2022 in Hindsight

The past year has seen a lot of change.

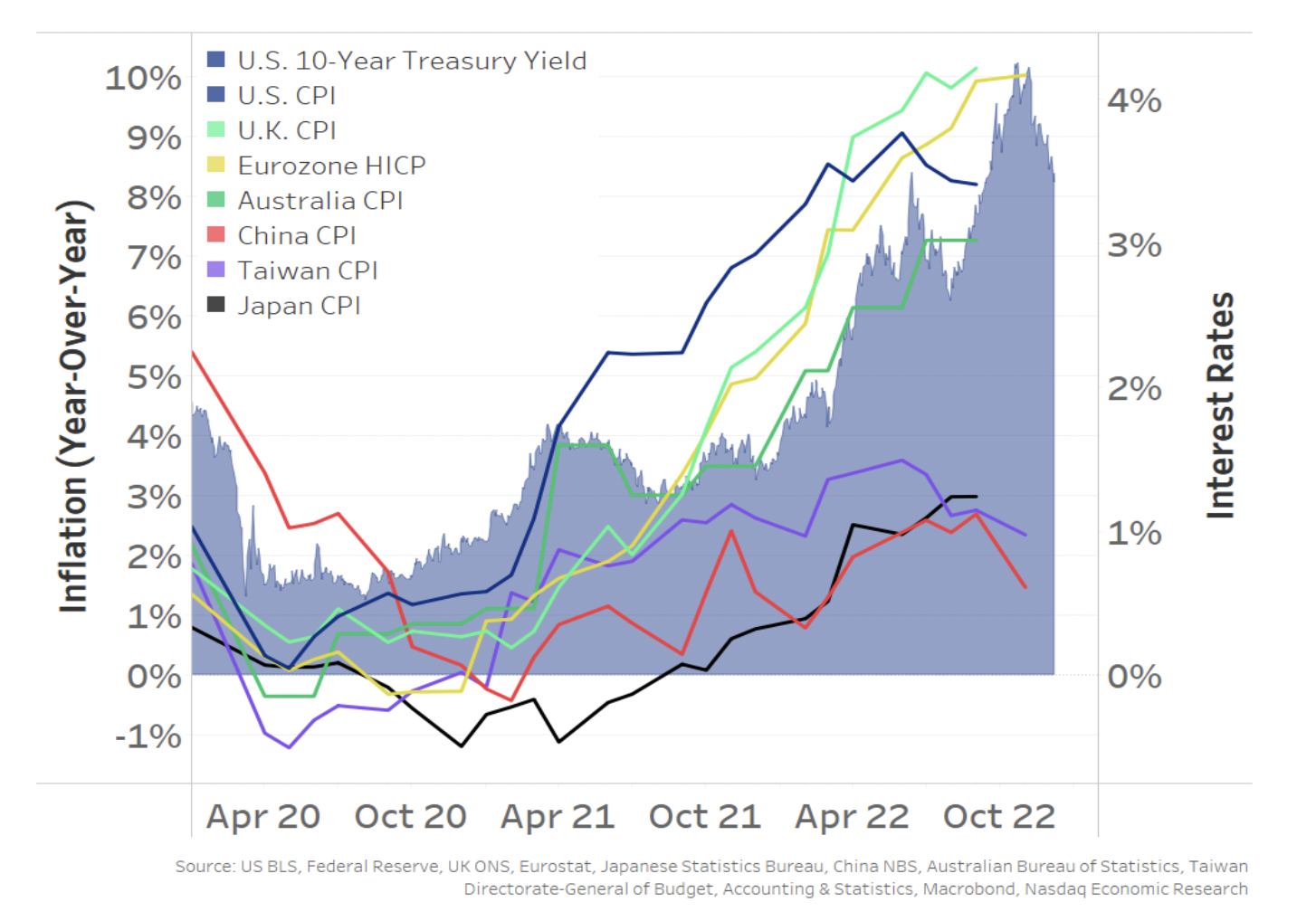

We saw a return to conferences and in-person meetings even though Covid persists. We watched as a robust consumer worked to spend all their Covid savings, as well as a war in Ukraine that limited energy and food supplies, especially to Europe. Both helped drive inflation around the world (lines in Chart 1).

