The S&P 500 is having another tremendous year, rising by 27% as of Monday's close. In five years, the broad index has nearly doubled in value.

While that's impressive, it also raises the question of whether the stock market is too hot to invest in right now. The concern many investors may have is whether the market is due for a slowdown, or worse: that a bear market may be around the corner.

For growth investors, rather than picking stocks individually, a safer approach nowadays may be to invest in an exchange-traded fund (ETF) that is less vulnerable to a single investment and can still generate solid returns in the long run. These types of investments can help you reduce your risk while staying invested in the market.

A couple of top Vanguard ETFs that can be highly attractive to growth investors are the Vanguard Growth Index Fund ETF (NYSEMKT: VUG) and the Vanguard Mid-Cap Growth Index Fund ETF (NYSEMKT: VOT). Here's a look at why these can be ideal investments to buy and forget about.

Vanguard Growth Index Fund

What's attractive about the Vanguard Growth Index ETF is that it has positions in large U.S. stocks and is suitable for buy-and-hold investors since it has a low expense ratio of just 0.04%.

As of the end of October, the ETF contained 182 stocks with a heavy exposure to tech, which accounts for 58% of its total weight. Apple, Nvidia, and Microsoft are the fund's top holdings, giving investors a position in the leading growth stocks in the world. And those stocks have helped it outperform the S&P 500 over the past five years, with the fund more than doubling in value during that stretch.

While those stocks aren't cheap holdings these days, investing in top tech companies can still be a good way to position yourself for strong returns in the long run. And by having a diverse investment such as the Vanguard Growth Index ETF, you're not overly dependent on any single stock as you might be if you were picking individual companies to add to your portfolio.

Vanguard Mid-Cap Growth Index Fund ETF

For investors craving a bit more upside, Vanguard's Mid-Cap Growth Index Fund may be an enticing option. As the name suggests, it focuses on mid-cap stocks, which can have significant potential in the long run given their more modest valuations.

These can sometimes be risky investments. However, the advantage with an ETF is that not only is the stock-picking done for you, but the risk is also not as significant given the fund's diversification.

The fund contains 140 stocks, and the median market cap is just under $38 billion. It isn't heavily skewed to one sector; tech stocks make up 23% of its holdings, followed by industrials at 22%, consumer discretionary at 14%, and healthcare at 12% -- the only sectors that account for more than 10%.

The largest holding in the fund is Palantir Technologies, but at around 2.3%, its percentage of the ETF's total weight isn't significant enough to have a drastic impact on how the fund does. There's some solid diversification here, making the ETF a more balanced option than other funds. And its expense ratio of 0.07% is also fairly low.

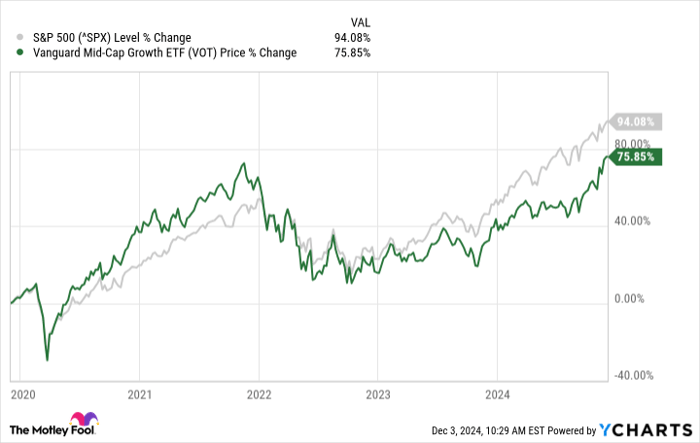

The fund has underperformed the market in recent years, but that doesn't mean the trend will continue. As tech stocks become overvalued, it may only be a matter of time before growth investors target stocks with more upside, like many of the mid-cap stocks within this fund.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $872,947!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Palantir Technologies, Vanguard Index Funds-Vanguard Growth ETF, and Vanguard Index Funds-Vanguard Mid-Cap Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.