Prudent underwriting, increasing rates in the auto business and exposure growth have helped the insurance industry perform well. Focus on increased automation, consumer-centric products and partnerships to grow the footprint bodes well for the industry. Rising interest rates resulted in strong sales for annuity businesses. These trends are expected to continue in 2025, and drive the top and bottom lines of insurance companies.

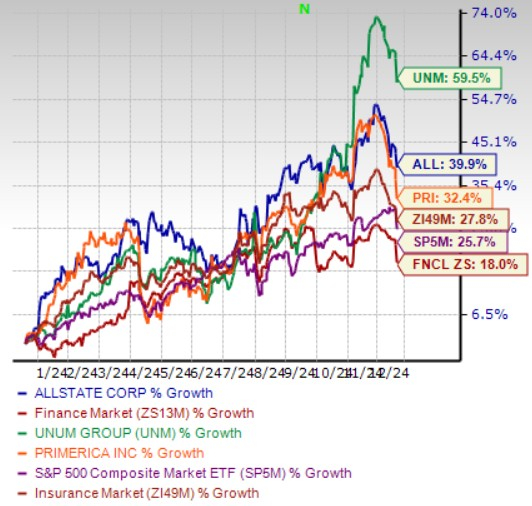

The insurance industry has outperformed the Zacks S&P 500 composite and the Finance sector in the year-to-date period. The insurance industry has rallied 27.8% in the year-to-date period compared with the Zacks S&P 500 composite’s return of 25.7% and the Finance sector’s growth of 18%.

YTD Stock Price Performance of Zacks Insurance Industry

Image Source: Zacks Investment Research

Future Catalysts

The adoption of AI for underwriting, claim processing and customer engagement will be a crucial factor for growth for non-life insurance companies in 2025. As AI-related liabilities increase, insurers should innovate to create insurance products and coverage related to technology. Per Deloitte FSI Predictions, AI could generate up to US$4.7 billion in annual global premiums by 2032.

The profitability of property and casualty companies has started to improve, given the rate hikes implemented to control claim costs. Improved combined ratios and higher premiums have provided some respite to insurers battling high inflation, leading to high claim costs.

Year 2025 is expected to experience moderating rate increases. After several years of sharp price hikes, particularly in commercial lines, the market is expected to stabilize, with more moderate pricing across regions and lines of business. Overall, P&C insurers will likely benefit from improved underwriting profitability, but ongoing geopolitical risks and natural catastrophe events could be concerning.

Per Swiss Re Institute’s insurance market outlook for 2025-2026, global life insurance premiums are expected to reach $4.8 trillion by 2035. Robust growth will primarily be driven by continued high demand for savings products, particularly in emerging markets. The overall demand for life and annuity insurance remains elevated due to factors like aging demographics, the rise of the middle class in developing countries, and an increased focus on pension de-risking. Per Swiss Re, the global life insurance market is predicted to reach USD 4.8 trillion by 2035.

Embedded insurance, wherein policies are sold through partnerships with industries like automotive, retail and real estate, is expected to reach more than US$722 billion in premiums by 2030, Per Swiss Re. This model improves accessibility, convenience and distribution reach, allowing insurers to tap into a wider audience with lower capital investments.

Providing personalized, seamless experiences for consumers, especially younger demographics that are increasingly influenced by social media, should bode well for insurers.

3 Stocks to Watch

Here, we have picked three insurance stocks that flaunt a Zacks Rank #1 (Strong Buy) or #2 (Buy), and have the potential to retain their purple patch going forward. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Allstate Corporation ALL: Headquartered in Illinois, this insurer is likely to benefit from continued growth in premiums, strong underwriting performance and increased investment income from market-based assets, which should drive revenues and profitability. Continued rate increases in the auto business will now slow down and improve retention ratios for ALL.

Allstate’s earnings surpassed estimates in the last four quarters, the average surprise being 135.2%. The Zacks Consensus Estimate for ALL’s 2025 earnings is pegged at $19.17 per share, which indicates an improvement of 17.9% from the 2024 estimate. ALL currently sports a Zacks Rank #1.

The Allstate Corporation Price and EPS Surprise

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

Primerica, Inc. PRI: Headquartered in Georgia, the company gains from strong policy sales in its Term Life segment, and enhancement of its products in the Investments and Savings Products segment. Primerica’s expanding sales force, with an increase in independent life-licensed representatives, also provides a solid foundation for business growth. Increased investment income, and a rise in commissions and fees also bode well.

The Zacks Consensus Estimate for Primerica’s 2025 earnings is pegged at $20.71 per share, indicating a 7.2% improvement from the 2024 estimate. PRI’s earnings surpassed estimates in two of the last four quarters and missed twice, the average being 4.9%. PRI currently carries a Zacks Rank #2.

Primerica, Inc. Price and EPS Surprise

Primerica, Inc. price-eps-surprise | Primerica, Inc. Quote

Unum Group UNM: Headquartered in Tennessee, the company gains from strong premium growth across key segments, particularly in Unum U.S. and Unum International, reflecting its solid market position and product demand. Additionally, favorable benefit experiences, improved net investment income and lower expenses will continue to support profitability.

The Zacks Consensus Estimate for Unum’s 2025 earnings is pegged at $9.03 per share, which suggests a 5.7% rise from the 2024 estimate. UNM’s earnings outpaced estimates in three of the last four quarters and missed the mark once, the average being 3.2%. UNM currently carries a Zacks Rank #2.

Unum Group Price and EPS Surprise

Unum Group price-eps-surprise | Unum Group Quote

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpThe Allstate Corporation (ALL) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.