To tackle inflation, central banks started tightening monetary policy; interest rates increased from historically low levels (and negative rates in Europe), with the US 10-year yield peaking above 4% in October (blue area, Chart 1).

Chart 1: Inflation has increased around the world (lines), and central banks are increasing interest rates to slow demand

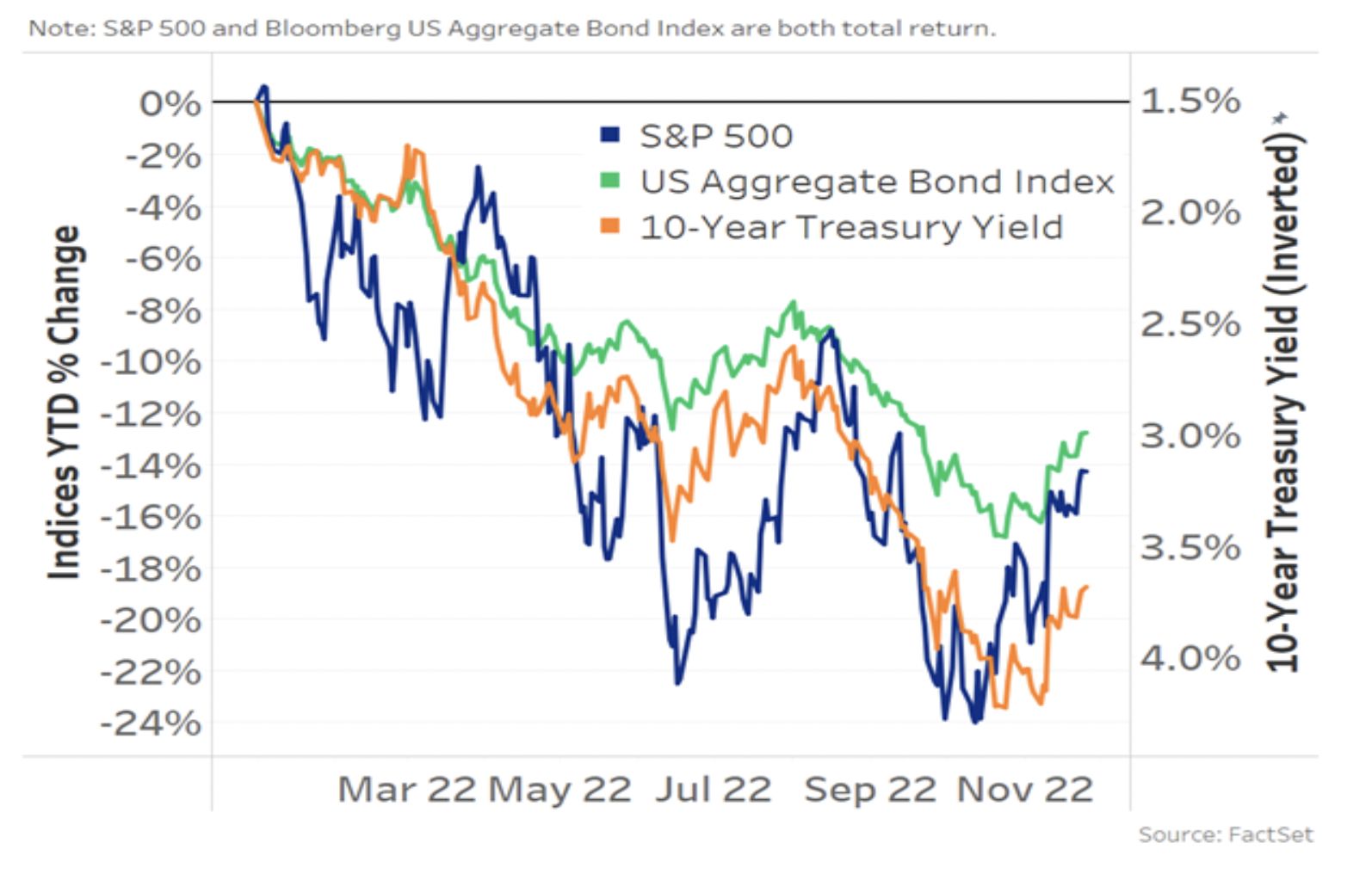

That led to a market selloff that has lasted all year. As Chart 2 shows, each time rates increased (green line fell), the prices of bonds (green line) and stocks (blue line) also generally fell – and vice versa. In addition, with earnings stalling in 2022, interest rate changes explain a large proportion of the 2022 markets.

Overall, this has made it a tough year for investors in stocks or bonds. In fact, annual returns on a diversified stock and bond portfolio are among the worst years in history.

Chart 2: Bond and stock markets have fallen as rates rose in 2022

Despite that, other data shows retail has stayed surprisingly active and short interest remains structurally lower than pre-covid levels.

A busy year for Nasdaq research

It’s also been a busy year for expanding what we know about market quality and trading. In 2022, we have focused on a few core topics:

- Spreads, Splits and Companies Costs of Capital: We improved our understanding of optimal stock prices and how round lots and incorrect tick sizes make spreads wider. We have also seen how 20 stock splits this year and explored different trading rules in other countries — both of which help make stocks trade better and improves valuations.

- Reducing Investors Costs: We added new research on market quality, from how good incentives can help reduce spreads and how that saves buy-side trading costs, including for off-exchange trades. We also looked at how we can make Nasdaq’s markets even better for issuers, with our better spreads and less volatile close auctions.

- ETFs: We covered from a variety of angles, including the growth in Cyber ETFs, retail trading in ETFs and how LULD bands could work better for illiquid ETFs.

A busy year for regulators

