Moving past the holiday shopping season, which is capped by Christmas and New Year's, several retailers will be able to gain or keep their momentum going with Valentine's Day.

Keeping this in mind, here are three retail stocks that could benefit from Valentine’s Day shopping and may be in store for more upside in the coming weeks.

Amazon’s Ultimate Brand Sale

Zacks Rank #3 (Hold)

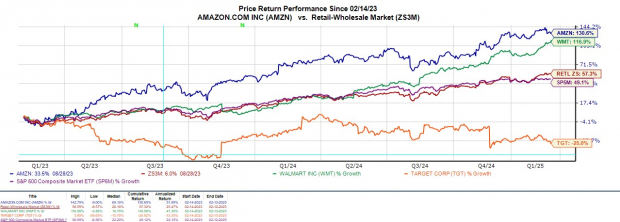

Amazon’s AMZN online presence and frequent sales events can lead to an advantage over competitors like Walmart WMT and Target TGT even for a more intimate or “in-person” holiday like Valentine’s Day. Prime shipping plays a part in this, which ensures quick delivery for last-minute shoppers with Amazon’s Ultimate Brand Sale sticking out among its omnichannel peers.

The Ultimate Brand Sale has attracted Valentine’s Day shoppers with 80% discounts on a wide range of products including beauty goods, home goods, and electronics. Coming off a record holiday shopping season, Amazon recently posted Q4 sales of $187.79 billion with AMZN up nearly +35% over the last six months as the e-commerce giant continues to reward long-term investors.

Image Source: Zacks Investment Research

Valentine’s Day Could Strengthen Macy’s Rebound Prospects

Zacks Rank #3 (Hold)

Trading at $15, Macy’s M stock is near its 52-week lows and may start to make the argument for a buy-the-dip candidate. Notably, Macy’s stock trades at just 6X forward earnings and typically sees a significant boost from Valentine’s Day as the company offers special deals on chocolates, jewelry, clothing, and home goods.

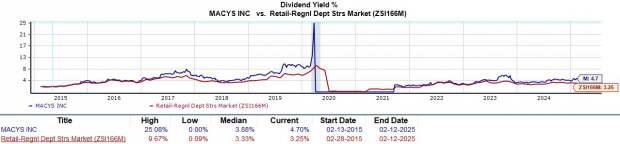

Although there could still be better buying opportunities, the risk to reward is becoming favorable with Macy’s at a discount to its Zacks-Retail Regional Department Stores Industry average of 10.2X forward earnings. Plus, at current levels, Macy’s has a 4.7% annual dividend yield which tops its industry average of 3.25% and the S&P 500’s 1.19% average.

Image Source: Zacks Investment Research

Victoria's Secret’s Niche

Zacks Rank #2 (Buy)

Last but not least is Victoria’s Secret VSCO, which of course has a niche as an intimate specialty retailer. Very likely to benefit from Valentine’s Day, Victoria's Secret’s stock is seeing a positive trend of earnings estimate revisions which correlates with its buy rating.

VSCO has popped over +40% in the last six months but trades at a reasonable 11.5X forward earnings multiple. Starting to gain traction as a suitable long-term investment, Victoria’s Secret’s EPS is expected to increase 4% this year and is projected to spike another 19% in fiscal 2026 to $2.83 per share. More intriguing, FY25 and FY26 EPS estimates are up 2% and 5% in the last 30 days respectively.

Image Source: Zacks Investment Research

Takeaway

Amazon, Macy’s, and Victoria’s Secret stock will be worth keeping an eye on in the coming weeks as they may be capitalizing on Valentine’s Day. Following the trend of earnings estimate revisions will be an indicator of such with Victoria’s Secret standing out in this regard.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAmazon.com, Inc. (AMZN) : Free Stock Analysis Report

Macy's, Inc. (M) : Free Stock Analysis Report

Victoria's Secret & Co. (VSCO) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.