In the battle of coffee shop stocks, Dutch Bros (NYSE: BROS) looks like it will be the clear winner in 2024, as the company has greatly outperformed its larger rival Starbucks (NASDAQ: SBUX) this year. The stock is up more than 70% in 2024 versus about a 6.7% gain for Starbucks.

Even with its strong performance, however, there are several reasons why Dutch Bros stock should keep growing and become a long-term winner. Let's look at three reasons investors should consider buying the stock hand over fist.

1. Dutch Bros is introducing additional food products

While Dutch Bros stores are much smaller than Starbucks stores and rely primarily on drive-thru traffic, they surprisingly generate more revenue per store on average than Starbucks. Last quarter, Dutch Bros' average unit volume (AUV) was $2 million, well ahead of the approximately $1.5 million in AUV for Starbucks' U.S. locations.

This likely can be attributed to the fact that Starbucks has a much larger and denser footprint. With fewer stores in an area, individual Dutch Bros stores will draw customers from a wider area.

While Dutch Bros is beginning to add more locations within already existing markets, which can impact same-store sales by drawing traffic away from old stores to new stores, it still does have opportunities to increase same-store sales. One of the biggest opportunities to help on this front is with food.

Last quarter, the company started testing more food offerings in six locations. Food currently represents only 2% of its sales, so this is a big opportunity if it can get it right. By contrast, in 2023, approximately 22% of Starbucks' sales came from food.

Image source: Getty Images.

2. Dutch Bros is expanding mobile ordering

In addition to food, another big opportunity to help drive sale-store sales for Dutch Bros is with mobile ordering. While mobile ordering has been a driver for many quick-service restaurant stocks over the past several years, Dutch Bros just recently began introducing it. It was available in 90% of its stores at the end of September, including in 96% of its company-owned locations.

Nonetheless, mobile is still a small percentage of its orders at the moment due to the recent introduction of the offering. In Q3, it made up just 7% of its total orders. The company, however, was already beginning to see a sales lift, reporting that customers who have started using mobile ordering increased their frequency by about 5%.

The company also said that it has begun to see an uptick in loyalty members as well, helped by its introduction of mobile orderings. Loyalty programs have been another big driver in the quick-service restaurant space, so this is another nice positive for the company that is still in its early days.

3. Plenty of expansion opportunities for Dutch Bros

The biggest opportunity for Dutch Bros going forward, though, is expansion. The company ended last quarter with 950 stores, of which 645 were company-owned. That pales in comparison to the nearly 17,000 stores that Starbucks has in the U.S. alone.

After a quick pause to reevaluate its real estate strategy moving forward, Dutch Bros plans to open 150 new locations this year, which was at the low end of its original guidance for the year. However, it will accelerate new store openings in 2025 to at least 160 stores and plans to open an even greater number in 2026.

Overall, the company thinks it can increase its store base to more than 4,000 locations over the next 10 to 15 years. A more than four times increase in its number of stores over this period will undoubtedly drive a lot of growth.

Just as importantly, though, Dutch Bros stores have a small footprint, with newer stores typically between 800 square feet and 1,000 square feet, with multiple drive-thru lanes served by one window and a walk-up window. This makes building out new stores relatively inexpensive.

This allows Dutch Bros to fund its new store openings with its current operating cash flow. Through the first nine months of this year, Dutch Bros has generated $184.2 million in operating cash flow while spending $179 million on capital expenditures, most of which is going toward opening new stores.

The company is expanding at a nice pace, but also within its means. Expansion stories typically run into trouble when companies take on debt and try to grow their store bases beyond their means, which is something Dutch Bros is not doing.

A good time to buy Dutch Bros stock

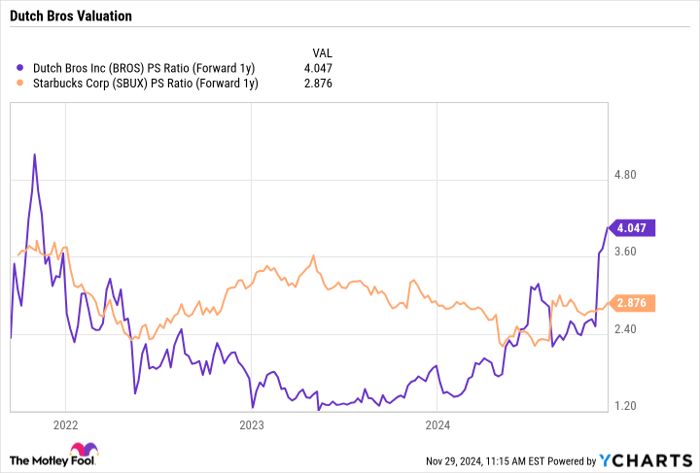

Despite its strong performance this year, Dutch Bros is still a solid option for investors to consider adding to their portfolios. While it trades at a higher valuation than Starbucks on a forward price-to-sales basis, it has a much larger growth opportunity ahead of it.

BROS PS Ratio (Forward 1y) data by YCharts

As such, I think Dutch Bros remains a solid long-term option for investors as it continues to expand its store base over the next decade.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.