Momentum investors look to ride bullish trends where buyers are in control.

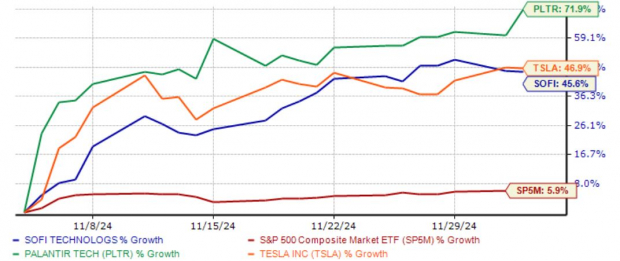

And recently, three popular stocks – Tesla TSLA, Palantir PLTR, and SoFi Technologies SOFI – have seen strong price action, outperforming nicely.

Below is a chart illustrating the performance of each over the last month, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each.

Tesla Sees Higher Profits

Tesla’s current momentum is undeniable, boosted by a recent set of strong quarterly results. It remains the prime selection for those seeking EV exposure, and its current favorable Zacks Rank alludes to further near-term gains.

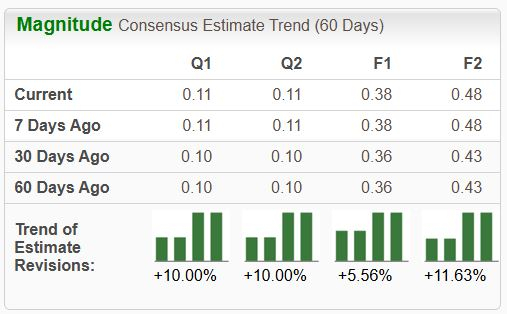

As shown below, analysts raised their earnings expectations across the board following its latest quarterly release. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The focal point of the quarterly print was margin expansion, with the company’s gross margin expanding to 19.8% vs. a 17.9% print in the same period last year. It’s worth noting here that Tesla also reported its lowest-ever level of cost of goods sold (COGS) per vehicle throughout the period.

The profitability spike undoubtedly bodes well for the company, with shares also seeing a decent boost from the recent U.S. election results.

Palantir's Customer Base Expands

Palantir’s robust performance has been fueled by the AI frenzy, with the company’s latest set of quarterly results pleasing investors in a big way. The strong results and favorable commentary have brightened its earnings outlook in a big way, as we can see below.

Image Source: Zacks Investment Research

The company’s sales have snowballed thanks to strong AI demand, with sales of $726 million throughout its latest period growing 30% year-over-year and 7% sequentially. As shown below, PLTR’s sales have consistently grown sequentially over the years.

Image Source: Zacks Investment Research

The stock overall remains a prime pick for those seeking artificial intelligence exposure, underpinned by unrelenting demand and a snowballing customer count.

SoFi Raises Outlook

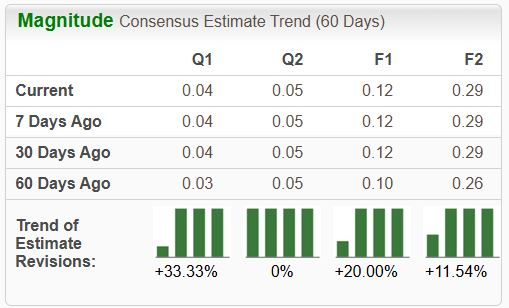

SoFi’s market-beating share performance has also been fueled by strong quarterly results, also remaining in a favorable spot given the Fed’s current easing cycle. Big growth is expected for its current fiscal year, with our consensus estimates suggesting 130% EPS growth on 21% higher sales.

Like those above, the stock sports a favorable earnings outlook.

Image Source: Zacks Investment Research

The company’s platform continues to attract consumers rapidly, with SOFI reporting 35% year-over-year membership growth from the same period last year. Net interest income growth of 25% paired with record Q3 personal loan originations of $4.9 billion led the company to raise its FY24 outlook, also explaining the share melt-up post-earnings.

Bottom Line

Momentum investing is all about riding bullish trends where buyers are in control.

And buyers have certainly been in control of all three stocks above – Tesla TSLA, Palantir PLTR, and SoFi Technologies SOFI – with shares of each soaring over the last month.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.