2023’s Scorching Hot Start

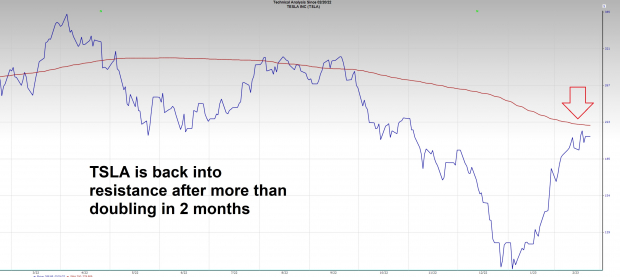

Regarding the U.S. stock market, 2023 has been the polar opposite of 2022. 2022 saw the stock market steadily trend lower, while technology, biotech, and small caps led the way down – meanwhile, slower-moving “safer” stocks outperformed. Thus far in 2023, tech is once again leading the market (this time higher) as a risk-on mood returns. In fact, the Nasdaq 100 ETF QQQ is up 13.10% year to date. Electronic vehicle maker Tesla TSLA is up a mind-blowing 100% since hitting lows last month (yes, you read that right).

Image Source: Zacks Investment Research

Meanwhile, Cathy Wood’s Ark Innovation ETF ARKK, which rose to superstardom during the last bull cycle only to be crushed in 2022, is up 34% in 2023.

Can the Strength on Wall Street Continue?

While the solid start for 2023 is a welcome sign for investors, the key is to look forward. In the short term, there are some signs that the market may need to pull back or digest gains at the very least, including:

- Sentiment: Two of the most followed sentiment indicators show signs that bears that may have overstayed their welcome are capitulating. The CNN Fear & Greed Index, a sentiment gauge that combines seven different indicators to distinguish what “emotion” is driving the market, has flashed a “greed signal” for over a month. The American Association of Individual Investors’ (AAII), another closely followed sentiment gauge, recently flipped from bears making up the majority to bulls making up the majority. This week marks the first consecutive two-week stretch in which bulls outweighed bears in more than one year. While the sentiment indicators should not be used in a stand-alone manner and are not a timing device, the data should raise investors’ antennas. As legendary General George S Patton once warned, “If everyone is thinking alike, then somebody isn’t thinking

- No Market Goes Straight Up: How strong have stocks been? The tech-heavy Nasdaq 100 Index ETF is up 6 out of 7 weeks thus far in 2023. While market leaders like Tesla haven’t shown any signs of slowing yet, they are reaching frothy-like levels. Tesla is up every single week this year but is now approaching the underside of its 200-day moving average – an area where it broke down from in late 2022.

Image Source: Zacks Investment Research

Conversely, many stocks, such as Meta Platforms META and Fastly FSLY, have seen strong moves post-earnings. While it is overall a positive development to see investors applaud earnings for a change, some digestion after such significant moves is warranted.

Image Source: Zacks Investment ResearcThe 50-day moving average tends to act like a bungee cord. When stocks get too stretched, they usually must pullback through price or time so that the moving average can catch up.

- Late February Seasonality: Though U.S. stocks tend to march higher over the long haul, late February has been a rare weak spot over the years. Since 1950, the second half of February has been negative on average. After the blistering start the major U.S. Indexes have had thus far, a pullback or sideways digestion would make sense at this juncture.

Conclusion

Knowing your time frame is a critical attribute investors need to navigate the market successfully. Stocks have had a multi-week run, we are in the middle of a seasonally weak period, and sentiment is getting hot. For short-term investors, now is not the time to chase. On the contrary, mid to longer-term investors should stay the course. U.S. stock markets rarely have two consecutive down years, the pre-presidential election years tend to be the strongest from a seasonality perspective, and longer-term bullish technical indicators are triggering. For example, the S&P 500 Index ETF SPY, just flashed a bullish “golden cross.”

Image Source: Zacks Investment Research

Regardless of the time frame, a pullback here should be welcomed by investors to work off excess bullishness and set up new buy zones. As always, patience is a virtue.

Just Released: Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for 2023?

From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%. Our Director of Research has now combed through 4,000 companies covered by the Zacks Rank and handpicked the best 10 tickers to buy and hold in 2023. Don’t miss your chance to still be among the first to get in on these just-released stocks.

See New Top 10 Stocks >>Tesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

ARK Innovation ETF (ARKK): ETF Research Reports

Fastly, Inc. (FSLY) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.