During each of the fourteen Federal Open Market Committee meetings from March 2020 through June 2021, Chair Jerome Powell and committee members have decided to leave the federal funds rate unchanged, at a target range of 0% to 0.25%.

With inflation on the rise and unemployment falling, the Fed instead revealed their plan to increase the federal funds rate to 0.6% by 2023 after a torrential year largely impacted by the COVID-19 pandemic. While this may seem like uncharted territory given near-zero rates for much of the last decade, the US markets have had some practice dealing with moments like these.

The Fed’s Goal And How It Regulates The US Markets

Within the Federal Reserve, the Federal Open Market Committee (FOMC) is responsible for monetary policymaking in the US. The Fed’s two main goals, known as the dual mandate, are to foster the country’s long-term price stability and maximize sustainable employment.

Download Visual | Modify in YCharts

Since 2012, the FOMC has targeted an average inflation rate of 2 percent. The Fed estimates that unemployment will drop to 4.5% by the end of 2021, with continued decreases into 2022 and 2023 to 3.9% and 3.5%, respectively.

The key factor driving these outcomes is the federal funds rate. The FOMC’s decision to either cut or raise rates depends on whether they want to stimulate the economy or slow it down, respectively.

What Happened Last Time Rates Were At Zero (Post-2008 Financial Crisis)

With the federal funds rate at nearly zero percent, let’s take a look at the last time rates were this low to see if any lessons can be applied to the present and future situations.

The federal funds rate was most recently at 0% at the tail-end of 2008, due to the global financial crisis that led into the Great Recession. The lasting economic downturn prompted the Fed to keep rates at zero for roughly six years.

Download Visual | Modify in YCharts

In December of 2015, the Fed began raising the federal funds rate after recognizing a period of sustained economic activity, a continued decline in unemployment, and expectations that inflation would rise to a 2% average.

The Fed increased the rate incrementally through 2019 as unemployment continued to shrink and inflation approached its intended average. The central bank had achieved its dual mandate goal for the US economy, ensuring that markets were working as effectively as possible.

The stock and bond markets trended together until the US Inflation Rate stabilized around 2% in late 2015, but once the Fed began hiking rates, asset class performance began to diverge.

Download Visual | Modify in YCharts

What’s Happening This Time Around (Post-2020 COVID-19 Pandemic)

Fast forward a decade, and the Fed’s zero-rate tactic is still mostly working.

At the start of 2020, the S&P 500 was setting a fresh all time high. And while there were three rate cuts in 2019, the FOMC noted they “acted as appropriate to sustain the [economy’s] expansion” with no indication of future, additional cuts.

That all changed with the COVID-19 pandemic. On March 3, 2020, the Fed made an emergency rate cut of 50 basis points to the federal funds rate in direct response to the abrupt economic stall out.

