The market’s reaction to quarterly results from Adobe ADBE and Oracle ORCL can be seen as an early sign of what to expect as other companies come out with their March-quarter reporting cycle.

Investors loved the Oracle report, seeing the results and guidance reflective of an improving demand environment. Market participants had the opposite reaction to the Adobe report as they saw the company’s underwhelming guidance and fresh buyback authorization as reflective of a disadvantageous standing in the artificial intelligence (AI) race.

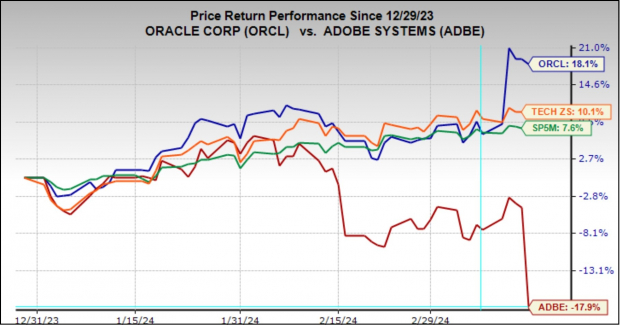

The chart below shows the year-to-date performance of Adobe and Oracle relative to the Tech sector and the broader market.

Image Source: Zacks Investment Research

This is admittedly a narrow performance window, but you can see that Oracle (the blue line) and Adobe (the red line) have clearly diverged for almost a month now, and the divergence magnifies in the wake of the quarterly releases.

The earnings reports from Adobe and Oracle and this week’s reports from Micron, FedEx, General Mills, and others are for their respective fiscal quarters ending in February, which we and other research organizations count as part of the overall March-quarter or Q1 tally. In fact, by the time the big banks come out with their quarterly results on April 12th, we will have such Q1 results from almost two dozen S&P 500 members.

Regular readers of our earnings commentary are familiar with our sanguine view of the overall earnings picture. We aren’t saying that the earnings picture is great, but we don’t agree with the doom-and-gloom projections either.

Earnings growth remained under pressure in 2022 and through the first half of 2023 as a host of macro factors weighed on corporate profits. These factors included the post-COVID onset of inflationary pressures that compressed margins while the Fed’s extraordinary tightening moderated top-line growth.

A loud segment of the commentariat saw these unfavorable trends culminating in a recession for the economy and a material hit to the overall earnings picture. However, the U.S. economy has proved resilient even as the Fed’s extraordinary tightening has put us on track for a happy resolution to the inflation issue.

With the Fed now gearing up to start easing policy in the coming months, those extreme risks to the economy and corporate earnings have eased significantly. This is the macro backdrop in which we will receive the Q1 earnings results in the coming days.

The expectation is that Q1 earnings will be up +2.1% from the same period last year on +3.4% higher revenues, following the +6.5% earnings growth on +3.8% revenue gains in the preceding period.

The chart below shows current earnings and revenue growth expectations for 2024 Q1 in the context of where growth has been over the preceding four quarters and what is currently expected for the following three quarters.

Image Source: Zacks Investment Research

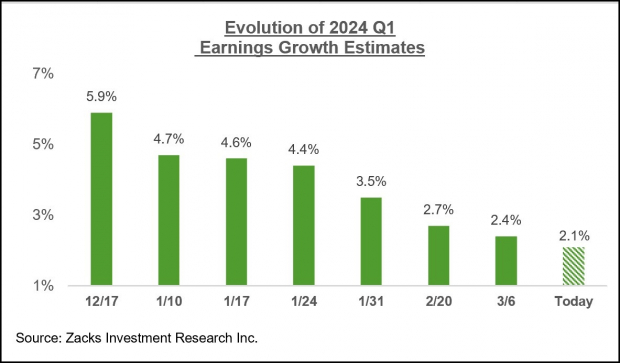

The chart below shows how Q1 earnings growth expectations have evolved since the quarter got underway.

Image Source: Zacks Investment Research

Please note that while the revisions trend has been negative, the magnitude of cuts to Q1 estimates compares favorably to what we had seen in the comparable period for the preceding quarter (2023 Q4).

Since the start of Q1, estimates have come down for 10 of the 16 Zacks sectors, with the biggest cuts to estimates for the Energy, Autos, Basic Materials, and Transportation sectors. Estimates have modestly increased over this time period for 6 of the 16 Zacks sectors, with the Retail, Consumer Discretionary, and Tech sectors enjoying notable positive revisions.

Embedded in current Q1 earnings and revenue estimates is a modest year-over-year decline in net margins, as the chart below shows.

Image Source: Zacks Investment Research

This chart shows that the extreme margin pressure we witnessed in 2022 and the first half of 2023 is now over.

For 2024 Q1, net margins are expected to be below the year-earlier level for 9 of the 16 Zacks sectors, with the biggest declines at the Energy, Basic Materials, Autos, and Medical sectors. Net margins are expected to be above the year-earlier level for 5 of the 16 Zacks sectors, with the biggest gains at the Tech and Utilities sectors.

The Tech sector is now firmly back in growth mode, and this trend is expected to continue.

For 2024 Q1, Tech sector earnings are expected to increase +18.5% from the same period last year on +7.8% higher revenues. This would follow the sector’s +27.4% higher earnings in 2023 Q4 on +8.5% higher revenues.

The sector experienced a period of post-COVID adjustment in 2022 and the first half of 2023, during which time it became a drag on the aggregate growth picture.

Please keep in mind that Tech isn’t just any other sector; it is the biggest earnings contributor to the S&P 500 index. The sector is currently expected to bring in 28.6% of the index’s total earnings over the coming four-quarter period, with the second and third biggest contributors being Finance and Medical, at 17.8% and 12.5%, respectively.

This means that the Tech sector’s growth profile has a very big impact on the aggregate picture, both negatively and positively.

The Tech sector dragged down the aggregate growth picture in 2022 and the first half of 2023 and now appears to be ready to resume its historically positive growth role.

You can see this growth profile in the chart below, which also shows that the sector’s 2023 Q4 earnings tally of $158.2 billion was a new all-time quarterly record.

Image Source: Zacks Investment Research

Please note that the Tech sector is instrumental in keeping the aggregate growth picture in positive territory in Q1. Excluding the sector’s substantial contribution, Q1 earnings for the rest of the index would be down -3.3% from the same period last year (vs. +2.1% as a whole).

Looking at the overall earnings picture on an annual basis, total 2024 S&P 500 earnings are expected to be up +8.7% on +2.9% revenue growth.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Tech Sector Resumes Growth Mode

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>Oracle Corporation (ORCL) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.