- The biggest winner in 2022 is this year’s biggest loser, and the biggest 2022 loser is this year’s biggest winner.

- Most asset classes had a great January 2023

- Good January performance usually bodes well for the year.

Last year commodities skyrocketed with a 24% return while real estate plummeted with a 26% loss. This year real estate has come back with a 10% return in January (a whopping 200% return annualized), and commodities were down slightly – minus 0.1%

Great start for target date funds

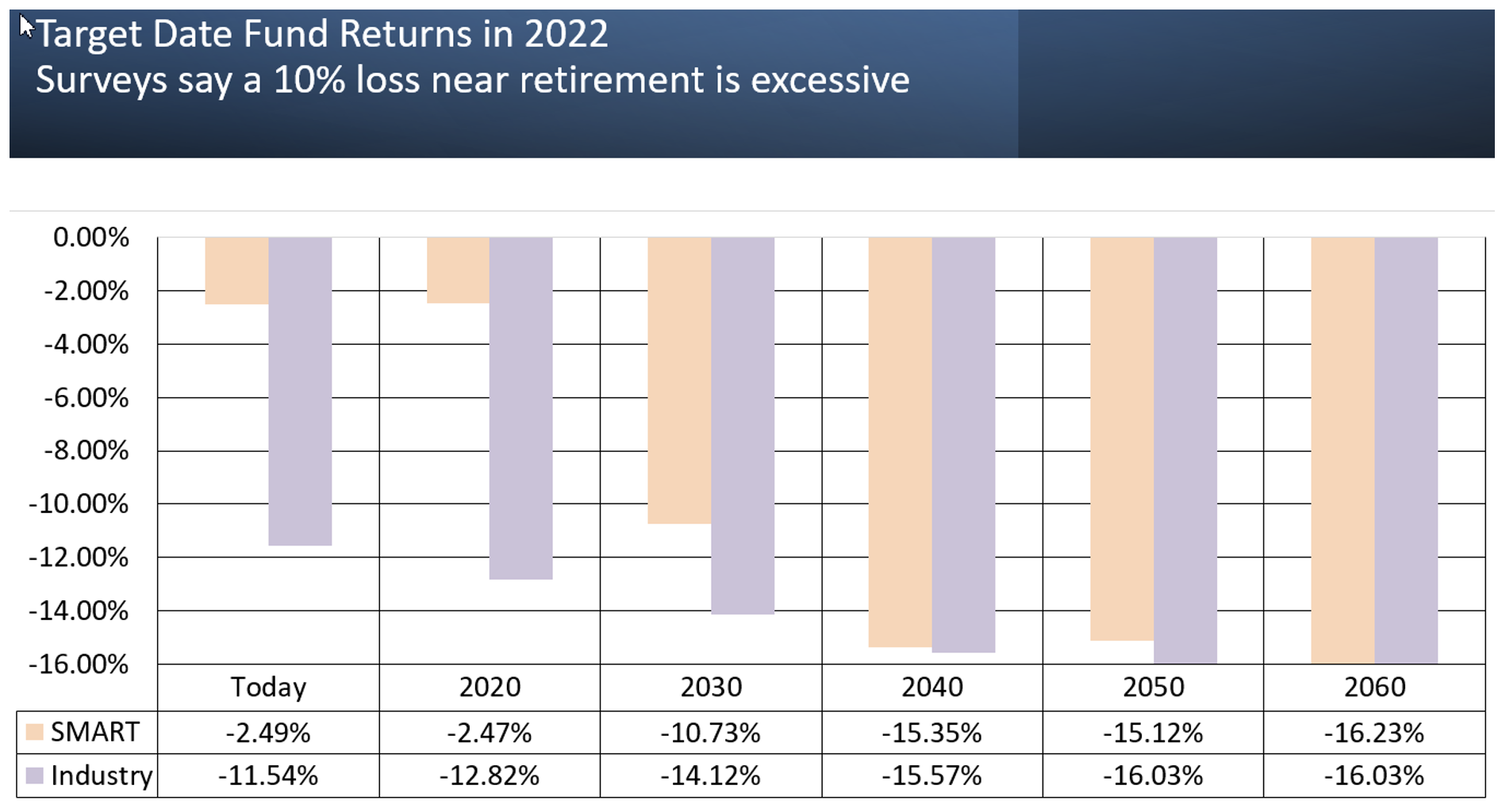

With $3.5 trillion, target date funds (TDFs) are the biggest deal in 401(k) plans. Last year these plans lost more than 13% for those near retirement in 2020 funds, although the few safe TDFs, like the SMART TDF Index, lost only 2.5.

But this year TDFs stampeded out of the starting gate, earning 4.6% for those near retirement and almost 7% for those retiring in 2060 -- a very nice recovery so far. No surprise, the Safe SMART TDFs lagged in January because oof their defensive posture.

Conclusion

The common belief is that the year will bring more of whatever happens in January. Annualizing January’s stock and bond returns brings U.S. stocks up more than 100% and bonds about 50%. Nice dreams.

A lot of what happens hinges on the dangers, including war, inflation, rising interest rates, COVID, etc. Investor optimism has driven up the prices of most assets so far this year, but many believe that last year’s correction is just the beginning of more to come – that the regression to the mean is not yet complete. Stay tuned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.