It also feels like it has been a busy year for regulators. Following on the heels of the meme stock craze and the collapse of Archegos, a number of new rules were proposed, including changes to T+1 settlement, short reporting and stock loan reporting.

Even before this week’s announcement of four new market structure proposals, it seemed the SEC has been especially busy. SEC data shows 35 proposals in the past 12 months, although there were even more under Chair Shapiro in 2011 and Chair Pitt in 2002 and 2004.

Chart 3: Rule filings by year (and chair)

For those that don’t remember, Chair Mary Jo White’s SEC enhanced routing and dark pool disclosures (changing rule 606 and adding form ATS-N). Chair Pitt’s term included some Sarbanes Oxley rules in response to the Enron and WorldCom accounting scandals, as well as the proposed Reg NMS in 2004.

Although 2022 saw a lot of new rules proposed, as we look through the list, many address similar and related topics – often across multiple underlying but different laws:

New short selling and settlement rules

After the meme stock trading rally in January 2021, which initially targeted highly shorted stocks, regulators turned their focus to short interest and settlement rules.

One proposed rule would move the US to a T+1 settlement regime, which would reduce brokers' credit exposures on unsettled trades, saving on clearing margin and capital costs.

The SEC’s 2021 GME report concluded that “improved reporting of short sales would allow regulators to better track” the interplay of shorting and short covering on prices. So, it’s no surprise that a number of different proposals address short selling:

- The Financial Industry Regulatory Authority (FINRA) has proposed more frequent reporting to the public of short interest data it collects. FINRA suggests moving Rule 4560 from the current twice a month to weekly or daily, as well as shortening the time for submitting and publication of short interest data to the public.

- FINRA has also proposed collecting additional account-level data, including synthetic shorts (those using derivatives), loan obligations from borrowing shares, and daily fail-to-deliver positions. However, that’s expected to be for their own Regulation SHO surveillance, not a public feed.

