Generating reliable passive income requires more than just picking stocks with appealing current yields. The most successful income investors focus on companies that consistently grow their dividend payments year after year. This strategy provides natural protection against inflation while building wealth through steadily increasing cash flow.

Traditional income investments, like bonds and CDs, typically offer static payments that lose purchasing power over time. In contrast, well-chosen dividend-growth stocks can provide rising income streams backed by expanding businesses and strong competitive positions. The challenge lies in identifying companies with both the ability and commitment to maintain consistent dividend growth.

Image source: Getty Images.

Three key factors signal sustainable dividend growth potential:

- Conservative payout ratios that leave room for increases

- Proven histories of raising distributions through multiple economic cycles

- Durable competitive advantages that protect future cash flow

Let's explore three companies that exemplify these essential qualities.

Market dominance fuels five decades of dividends

Walmart (NYSE: WMT) leverages its unmatched scale to deliver consistent shareholder returns. The retail powerhouse has raised its dividend for 51 consecutive years while still maintaining a fairly conservative 41.4% payout ratio. The current 0.99% yield, combined with a 1.9% five-year growth rate, reflects management's balanced approach to dividends and reinvestment in the business.

The world's largest retailer trades at 33.5 times forward earnings, well above the S&P 500's multiple of nearly 24. This premium valuation stems from Walmart's efficient supply chain, expanding e-commerce presence, and formidable competitive position. The stock's whopping 76.4% gain year tp date through Dec. 2, 2024 reflects the company's operational strength and appeal to bargain shoppers in a tight economy.

Clean technology drives dependable income

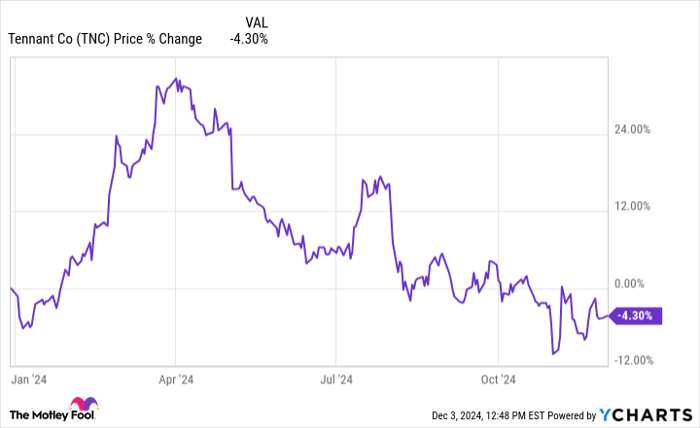

Tennant (NYSE: TNC) turns innovation in cleaning equipment into steady dividend growth. A global leader in professional cleaning equipment and solutions, Tennant has increased its payout for 53 straight years, supported by a remarkably low 19.7% payout ratio. A healthy 1.33% current yield and 4.8% five-year dividend growth rate showcase the company's commitment to shareholder returns.

Trading at just 13.7 times forward earnings, Tennant stock offers significant value, compared to the broader market represented by the S&P 500. After all, the company's product innovation, brand strength, and worldwide service network form a wide competitive moat. The stock's 4.3% decline year to date through Dec. 2, 2024 could thus represent a compelling entry point for long-term investors.

Financial data powers dividend excellence

S&P Global (NYSE: SPGI) converts its critical role in financial markets into growing income streams. The analytics giant has delivered 51 years of consecutive dividend increases while maintaining a prudent 32% payout ratio. Though the current yield sits at just 0.7%, S&P Global's impressive 12.5% five-year dividend-growth rate demonstrates strong income growth potential.

At 30.8 times forward earnings, S&P Global stock commands a premium valuation to the broader market represented by the S&P 500. The company provides essential credit ratings, market intelligence, and commodity pricing data that form the backbone of global financial markets.

Its entrenched market position creates high switching costs for customers and generates consistent cash flow, helping explain the stock's premium multiple. S&P Global's shares have risen 18.7% year to date through Dec. 2, 2024, reflecting the company's strong market position and attractive dividend program.

Building passive income for the future

Constructing a reliable passive income stream demands selecting companies with demonstrated abilities to grow dividends across market cycles. Walmart, Tennant, and S&P Global showcase the hallmark characteristics of sustainable dividend growth: financial discipline, proven track records, and strong competitive positions. Combined thoughtfully within a diversified portfolio, these dividend-growth leaders could deliver steadily rising passive income streams for decades to come.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $849,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

George Budwell has positions in Walmart. The Motley Fool has positions in and recommends S&P Global and Walmart. The Motley Fool recommends Tennant. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.