Target (NYSE: TGT) missed the mark for shareholders with a disappointing third-quarter earnings report. Comparable sales from the retail giant grew just 0.3% year over year for the period ended Nov. 2, while adjusted earnings per share (EPS) of $1.85 fell well below the company's guidance range of $2.10 to $2.40. At the time of this writing, the stock is down 30% from its 52-week high.

The headline numbers may not inspire much confidence, but a deeper look highlights plenty of positives for investors to consider. The potential for stronger growth into 2025 could set the stage for shares to rebound sharply.

Here are three reasons to buy Target stock now.

1. Still profitable with solid fundamentals

Even as a resilient labor market and climbing consumer sentiment suggest the U.S. economy is on firm footing, the cumulative impact of price inflation over the last several years and still elevated interest rates continue to weigh on certain segments of consumer spending.

That was the message from Target describing its otherwise mixed third-quarter results, pointing to a delicate macroeconomic environment. A combination of more aggressive discounting and a shift in the sales mix toward lower-priced ticket items led to the soft top and bottom lines in Target's financials with shoppers pushing back on discretionary categories like home goods and electronics.

That being said, the latest trends did have some strong points. Traffic at stores was up 2.4% from last year, representing more than 10 million incremental transactions. Beauty items including cosmetics have been a growth driver, with sales up 6% from the prior-year quarter. Target is also finding success with its online strategy, where comparable digital sales increased by 11% from Q3 2023 including home delivery and in-store pickup.

These themes are important as they demonstrate ongoing brand momentum and customer engagement keeping Target well positioned to emerge stronger as the broader operating environment improves.

Image source: Getty Images.

2. Upside to earnings in 2025

Target stock has fallen out of favor with the market, but the upside here is that a lower bar of expectations provides the company more space to overdeliver.

Wall Street analysts estimate Target will rebound from a projected 1.4% revenue decline in 2024 to a 2.8% growth rate in 2025. Similarly, compared to an estimated EPS of $8.67 in 2024, earnings per share is forecast to climb by 7% next year to $9.29.

The possibility that Target captures a strong holiday shopping season this fourth quarter would be a good first step to rebuilding the market's confidence in the stock. From a high-level perspective, there is a case to be made that recent moves by the Federal Reserve to cut interest rates could begin having an impact on boosting consumer spending over the next few quarters.

Stronger-than-expected results in 2025 could be a catalyst for the shares of Target to rally higher.

| Metric | 2024 Estimate | 2025 Estimate |

|---|---|---|

| Revenue | $105.9 billion | $108.8 billion |

| Revenue change (YOY) | (1.4%) | 2.8% |

| EPS | $8.67 | $9.29 |

| EPS change (YOY) | (3%) | 7.2% |

Data source: Yahoo Finance. YOY = year over year.

3. A compelling valuation

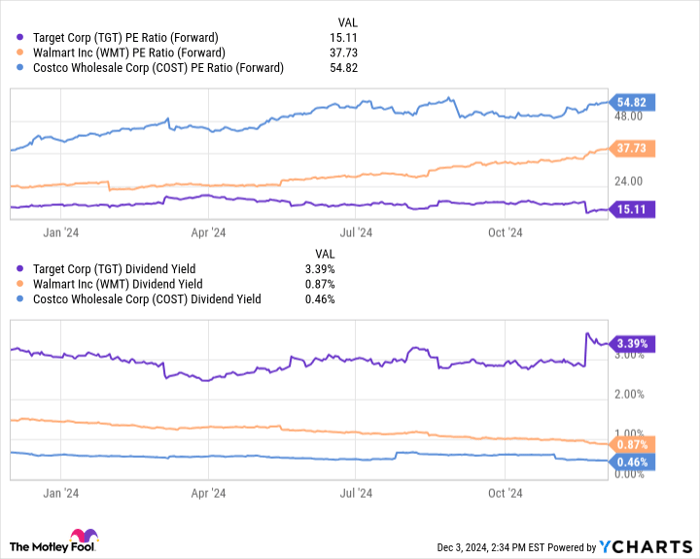

The main reason I'm bullish on Target is my view that the stock is simply undervalued. Shares are trading at 15 times its 2024 consensus EPS as a forward price-to-earnings (P/E) ratio, which marks a deep discount to big box retail peers like Walmart at a forward P/E of 37 and even Costco Wholesale at 55.

Some of that valuation spread may be justified with Walmart and Costco generating stronger growth this year, but Target stands out as offering better value in the industry. On this point, Target's 3.4% dividend yield is compelling relative to just the 0.9% yield from Walmart or 0.5% in Costco stock. With Target's dividend payout supported by underlying cash flow and a strong balance sheet, investors are getting paid to wait for its turnaround to transpire.

TGT PE Ratio (Forward) data by YCharts

Final thoughts

Target still has a lot to prove in what will be a critical 2025. Recognizing the lingering uncertainties, I believe the recent market volatility presents a great opportunity for investors to pick up shares in this beaten-down industry leader that maintains a positive long-term outlook.

Should you invest $1,000 in Target right now?

Before you buy stock in Target, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Target wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $889,004!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.