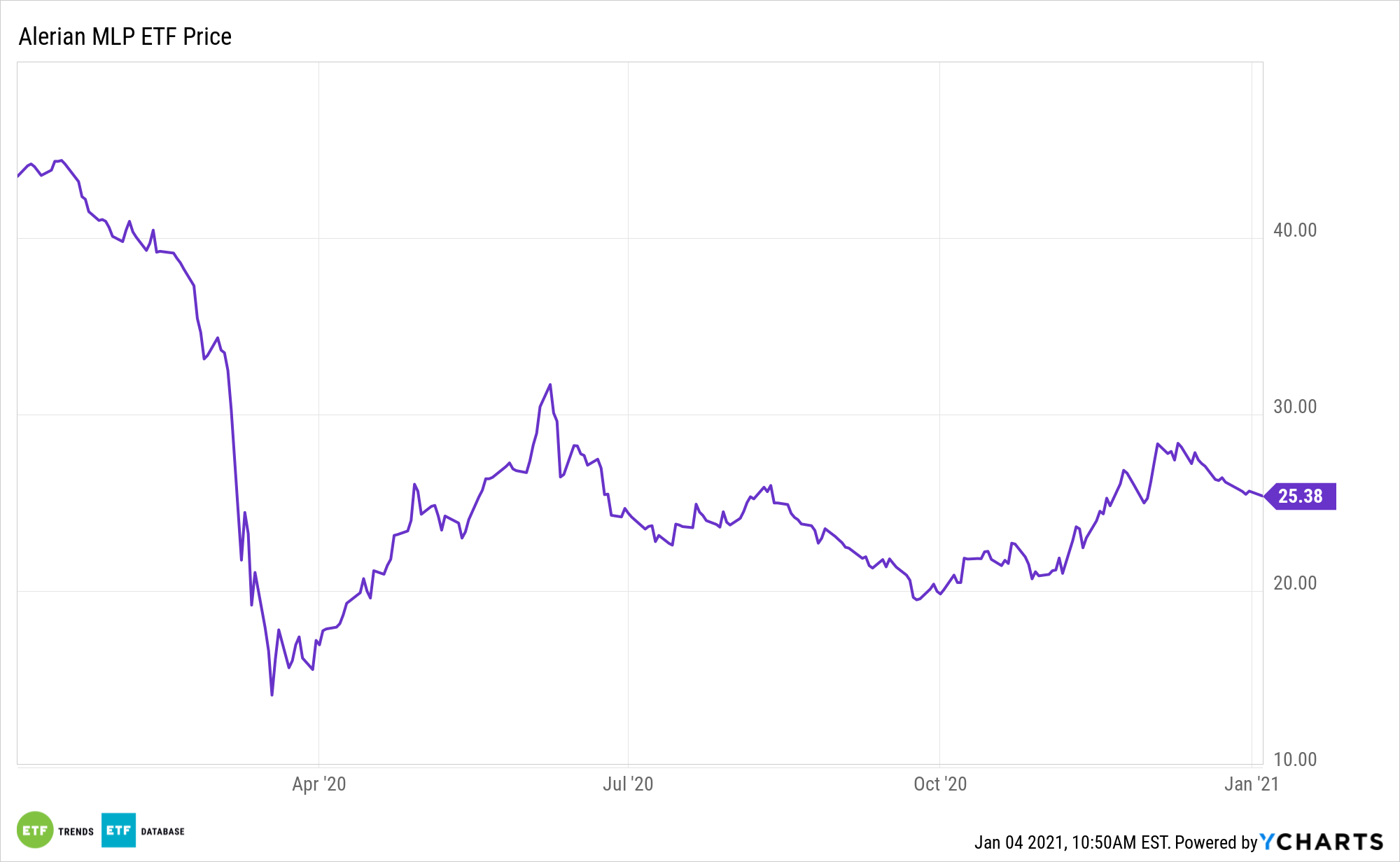

The energy sector was punished by last March's broad market swoon forced by the coronavirus pandemic. Master limited partnerships (MLPs) are bouncing back with the ALPS Alerian MLP ETF (NYSEArca: AMLP) ready for a better showing in 2021.

AMLP seeks investment results that correspond generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index. The index is comprised of energy infrastructure MLPs that earn a majority of their cash flow from the transportation, storage, and processing of energy commodities.

With interest rates low and the energy sector positioned to rebound this year, some market observers are leaning toward MLPs to start the new year.

“MLPs are partnerships that are often, though not always, in the oil and gas pipeline business. When you buy an MLP, you are considered a partner, not a shareholder. As a result, you own units, not shares, and you are paid distributions instead of dividends,” according to Investment U.

AMLP Advantages Go Beyond an Energy Rebound

MLPs primarily deal with the distribution and storage of energy products, so their business model is less reliant on the commodities market since MLPs profit off the quantity of oil and natural gas they are able to move around. Consequently, MLPs have historically shown a weaker correlation to energy prices over longer periods as MLPs act more like energy toll roads, profiting on the volume of oil moving through their pipelines.

However, the oil industry’s midstream role in the energy value chain may be more insulated from the price volatility since this segment of the energy sector engages in gas processing, fractionation, storage, transportation, and crude oil gathering.

Moreover, these services are under long-term contracts. Master Limited Partnerships charge a fee for each barrel of petroleum or MMcf of natural gas transported. This covers smaller pipelines connecting wells to hubs or processing facilities for natural gas, which are more sensitive to production dynamics, along with larger, longer pipelines that connect hubs or producing regions with end markets. These MLPs typically charge rent for third parties to use storage tanks.

MLP-focused funds that invest in MLPs, produce a 1099 tax form and have historically provided a high level of income and tax deferral. The total tax deferral on distributions of AMLP since inception is 81.5%.

Other funds with exposure to income-generating energy assets include the VanEck Vectors Energy Income ETF (EINC) and the Global X MLP ETF (NYSEArca: MLPA).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.