- In 2021, the SEC proposed what is essentially a “tape” for stock loans. Known as Exchange Act Rule 10c-1, it would require all loans in a security to be reported within 15 minutes to FINRA, including details like issuer, ticker, time, venue, amount loaned, securities lending fee, other fees, collateral used, and the type of entity the borrower is. Information on securities available to and on loan would be required at the end of the day; it would be aggregated and made public the next business day by FINRA.

- The SEC has also voted to propose amendments to the CAT NMS Plan to require CAT reporting firms to report “buy to cover” information to CAT, including indicating where shorts were bona fide market making exception under Regulation SHO.

- In conjunction with the proposed amendments to the CAT NMS Plan, the SEC also proposed a new short position disclosure rule. Proposed Rule 13f-2 and the corresponding Form SHO would require institutional investors to report short positions to the SEC on a monthly basis (14 days after the end of each month) if their gross position was larger than $10 million. The SEC then would make aggregate data about large short positions, including daily short sale activity data, available to the public for each individual security. That’s similar to what happens in Europe, where hedge funds are required to report short positions once they short more than 0.1% of the shares outstanding, decreased from 0.2% in January 2022, where data is made public when shorts exceed 0.5% of shares outstanding. However, it is different from how U.S. investors report long positions, which are mostly reported each quarter, by account, on Form 13F.

- In a related move, the SEC proposed in 2021 to broaden U.S. long position reporting to “look through” swap positions, which is similar to FINRAs proposal about including synthetic shorts in their data collection.

New ESG rules

There are also changes afoot in the ESG space. Many international regulators and standard setters are working on ESG reporting rules, including:

- Taskforce on Climate-related Financial Disclosures (TCFD): developed recommendations to assist companies with the disclosure of climate-related metrics, targets, and transition plans.

- International Sustainability Standards Board (ISSB): recently released its first two proposed standards based on the TCFD recommendations. The first sets out general sustainability disclosures, while the second specifies climate-related disclosures.

- European Financial Reporting Advisory Group (EFRAG): has issued draft European sustainability reporting standards to standardize ESG reporting in the EU.

- International Organization of Securities Commissions (IOSCO): has adopted a 2022 work plan to develop sustainable finance by increasing transparency and mitigating greenwashing.

In the U.S., both the SEC and the Department of Labor (DoL) have new rules addressing ESG.

New DoL rules affect ERISA (retirement plans and advisors) and provide a framework for fiduciaries to consider ESG without requiring or restricting them from using EGS metrics.

The SEC has a number of separate rule proposals that impact ESG for companies and funds:

- Company reporting of climate metrics: Companies would need to include climate-related information in their SEC reports, such as their Form 10-K. This includes Climate-related risks to their business from things like office and factory locations and Green House Gas (GHG) emissions from their own direct (Scope 1) and indirect (Scope 2) emissions, as well as those of their suppliers and customers (Scope 3).

- Fund disclosures: Additional disclosures by ETFs, mutual funds and investment advisors to describe ESG factors in their stock selection methodology. The proposal classifies three new categories of “ESG” funds: Integration funds, which use ESG factors as one input in their stock selection process, ESG-focused funds, which use ESG factors as a significant factor in stock selection, and Impact funds, which aim to achieve a specific ESG-related impact.

- Fund names: Tightens the rules in the Investment Company Act of 1940 (Rule 35d-1) and will require funds to invest at least 80% of their assets with the investment focus in the fund’s name, including funds with ESG-related names.

- Recovery of Compensation: The final rule, now adopted, requires exchanges to establish listing standards for issuers providing for the recovery of incentive-based compensation based on incorrect financial information.

- Buybacks: Will require an issuer to provide daily disclosure on Form SR regarding buyback purchases. Separately, the Inflation Reduction Act of 2022 imposes a non-deductible tax of 1% on the value of any stock repurchased.

