Technology stocks have been badly hurt by the cooling economy. Initially it was just because of their growth premium that investors dumped them for safer bets. But as we moved through the months, it was apparent that there are bigger concerns than that.

Most of the companies are seeing difficult comps this year, as pandemic-driven investment in technology is cooling down, which was expected, more or less. There is particular weakness in PCs, which had benefited greatly from the stay-home period. Companies that benefited from the surge in PC sales or the at-home economy of the last couple of years, such as NVIDIA NVDA could therefore be particularly hard-hit.

And while the supply chain issues affected most companies – not just tech – tech too was affected by them. Based on earnings reports from the last quarter, supply chain issues remain in certain segments. Microsoft MSFT is a big tech stock that saw some supply chain impact in the data center.

Inflation is another problem for both consumers and companies. The Fed’s control measures, aimed at slowing down the economy, also impact corporate spending, including on technology. For a company like Apple AAPL, which sells high-end products, inflation could be a deterrent. Its recent focus on services along with the expansion of its installed base are positives in this respect.

Still, the impact on PCs is likely to be greater than on other technology (like software, which could increase efficiencies for companies). And not all companies are equally impacted by the other concerns mentioned above -- only to the extent that they are exposed to the particular concern.

All of them also don’t have the same operating model. Alphabet GOOGL, for instance, depends on advertisers for the bulk of its revenue. With the economy expected to slow down more substantially next year, its 2023 outlook looks worse than this year, unlike some of the others.

Let’s dig into some details:

Apple

Apple’s two straight quarters of double-digit revenue declines are in line with the normal seasonality associated with its business. What’s concerning is that despite the sharp revenue decline, its operating expenses increased, non-cash expenses increased, and therefore, EBIT fell. Net income before non-recurring items was down more than 20% for the second straight quarter.

Net cash per share, which has declined in every quarter except one since the pandemic first hit, also declined in the last quarter.

Apple grew its long-term debt between 2013 and 2018, but since then debt levels have varied. In the last quarter, it ended with a debt/cap ratio of 67.3%, which is very high for a technology company. Of course, Apple is also a consumer goods provider, given the nature of its products. And to that extent some of the debt may be justified.

Analysts are taking down their estimates on Apple. The 2022 estimate is down a penny since the company last reported. The 2023 estimate is down 11 cents (1.7%). They still expect single-digit increases in both revenue and earnings for the two years.

Microsoft

Microsoft has fared better than Apple in terms of revenues, and continued its trend of revenue growth every other quarter. Its operating expense increases also reflect historical trends. Like Apple however, the increases in opex and non-cash expenses contributed to a lower EBIT in the last quarter.

Microsoft’s net cash per share has grown through most of the pandemic-inflicted period, but in 2022, it dropped below 2019 levels.

The company has been lowering its debt steadily over the last several years, and in the last quarter it ended with a debt cap ratio of 23.0%.

Analysts have taken down their estimates of Microsoft earnings. For 2022, the Zacks Consensus Estimate is down 48 cents (4.5%) and for 2023, it is down 38 cents (3.2%).

Alphabet

Alphabet’s revenue growth has not been an issue thus far, although last year’s sharp pace of growth is flattening out this year. In the last quarter, both operating and non-cash expenses increased faster than revenue, leading to a decline in EBIT.

Net cash per share has been on a general upward trajectory since the pandemic, but has been softening since the December quarter, and more sharply this year.

Alphabet increased its debt more than three-folds in 2020, and debt levels have edged up further since then. But given its size, the debt cap was a mere 5.5% at the end of the last quarter, which is not worth bothering about.

Estimates have moved quite a bit lower after Alphabet’s negative surprise in the last quarter. For 2022, the Zacks Consensus Estimate is down 32 cents (5.8%) while for 2023, it’s down 70 cents (10.8%).

NVIDIA

NVDIA has been the tech investors’ darling since before the pandemic, and during the pandemic years (2020 and 2021), its revenues kept climbing. But this is one company that seems to be badly affected by the way the economic slowdown has affected technology providers. July 2022 was the first time since January 2019 that its revenue declined. And the outlook points to further weakness through the rest of 2022.

NVIDIA’s manufacturing/input costs appear to be on the rise. And that’s despite the revenue decline in the last quarter. However, its operating expenses are down. The net result is a reduction in EBIT.

The net cash per share recovered nicely from the pandemic, but the last two quarters have set a negative trend.

Debt levels have increased more than five-fold since the pandemic although the debt cap of 28.9% at the end of the last quarter doesn’t look too bad.

Estimates have fallen sharply after NVIDIA management’s cautionary remarks. The 2022 estimate went from $5.38 to $3.46 (down 35.7%) while the 2023 estimate went from $6.09 to $4.57 (down 25.0%).

Conclusion

While all of these stocks are trading below their median value over the past year, this should not be read as an obvious signal to buy. The reason is that there remains significant economic uncertainty related to the Fed’s policy measures and a recession sometime next year can’t be ruled out. It’s quite possible that there will be further hits to share prices if the economy takes a notable turn for the worse.

So why do we not recommend a sell either? For all the stocks except NVIDIA, the valuation is at best reasonable. Nobody is going to make much profit by selling at these levels because chances are, you bought higher. Also, it’s an absolute certainty that these tech stocks will ultimately regain and exceed their current share prices given their market position, cash flow and the enormous war chests that they have to tide over the bad times. Therefore, it’s a good idea to hang on.

In NVIDIA’s case, the shares look overvalued after the recent estimate revisions, and chances are, they will be pushed lower. Therefore, it’s better to sell them.

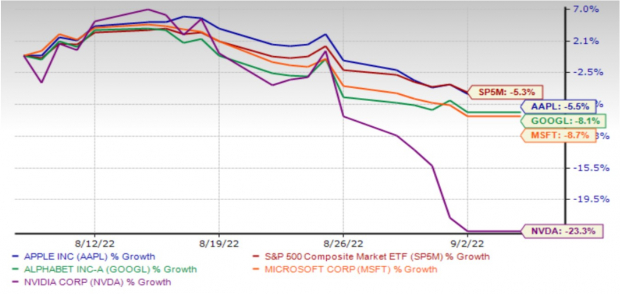

One-Month Price Performance

Image Source: Zacks Investment Research

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.