Meta Platforms (NASDAQ: META) has invested tens of billions into developing virtual and augmented reality (VR/AR) technology without much to show for it in terms of a viable new business segment. That could start to change next year.

While management plans to continue its outsized investments in the Reality Labs segment, management plans to keep investments in line with overall revenue growth starting in 2024 and beyond. "We expect to pace Reality Labs investments to ensure that we can achieve our goal of growing overall company operating income," CEO Mark Zuckerberg said on the company's third-quarterearnings callin October.

An indication of improving profitability in Reality Labs could give investors confidence that Zuckerberg's massive bet will finally pay off.

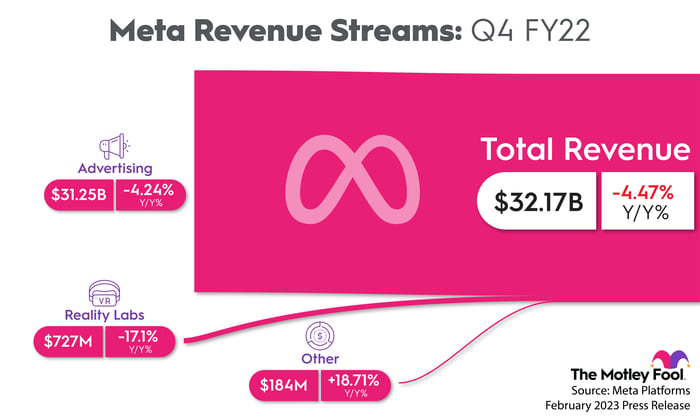

Meta reported big costs, little revenue

Reality Labs is currently generating massive operating losses with inconsistent revenue.

Meta had a hit with the Oculus Quest 2, but sales dropped in 2023.

Image source: The Motley Fool. Data source: Meta Platforms.

The fourth-quarter revenue decline indicates the market for virtual reality headsets remains relatively limited. Meta and other companies in the VR/AR space have work to do in order to expand the market.

That could come with a new wave of product announcements in the near future from several companies, including Apple (NASDAQ: AAPL). Apple is reportedly developing its own AR/VR headset with a potential release later this year. Apple's entry into a category has historically given the entire industry a boost.

The meager revenue from the segment barely makes a dent in Meta's operating expenses. Reality Labs produced operating losses of $13.7 billion and $10.2 billion in 2022 and 2021, respectively. The net effect on operating margin for 2022 was nearly 12.5 percentage points.

What's driving those massive losses?

The biggest thing driving losses in Reality Labs is Meta's investments in augmented reality technology.

There are three areas of investment within Reality Labs: Virtual reality products like its Oculus lineup, metaverse software development like Horizon Worlds, and augmented reality technology, none of which has shipped. In fact, Zuckerberg says augmented reality research and development is the biggest expense in the segment.

Indeed, augmented reality could be a much bigger market than virtual reality. The potential for technology to overlay information in the real world (AR) is much more appealing for many than immersing yourself in a separate virtual world (VR). There are likely many more uses, too. VR may be just a stepping stone to AR.

To that end, Meta's spending on Reality Labs isn't going to slow down. "We're going to continue to invest meaningfully in this area given the significant long-term opportunities that we see. It is a long-duration investment," CFO Susan Li said on Meta's Q4earnings call

Managing for operating profit growth

There are two ways Meta can improve operating profits while increasing its investments in AR research and the rest of Reality Labs: Reaccelerate growth in the advertising business, or start producing meaningful revenue from the Reality Labs segment.

The former is very likely going to happen. Meta is investing heavily in artificial intelligence to overcome the challenges it faces in tracking ad performance following Apple's introduction of App Tracking Transparency in iOS 14. It's showing improvements in Reels monetization as well, which has become a significant source of ad inventory, displacing some higher-value inventory in Feed and Stories. The outlook for the ads business is very positive.

The latter, however, remains a real possibility. As Meta brings its AR technology to market through smartphone and headset devices, it should be able to make headway in expanding the market and producing real revenue within the segment. 2024 will be the year to watch to see improvements in profitability for Reality Labs.

In the meantime, patient investors should be rewarded as the advertising business rebounds, making Meta shares a great way to invest in the potential of augmented reality.

10 stocks we like better than Meta Platforms

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Meta Platforms wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 8, 2023

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Levy has positions in Apple and Meta Platforms. The Motley Fool has positions in and recommends Apple and Meta Platforms. The Motley Fool recommends the following options: long March 2023 $120 calls on Apple and short March 2023 $130 calls on Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.