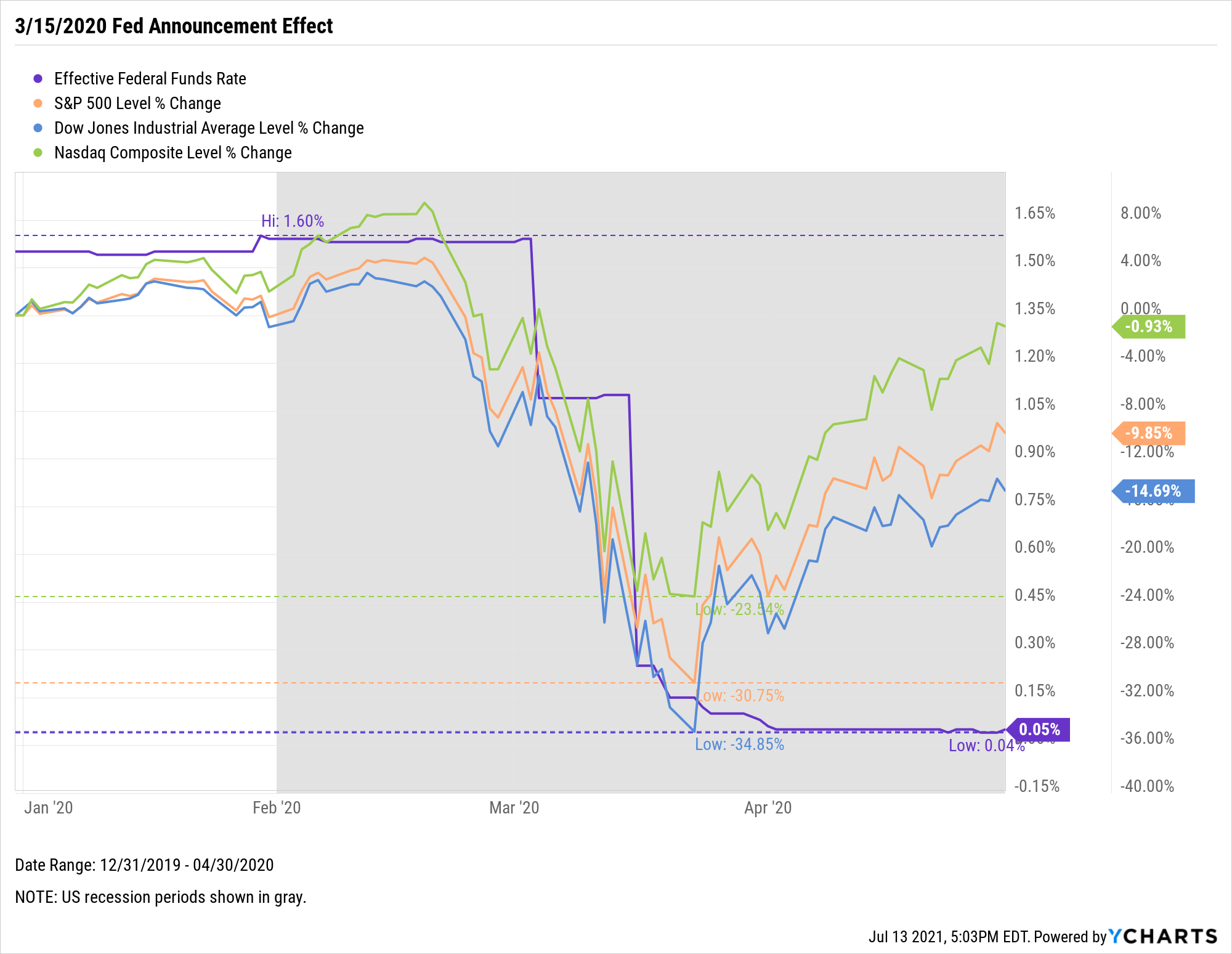

Download Visual | Modify in YCharts

With coronavirus cases accelerating worldwide, a second emergency rate cut was announced on March 15, 2020, lowering the target rate range to 0% to 0.25%. The Fed’s announcement was one of a few catalysts that caused concern among investors, and contributed to the S&P 500, Dow Jones, and Nasdaq Composite selling off.

