While the "Magnificent Seven" stocks often get a lion's share of attention in the tech world, semiconductor stocks outside Nvidia are often ignored by a lot of investors. And the semiconductor capital equipment ("semicap") stocks -- the makers of high-tech machines that produce semiconductors -- are ignored even more.

This is despite the semicaps having some of the best businesses around. Today, semicap leader Lam Research (NASDAQ: LRCX) looks like an excellent buy for long-term investors, especially after the big pullback from its summer highs.

1. A technology leader with a formidable moat

Lam is one of just a handful of companies that produce advanced etch and deposition equipment for chip manufacturing. Deposition equipment lays down materials on a silicon wafer, and etch equipment strips that material away. Given that chips are now made with literally hundreds of billions of transistors on a single semiconductor, with transistors just five nanometers wide placed just a few nanometers apart, the process of precisely placing and removing semiconductor material has gotten incredibly complex.

In particular, Lam specializes in etch and deposition processes that stack chip components in a vertical fashion. Verticalization in NAND flash memory began 10 years ago when companies began stacking NAND cells, but today, advanced logic and DRAM chips are going vertical too.

That niche puts Lam in a very good position in the age of artificial intelligence. Advanced logic chips are transitioning to gate-all-around transistors in which the gate wraps around a transistor on all four sides, allowing transistors to be stacked vertically. Additionally, more chips are now using "chiplet" architectures in which sub-components are fused together with advanced packaging to construct a chip. And high-bandwidth DRAM memory (HBM) has recently emerged as a key part of AI processing in which high-end DRAM cells are also stacked in vertical fashion.

These trends play right into Lam's strengths, deepening its technology moat.

2. Lam is a cash machine

Growth is nice, but if a company doesn't efficiently convert that growth into profits, shareholders won't ultimately benefit.

Fortunately, Lam has profits in spades. The company made a 30.3% operating margin last quarter, which is fairly typical of Lam's history and pretty high for a hardware company.

Moreover, Lam doesn't have to invest lots of capital on semiconductor fabs, as its customers do, since its competitive advantage comes mostly from advanced research and development. Lam's high margins and relatively low capital needs enable a very high return on equity (ROE) for Lam of nearly 50%. That's a very high ROE compared with the average 15% for the S&P 500 and even the technology sector's higher-than-average 25%.

High ROE companies generate lots of cash, which can be deployed into new growth opportunities or returned to shareholders in the form of share repurchases and dividends. To that end, Lam has a policy of returning 75% to 100% of its free cash flow to shareholders over the long term. While Lam has mostly embarked on repurchases as its favored means of capital return, lowering its share count by about 12% over the past five years, it has also raised its dividend consistently, with a recent 15% increase in September to the current yield of 1.25%.

Lam is also able to return all this cash while keeping a pristine balance sheet, with $6.1 billion in cash against just under $5 billion in debt.

3. It trades at a value price after its pullback

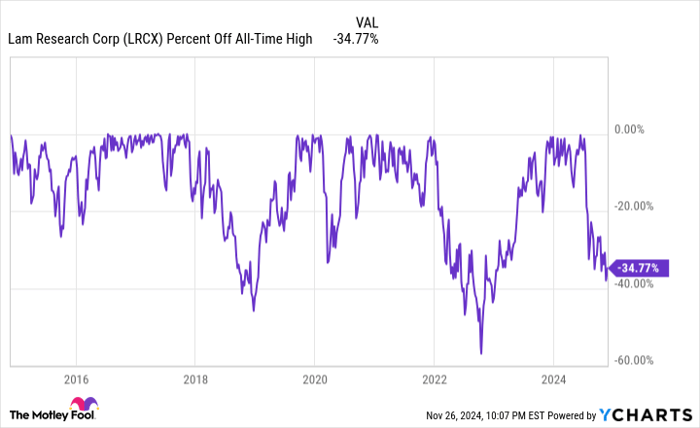

Some may debate how cheap Lam Research is at 23 times earnings. But those trailing earnings represent somewhat of a trough profit figure, with many end markets outside of AI just now coming out of the post-Covid hangover. Furthermore, the stock is down 35% from its all-time highs this past July. As you can see below, that's an even larger decline than the Covid downturn and only surpassed by the declines of late 2018 and early 2022, which were periods when the Federal Reserve was raising interest rates.

LRCX Percent Off All-Time High data by YCharts.

But with AI demand strong, many semiconductor end markets just emerging from their post-pandemic hangovers, and the Federal Reserve actually cutting interest rates, it's a strange time for Lam to have that big of a pullback.

Therefore, now seems like an opportune time to pick up shares for the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

Billy Duberstein and/or his clients have positions in Lam Research. The Motley Fool has positions in and recommends Lam Research and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.