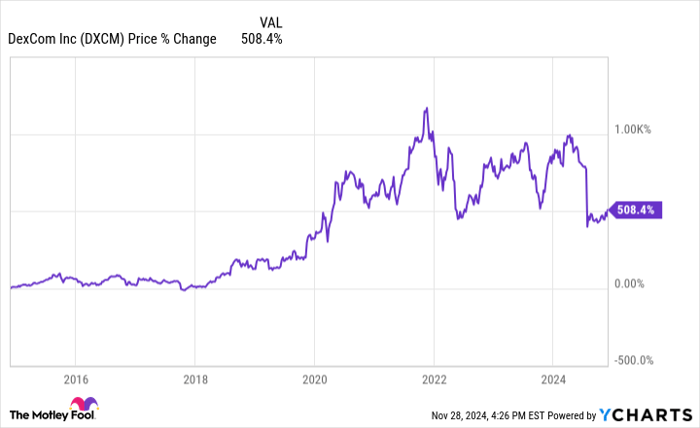

Medical device specialist DexCom (NASDAQ: DXCM) is going through a rough patch. The company's shares are down sharply year to date due to unimpressive financial results -- and some of the headwinds it has encountered are, no doubt, concerning. The company's slower-than-expected growth in international markets in the second quarter comes to mind.

However, there remain excellent reasons to be bullish on DexCom's long-term prospects. Let's consider three of them.

1. The power of CGM systems

DexCom is a leader in the continuous glucose monitoring (CGM) systems market. They aren't the only kinds of devices that help diabetes patients keep track of their blood glucose levels -- a necessary thing to do for many people with this chronic health condition. However, CGMs are, in many ways, superior to their alternatives, blood glucose meters (BGMs). CGMs automatically take measurements throughout the day, up to once every five minutes.

So, users are constantly up to date with their sugar levels. BGMs are manual devices that give patients measurements every time they use them. It'd be impossible to do it every five minutes. Further, CGMs don't rely on pesky and painful fingersticks, unlike BGMs. True, the latter are sometimes cheaper, at least upfront. But given the perks of CGMs -- and the fact that they lead to better health outcomes for patients -- they are well worth the money.

The CGM market is practically a duopoly that DexCom shares with Abbott Laboratories. DexCom's success in this market explains its long-term performance. And for investors willing to be patient, there is far more room for the company to grow.

2. Expanding its addressable market

There are at least three ways DexCom can increase its target market. The first is by entering new territories. Half a billion adults worldwide have diabetes, only 1% of whom have access to CGM systems, according to DexCom's biggest rival, Abbott Laboratories. One reason behind the market's low penetration is that most diabetes patients reside in developing countries where DexCom or Abbott have yet to launch CGM-related operations. DexCom has generally sought to enter new territories in the past, though. The company explicitly plans to continue doing so.

Second, CGM systems can get more third-party coverage as the evidence for their effectiveness grows. Patients, strictly speaking, don't need coverage to access CGM devices, but everyone is more likely to buy a product when someone else is helping foot the bill. Some of DexCom's latest wins in this category include a decision in France in June that helped it get access to an additional 100,000 patients with type 2 diabetes with its device, the DexCom ONE.

Third, DexCom can develop new devices to appeal to a broader audience. That's what the DexCom ONE was -- a cheaper CGM option it developed to attract more price-sensitive customers. More recently, DexCom launched Stelo, an over-the-counter CGM option for non-insulin diabetes users and people with prediabetes. Expanding its addressable market beyond diabetes patients is an excellent move by DexCom.

The bigger picture is that the company still has a vast runway for growth, even in the U.S., where many coverage-eligible patients have yet to get on board. The increased adoption of this technology could provide a long-term tailwind for DexCom.

3. Valuation is near three-year lows

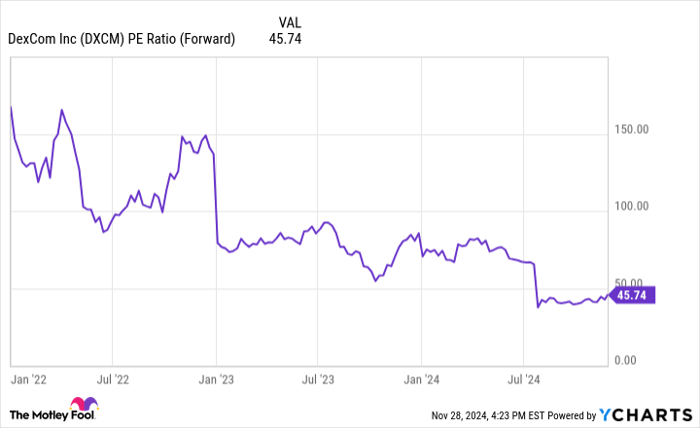

There is a silver lining to DexCom's poor performance on the market this year: The company's valuation has gotten far more reasonable. DexCom's forward price-to-earnings (P/E) ratio is near three-year lows as of this writing.

DXCM PE Ratio (Forward) data by YCharts

It's still pretty high; the average forward P/E for the healthcare industry is 18. But DexCom has historically been well above the market average in this category. The stock has been somewhat volatile as a result. DexCom's recent drop is not that out of the ordinary by its standards.

But despite the company's volatile streak and expensive-looking valuation, DexCom's dominance in the CGM market and strong financial results have led to excellent performances. In my view, DexCom can repeat that for investors who are patient enough to stay the course. Now is an especially good time to purchase the company's shares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 2, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends DexCom and recommends the following options: long January 2027 $65 calls on DexCom and short January 2027 $75 calls on DexCom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.