One of my favorite stocks is Square. (NYSE: SQ) In the future I think Square will be a superbank. Not surprisingly, when I tried to name the top 10 stocks of 2035, Square made my list. I think Square Chief Executive Officer Jack Dorsey is a genius.

While I'm a happy shareholder, I never followed Dorsey into Bitcoin (CRYPTO: BTC). In fact, for years I avoided all cryptocurrencies as too risky. And I watched on the sidelines as Bitcoin went up and up and up.

Finally, last week I started making my first crypto buys. And now I'm just shaking my head at how Dorsey understood the importance of this asset class years ago. In fact, Square is now basically married to Bitcoin, for better or for worse. These three charts will show what I'm talking about.

image source: Getty Images

January 2018: Square opens the Cash App to Bitcoin

As you probably know, Bitcoin is the top dog and first mover among cryptocurrencies. Bitcoin was created when someone or a group, using the fictitious name Satoshi Nakamoto, wrote a white paper in 2008 about using peer-to-peer networks to create an electronic currency without the involvement of a government or central bank. This was a revolutionary idea, and it caught fire among tech-savvy people in Silicon Valley.

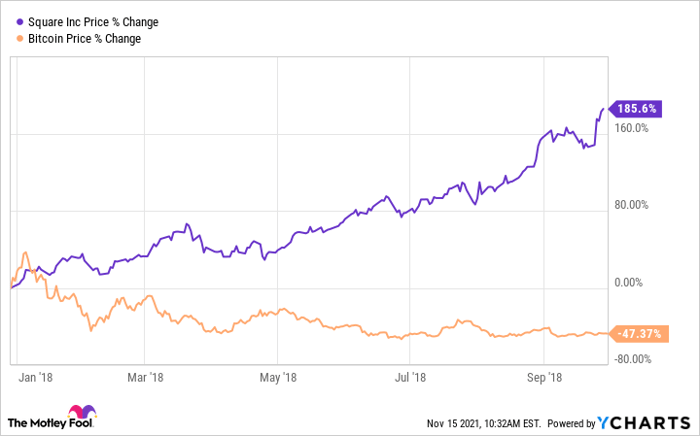

A decade after the white paper, Square opened up its mobile payments service, Cash App, to let users buy and sell Bitcoin. In the previous 10 years, a lot of risk-tolerant investors had already jumped in and bought the new asset on websites like Coinbase Global (NASDAQ: COIN). Waiting a decade to become a broker for cryptocurrency was actually pretty cautious. What happened once Square facilitated Bitcoin trading is fascinating.

Square's stock almost tripled in nine months. Meanwhile, Bitcoin investors got creamed. Newbies who bought crypto using Square's Cash App saw the value of their investment drop by almost 50%.

So Dorsey got his Cash App users into Bitcoin at the worst possible time, right? Well, not exactly. Only if you have a short-term time horizon.

October 2020: Square buys $50 million in Bitcoin

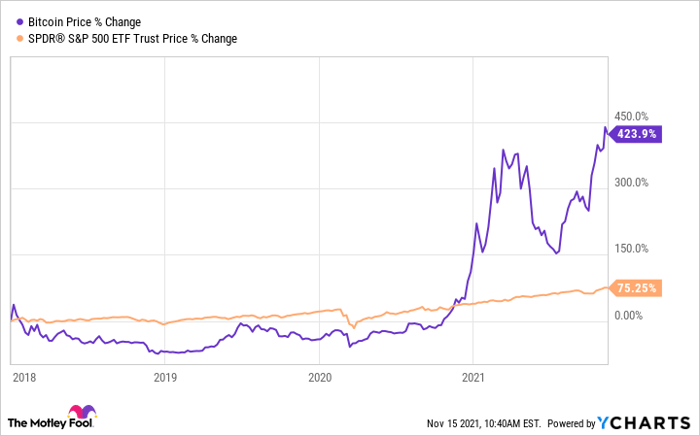

Yes, Bitcoin was a bad investment in 2018, in 2019 and for most of 2020. But then in October of last year, Square said that it had bought $50 million worth of Bitcoin for itself.

After underperforming the stock market for almost three years in a row, Bitcoin's price suddenly went through the roof.

Bitcoin Price data by YCharts

Financially speaking, for a company with a $108 billion market cap, $50 million is practically nothing. Nonetheless, Square's action validated the currency as a legitimate investment vehicle.

A few weeks later, PayPal Holdings (NASDAQ: PYPL) said that it would soon allow its users to buy and sell Bitcoin on its Venmo app. That just cemented the deal. The coin spiked in late 2020 and early 2021. And that's when Square made another announcement.

February 2021: Square buys $170 million of Bitcoin

At the beginning of 2021, Square upped its stake considerably, buying an additional $170 million in Bitcoin. So that's $220 million invested in Bitcoin. This is a sizable investment to you and me. But it's still way under 1% of Square's market cap and it's just 5% of Square's $5 billion in cash on hand.

Why is Square making this investment? Well, part of the reason is that Dorsey is a huge Bitcoin bull. He believes one day the world will unite behind a single internet currency. And he thinks that Bitcoin will be that currency.

Another reason is that all of the coins that are traded on Cash App are counted as Square revenue. This is not the Bitcoin that Square owns. This is the Bitcoin that Square holds in order to facilitate Bitcoin trading on Cash App. It's a quirk in accounting that requires Square to report all this Bitcoin trading as revenue. So when Bitcoin trades spike on the Cash App, Square's revenue spikes right along with it.

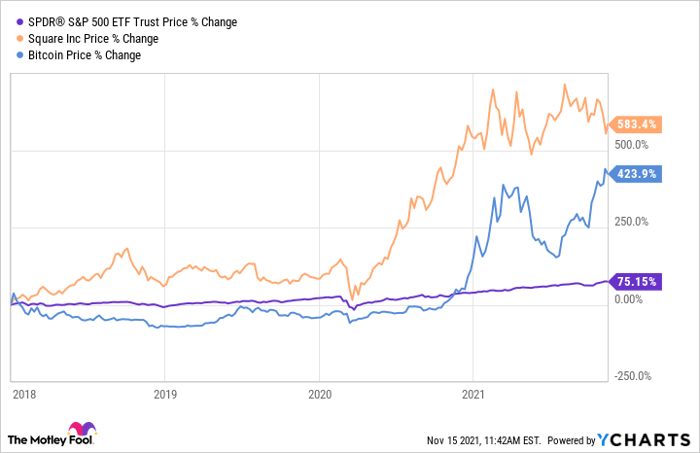

Square is effectively married to Bitcoin now. Even the two charts are coming into alignment. Let's compare Square, Bitcoin, and the S&P 500 from the beginning of 2018 -- when Square first opened up Cash App to Bitcoin trading -- to the present.

Both Square and Bitcoin have been killing the S&P 500 during the past four years. And I think we will see these two charts become more and more aligned. If you're a Square investor, you ought to consider Bitcoin and cryptocurrency as an investment idea. And if you dismiss crypto as foolhardy or dangerous, then maybe you ought to rethink your Square investment.

10 stocks we like better than Square

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Square wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 10, 2021

Taylor Carmichael owns shares of Coinbase Global, Inc., PayPal Holdings, and Square. The Motley Fool owns shares of and recommends Bitcoin, PayPal Holdings, and Square. The Motley Fool recommends the following options: long January 2022 $75 calls on PayPal Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.