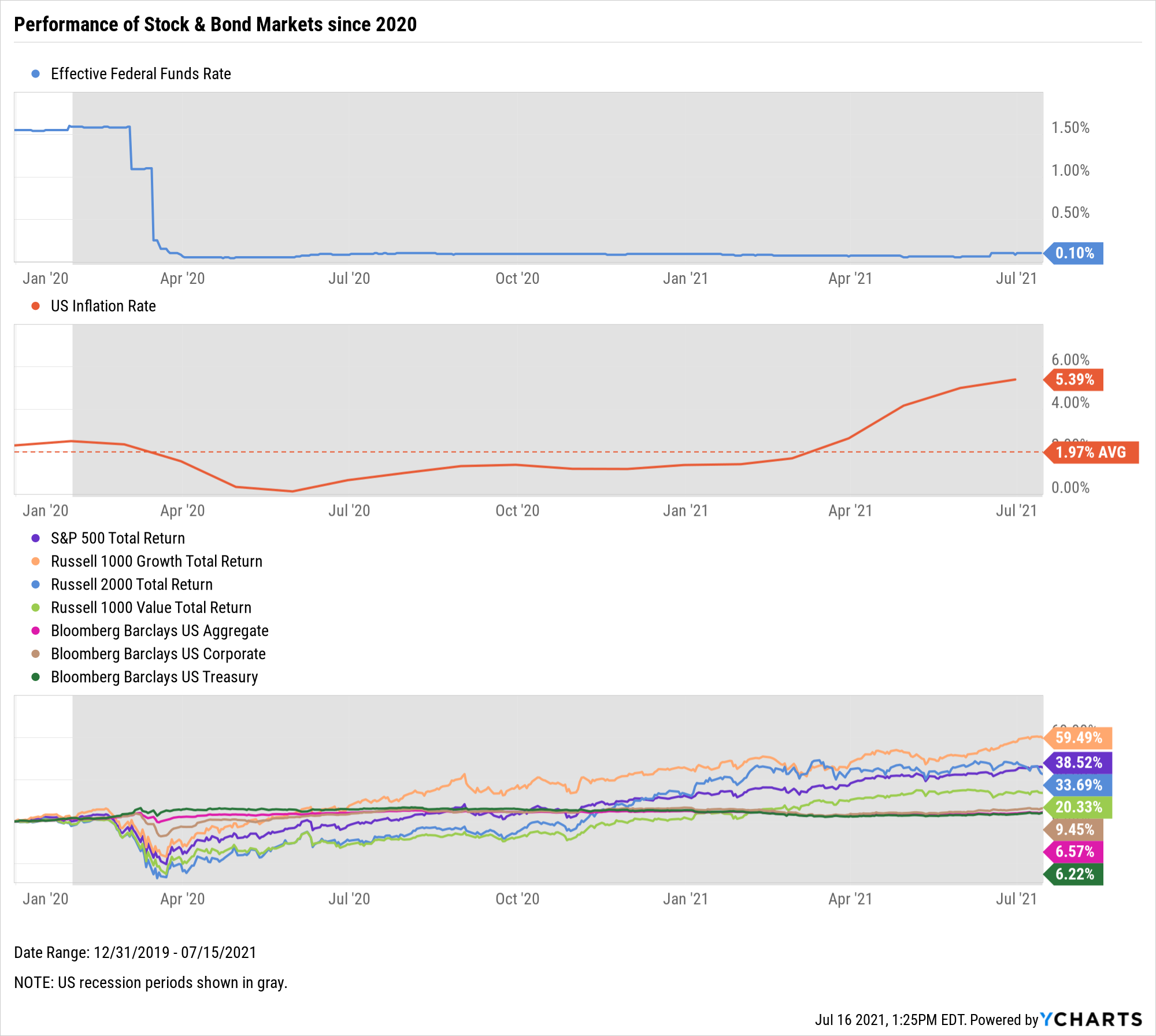

However, while unemployment responded to rate cuts as early as April 2020, inflation started a steady uptrend at the same time, and soon ran away from the Fed’s 2% target.

Download Visual | Modify in YCharts

With the dual mandate front of mind and the global pandemic still present, the Fed maintained the 0-0.25% target range through 2021. When asked about inflation’s rise past 5%, the often-quoted word from Chair Jay Powell has been “transitory”. He and the FOMC have held firm that as long as “inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent” the current rate will be maintained. Inflation eclipsing 5% in 2021 stands in stark contrast to 2008, when cuts to the federal funds rate actually yielded negative inflation rates. It later normalized around the 2% average target.

Download Visual | Modify in YCharts

Similar to the last recession in 2008, stocks and bonds appear to be trending together—for the time being. With inflation rising well above the Fed’s 2% target, transitory or not, only time will tell which assets will meet headwinds or tailwinds.

A Brief History Of Emergency Rate Cuts

In February of 1994, the FOMC decided that it was important to communicate to the public when significant policy decisions were made. Thus began the tradition of “Fed days”, when the committee would announce new interest rates, both short-term and long-term, to allow the markets to adjust more smoothly and predictably.

While the Fed tries to provide the public with a general heads-up on what’s to come, there have been moments in the country’s history when emergency measures have been enacted.

The Fed has made nine emergency rate cuts since 1998:

• October 1998 (25 bps cut): In response to the collapse of Long-Term Capital Management and the Russian financial crisis to prevent an economic slowdown.