Other attempts to create cross-regulatory consistency

In many areas of finance, rule differences are significant enough to affect costs and competition for those operating across the different rule bases. Arguably, a lot of the other new proposals aim to reduce this regulatory arbitrage – and “level the playing field.” For example:

- Mutual funds vs. Hedge Funds: Form PF changes combined with new Private Fund Advisors rules require advisors to report more detail about hedge fund and private equity fund fees, exposures and also underlying strategies - similar to how mutual funds are required to report. Similarly, joint CFTC-SEC proposed Form PF changes would assist FSOC’s (Financial Stability Board) ability to monitor systemic risks as well as improve SEC oversight of private fund advisers. Other rules also require Investment Advisers to perform due diligence and monitor outsourced functions to ensure standards are maintained. To protect investors during heavy redemption activity, mutual funds do not have “gates” like hedge funds, so the SEC has proposed swing pricing, which adds a cost of trading to redemptions, as well as adding monthly reporting of positions to open- and closed-end funds and unit trusts, so investors are more aware of potentially illiquid assets in a fund.

- Cybersecurity: New Cybersecurity rules affect public companies reporting of cybersecurity risk management, strategy, governance, and incident reporting (1934 Act), while parallel rules affect Investment Advisors and Mutual Funds (1940 Advisers and Investment Company Acts). Other regulators, such as Cybersecurity & Infrastructure Security Agency (CISA) and NY Department of Financial Services (NYDFS), have requested information and proposed cybersecurity regulations, respectively.

- Different Markets Structures Doing Similar Things: Bond and stock markets include some rules that make very similar activity work very differently. Tackling that are broader rules on who qualifies as “Dealers” in government securities, requiring all to register with the SEC. Removal of credit ratings from rules makes bond sales more consistent. While changes to Treasury Clearing should increase the centralized clearing of bonds and the Definition of an Exchange makes bond and stock ATSs (dark pools) work a little more like stock exchanges, which have to comply with Fair Access and Reg SCI. Meanwhile, the Exchange Members Exemptions are being changed, so proprietary traders are now included and report trades just like brokers and dealers.

- SPACs: SPACs increased in popularity in 2020, and they represent an alternative to an IPO for a private company that wants to be publicly listed. However, because the SPAC is already listed, but the target company remains private, a lot of the IPO rules (Securities Act of 1933), as well as some trading rules (Exchange Act of 1934) and Private Equity Rules (Private Securities Litigation Reform Act of 1995), don’t work the same as for other IPOs. New SPAC proposed rules makes compliance more consistent – from financial statement requirements to using projections – while also clarifying that a SPAC is not also an Investment Company (under the 1940 Act).

New rules affecting trading

New rules released this week also aim to “level the playing field” for stock trading. Coming in at over 1,600 pages, there is obviously a lot of details still to read, but the overall objective of each rule is:

- Order Competition essentially creates auctions for retail spread crossing orders, allowing buy-side investors and all market makers to participate in trades with retail.

- Ticks and access fees require trades to occur on the same official “tick” prices (regardless of whether those trades happen on exchange or off exchange), but also splits the tick to be smaller for many of the most liquid stocks (so spread costs can be smaller), as well as reducing access fees to trade at those prices on exchange.

- Rule 605 modernization changes how execution quality is measured and reported, which will give important data over the impact of the two changes above.

- Best Execution mostly requiring all brokers to perform execution analysis, at least quarterly.

More work to do in 2023

With the mid-term elections now over and a split Congress poised to take their seats, it is possible that the pace of new rulemaking slows.

However, many of the rules above are still in the proposal and comment stage. Even final rules are mostly awaiting implementation. So, 2023 looks to be busy for regulators and for the industry, too, as it adopts processes to comply with each new rule becoming effective.

%20Latest%20Prices%2C%20Charts%20%26%20News%20%7C%20Nasdaq&_biz_n=0&rnd=540209&cdn_o=a&_biz_z=1743637876919)