Out on the Street, it’s full speed ahead. Despite the chaotic events of 2020, the S&P 500, which is coming off of its best quarter in more than 20 years, is down by only 2% year-to-date. Somewhat remarkably, the market has continued to charge forward as the number of new COVID-19 cases surges.

As COVID-19 could be with us in waves for some time, there’s plenty of uncertainty going forward into the second half of the year. Consequently, spotting compelling plays can feel like a fool’s errand, especially given the hefty toll the virus has already taken on companies spanning multiple sectors.

Having said that, the Street’s pros argue that the pandemic has actually positioned some names as beneficiaries. Looking specifically at the biotech sector, massive amounts of capital have been pumped into a handful of names racing to develop solutions to combat the virus.

Bearing this in mind, we used TipRanks’ database to get more information on three biotech penny stocks, trading for less than $5 per share, that are poised for COVID-related gains. While these tickers are risky in nature, the investing platform revealed that each has earned a Moderate or Strong Buy consensus rating from the analyst community and boasts substantial upside potential.

CTI BioPharma Corporation (CTIC)

Focused on the development of innovative therapies, CTI BioPharma wants to address the unmet medical needs of patients. Given the potential of its COVID-19 treatment and its $1.18 share price, it’s no wonder this healthcare name is on Wall Street’s radar.

CTIC scored major investor attention after it initiated the Phase 3 PRE-VENT study of its pacritinib asset in COVID patients, with the study evaluating whether the therapy can reduce the occurrence of acute respiratory distress syndrome (ARDS). It should be noted that the study will include cancer patients, and initial data is expected by YE:20.

Writing for Needham, five-star analyst Chad Messer points out that ARDS, which is caused by an overreaction of the immune system, is the leading cause of mortality in COVID-19 patients. What makes CTIC’s therapy a stand-out, in Messer’s opinion, is that unlike ruxolitinib, it doesn’t target JAK1. This is important as JAK1 inhibition has been associated with immune-suppression towards infections.

“Pacritinib also inhibits CSF-1R which is associated with macrophage activation. Additionally, pacritinib is less thrombocyotpenic than other JAK inhibitors. These features differentiate pacritinib and may make it a potential best in class JAK inhibitor for treatment of severe COVID infection,” Messer commented.

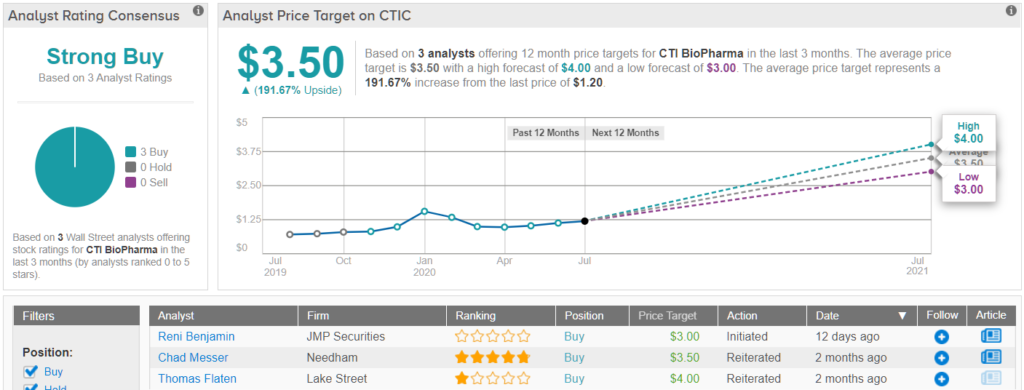

To this end, Messer continues to give CTIC his stamp of approval. Along with a Buy rating, the top analyst keeps the price target at $3.50. Should the target be met, a twelve-month gain of 195% could be in the cards. (To watch Messer’s track record, click here)

Other analysts also take a bullish approach. CTIC’s Strong Buy consensus rating breaks down into 3 Buys and zero Holds or Sells. Additionally, the $3.50 average price target matches Messer’s. (See CTIC stock analysis on TipRanks)

PhaseBio Pharmaceuticals (PHAS)

When it comes to PhaseBio, its focus lands squarely on the lack of new treatment options for serious cardiovascular diseases. Even though the pandemic has created challenges for the company, several members of the Street believe it can overcome these obstacles, with its $4.39 price tag reflecting an attractive entry point.

