Altria (NYSE: MO) is a stock that you are likely to either love or hate. There's very little middle ground. And the reasons that people might find themselves on either side of the debate will likely center around some of the same core facts. Here's a look at three key reasons that investors might like Altria... and why those same reasons might lead investors to avoid the stock.

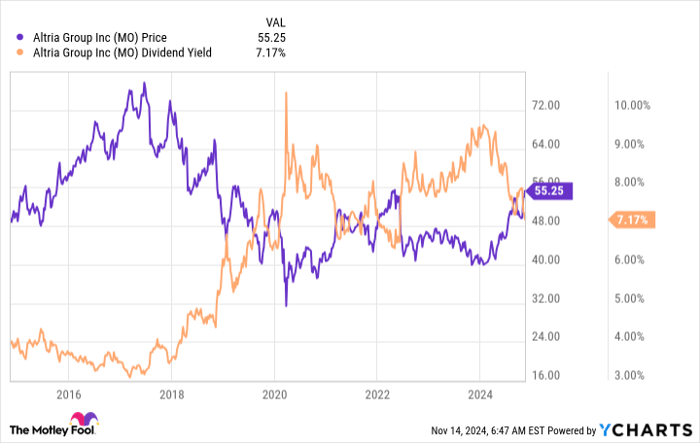

1. Altria has a giant 7.3% dividend yield

Dividend investors are the most likely kind of investor to be attracted to Altria thanks to the stock's huge 7.3% dividend yield. The average consumer staples company has a yield of just 2.6%, using the Consumer Staples Select Sector SPDR ETF (NYSEMKT: XLP) as a proxy, while the S&P 500 index (SNPINDEX: ^GSPC) is only offering 1.2%. And Altria has been increasing its dividend regularly for years as well. From this perspective, there's a lot to like.

Image source: Getty Images.

However, stocks don't generally find themselves with well above average dividend yields for no reason. In Altria's case the problem is pretty simple. It has been selling less and less of its main product, cigarettes, every year. The downtrend has been going on for a while and there's no sign of the trend shifting in a more positive direction. In fact, the declines look like they may be speeding up. Cigarette volume fell 9.7% in 2022, 9.9% in 2023, and 10.6% through the first three quarters of 2024.

Yes, Altria is offering a high yield, but dividend investors need to recognize that the yield comes with high risks, too. With Altria the risk is that its most important business could be in a permanent state of decline.

2. Altria owns Marlboro, the biggest premium brand

That said, Altria's position within the cigarette business is interesting. For starters, it only operates in North America. And it happens to control the most important cigarette brand in that market, Marlboro. The brand's market share of the North American cigarette industry is a massive 41.7%. Within the premium segment in which it more directly competes, Marlboro has a 59.3% share. There's no question that Altria is the market leader in the markets it serves, and that has material value. That includes the ability to be more aggressive with price increases, which have been used to offset the volume declines noted above.

There's a flip side, however. Altria is almost the definition of a one-trick pony. It was spun off from Philip Morris International, which basically operates all of the same brands as Altria, but outside of North America. With just a single market, Altria simply doesn't have as much diversification as it once had. That's compounded by the fact that its business is really centered around one core brand, Marlboro. If there's a problem with Marlboro in North America, like ongoing volume declines, Altria's options are pretty limited when it comes to finding a solution.

And to make matters worse, Philip Morris International has been entering the North American market with non-cigarette tobacco products. So, effectively, Altria created its own competitor when it created Philip Morris International. Having a large and dominant brand is good, but you still have to consider the risks that this might pose as well.

3. Altria has finally found a growth engine with NJOY

If you have a glass-half-full point of view, Altria's purchase of vape maker NJOY is a huge positive. In the third quarter of 2024, NJOY's consumables shipment volume increased 15.6% versus the same quarter of 2023. The company shipped double the amount of NJOY devices. And NJOY's market share jumped 2.8 points versus the prior year to 6.2%. This is all very good news and to many suggests that Altria has finally found a product that will help it offset the declines in cigarettes.

If you are a glass-half-empty type of investor, however, there's a number of negatives you might focus on here. First, NJOY is the third attempt by the company to find a growing product. The first two, an investment in Juul and a marijuana company, fell flat and led to billions of dollars worth of write offs. NJOY is going well right now, but the history of strategic decisions Altria has made isn't filled with success (including the Philip Morris International spin-off).

And then there's the not-so-small fact that NJOY is a very small business. In fact, it is so small that it is still classified in the "other" category, which made up just $19 million of Altria's $18.044 billion in revenue in the third quarter of 2024. It's growing fast, but it's still just a rounding error. And all of those big gains are, effectively, coming off of a very small base and they may not continue for long after NJOY's products have been plugged into Altria's distribution system for a year or so.

Yes, NJOY is very good news for a company that has been dealing with a lot of bad news. But the jury is still out on whether it is going to move the needle over the long term.

Buy Altria, but buy with caution

None of this is meant to suggest that Altria is a bad company, which isn't true. There are many positives to look at, but they come along with very real risks. This is not a set it and forget it dividend stock. Conservative income investors will probably want to take a pass even though the lofty yield is enticing. If you do buy Altria, go in cognizant of the risks and keep a very close eye on the company's performance to make sure the negatives don't get worse.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $22,819!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,611!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $444,355!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 11, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.