• January 2001 (50 bps cut): In response to the dot-com bubble burst to prevent a US recession.

• April 2001 (50 bps cut): In an effort to avoid a recession due to a weakened economy.

• September 2001 (50 bps cut): In response to the terrorist attacks of 9/11 to ensure liquidity to the financial markets.

• August 2007 (50 bps cut): To combat the economic downturn caused by the subprime mortgage crisis.

• January 2008 (75 bps cut): In reaction to the stock market crash to prevent a recession.

• October 2008 (50 bps cut): In response to Lehman Brothers filing for bankruptcy to prevent a recession.

• March 2020 (50 bps cut): To offset the near economic halt at the inception of the coronavirus pandemic and the international economic impact.

• March 2020 (lowered rate to 0%-0.25%): To combat the global economy’s downturn caused by the accelerated spread of the coronavirus.

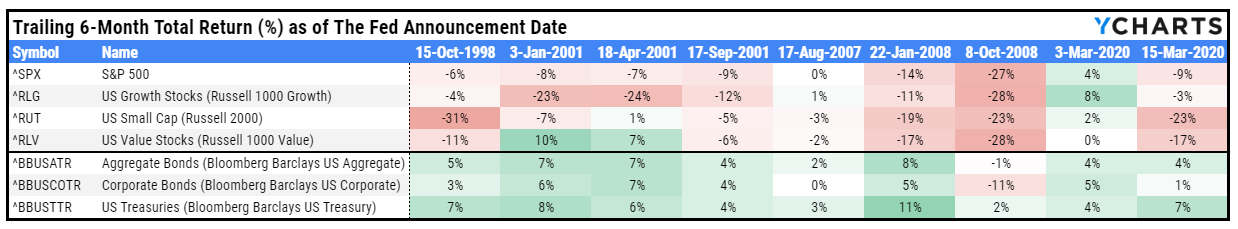

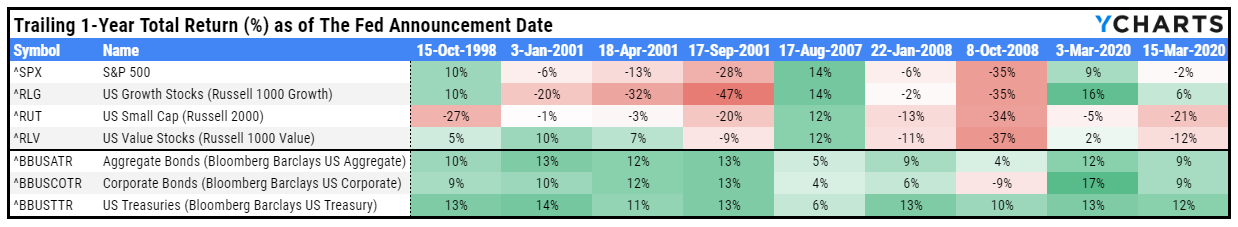

These tables show how different asset classes have performed following emergency rate cuts. There are definitely other factors at play here, but some patterns can be identified in the data:

Trailing 1-Month Performance After Emergency Rate Cut

Trailing 6-Months Performance After Emergency Rate Cut

Trailing 1-Year Performance After Emergency Rate Cut

At a glance, the bond market has historically risen following emergency rate cut announcements, while stocks have been more unpredictable. Rate cuts appear effective for lifting bond prices—as is the expected outcome when yields decline—but equity asset classes have shown inconsistent responses.

While the S&P 500, Dow Jones and Nasdaq continue to perform leaps and bounds, the inflation rate continues to rise beyond the Fed’s goal. Amid continued uncertainty surrounding COVID-19 variants, there are even more factors this time around that could cause further unpredictability.

With inflation on the rise and economic growth picking up, it’s a matter of when, not if, the Fed will increase the federal funds rate. Could it come sooner than the quoted 2023?

Connect with YCharts

To learn more, schedule time to meet with an asset management specialist, call us at (773) 231-5986, or email hello@ycharts.com.

Want to add YCharts to your technology stack? Sign up for a 7-Day Free Trial to see YCharts for yourself.

Originally published on YCharts.

Disclaimer

©2021 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.