Five-star analyst Andrew Fein, of H.C. Wainwright, reminds investors that its lead candidate, PB2452, which was designed to reverse ticagrelor antiplatelet effects in major uncontrolled bleeding and urgent emergency surgery events, has entered its pivotal Phase 3 trial. While this is exciting, the analyst doesn’t dispute that COVID-19 has spurred headwinds.

Expounding on this, Fein stated, “Specifically, ERs have focused their attention on treating COVID-19 patients, while surgical sites remain in the process of trying to get back up and running amid shelter-in-place guidance. Therefore, we believe site initiations and patient enrollment are to continue to be site specific for the foreseeable future, based on available site resources and overall quarantine guidelines.”

That being said, Fein remains optimistic about the PB2452 platform, as it “directly addresses the unmet therapeutic need in antiplatelet patients facing major bleeding and urgent surgery circumstances that could otherwise result in death or treatment delay.” He added, “We point out there are no ticagrelor or antiplatelet reversal agents, and ticagrelor reversibly binds the P2Y12 receptor, making it the only potentially reversible oral antiplatelet therapy.”

Although enrollment was halted for the Phase 2 PB1046 program, the fact that PB2452 Phase 2a data could potentially be presented during the upcoming European Society of Cardiology (ESC) 2020 virtual conference in August 2020 seals the deal for Fein.

To this end, Fein maintained a Buy rating on PHAS with an $18 price target, suggesting 298% upside potential from current levels. (To watch Fein’s track record, click here)

Looking at the consensus breakdown, other analysts are on the same page. With 5 Buys and no Holds or Sells, the word on the Street is that PHAS is a Strong Buy. The $13 average price target puts the upside potential at 187%. (See PhaseBio stock analysis on TipRanks)

Diffusion Pharmaceuticals (DFFN)

As for the final stock on our list, Diffusion Pharmaceuticals develops new treatments for life-threatening medical conditions by improving the body’s ability to deliver oxygen to the areas where it is needed most. Currently going for $0.95 apiece, one analyst thinks that now is the time to snap up shares.

Covering DFFN for H.C. Wainwright, analyst Swayampakula Ramakanth is looking forward to the initiation of its COVID-19 study. At the end of May, the company received a response from the FDA regarding its Pre-Investigational New Drug (PIND) meeting request on the proposed clinical development program to assess trans sodium crocetinate (TSC) in COVID-19 patients with severe respiratory symptoms and low oxygen levels.

The FDA stated the study should be designed as a double-blinded, controlled, randomized trial by including Gilead’s COVID-19 treatment, remdesivir, as a component of standard of care for hospitalized patients. Additionally, the agency also accepted the proposed safety and oxygenation marker endpoints.

If that wasn’t enough, Ramakanth highlights the fact that a European COVID-19 study of TSC will be conducted in collaboration with the Romanian National Institute of Infectious Diseases (NIID), which is the largest provider of treatment for COVID-19 patients in Romania. “Diffusion expects to enroll the first patient for the European study in June, upon regulatory approval, and report initial data in 3Q20, which we believe could be a catalyst,” the analyst said.

It’s true that the ongoing public health crisis could slow down the enrollment for its Phase 2 PHAST-TSC (Pre-Hospital Administration of Stroke Therapy-TSC) stroke study, designed to evaluate the therapy as an acute stroke treatment. That said, Ramakanth remains unphased by a possible delay.

“In our view, given that the pandemic is starting to abate and TSC is being studied as acute treatment, Diffusion could be able to get the PHAST-TSC study completed as planned. While reporting the company’s 4Q19 earnings, management stated their expectation to complete the study enrollment in 2021 and report topline data in 2022,” the analyst explained.

Based on all of the above, Ramakanth rates DFFN a Buy along with a $3.50 price target. This target suggests shares could soar 286% in the next twelve months. (To watch Ramakanth’s track record, click here)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.