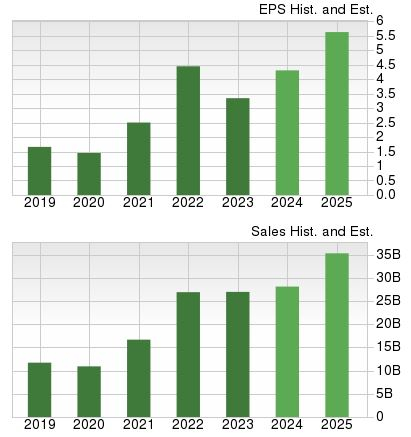

In addition, NVDA sports a strong growth profile, with earnings forecasted to soar 34% in its current fiscal year (FY24) and a further 32% in FY25.

The projected earnings growth comes on top of forecasted Y/Y revenue climbs of 10% in FY24 and 24% in FY25.

Image Source: Zacks Investment Research

Bottom Line

It’s impossible to pick which company will win the great AI race, with investors clamoring over the immense growth opportunities the technology brings.

So far, we’ve seen many big tech companies – Microsoft MSFT, NVIDIA NVDA, and Alphabet GOOGL – all throw their hats fully into the AI arena.

Free Report Reveals How You Could Profit from the Growing Electric Vehicle Industry

Globally, electric car sales continue their remarkable growth even after breaking records in 2021. High gas prices have fueled his demand, but so has evolving EV comfort, features and technology. So, the fervor for EVs will be around long after gas prices normalize. Not only are manufacturers seeing record-high profits, but producers of EV-related technology are raking in the dough as well. Do you know how to cash in? If not, we have the perfect report for you – and it’s FREE! Today, don't miss your chance to download Zacks' top 5 stocks for the electric vehicle revolution at no cost and with no obligation.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.