The early weeks of January are a wonderful time to reshuffle your stock portfolio and buy great stocks with big long-term upside.

The bull case remains firmly in place even after the stock market’s best back-to-back years since the late 1990s.

That said, the market appears a tad overheated heading into Q4 earnings season next week. There could be some selling pressure to recalibrate valuations and take some of the foam off the top of the market.

Despite tech and broader market valuations looking a bit stretched in the near term, tons of top stocks appear cheap right now.

Let’s dive into two stocks (ALGN and KO) that are trading at least 20% below their average Zacks price targets and offer great long-term value.

This Market-Crushing Stock Trades 70% Below its Highs: Buy ALGN in 2025

Align Technology, Inc.’s (ALGN) clear Invisalign aligners changed orthodontics forever. ALGN has helped doctors treat approximately 18.9 million patients over the past three decades. The stock has soared over 2,300% in the last 20 years vs. the S&P 500’s 430% and the Tech sector’s 800%.

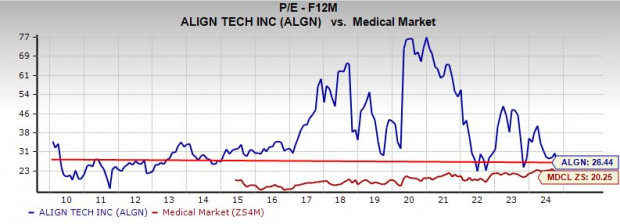

This massive outperformance includes ALGN’s 70% drop from its 2021 highs. The medical tech company’s fall, mixed with its solid earnings growth outlook, has Algin trading near some of its cheapest levels in the past 15 years at 26.4X forward earnings—a discount to Tech. Align is finding support at the low end of the trading range it’s been stuck in since 2017.

Algin trades 25% below its average Zacks price target and 9 of the 13 brokerage recommendations Zacks has are “Strong Buys,” with only one “Sell.” ALGN’s balance sheet is strong, with $6.4 billion in total assets vs. $2.4 billion in liabilities and zero debt. Its Medical - Dental Supplies industry is in the top 10% of over 250 Zacks industries.

Image Source: Zacks Investment Research

Align grew its revenue from roughly $1 billion in 2016 to $3.86 billion in 2023. Wall Street dumped ALGN on slowing sales growth and its plummeting earnings outlook following 60% sales growth in 2021—boosted by consumers flush with cash (it averaged 30% revenue growth between FY16-FY19). That growth is likely over, but Align looks like a buy as it settles into a more mature, slower-growth company.

Align expanded its reach in the key teenage demographic, successfully attracting more customers who might have otherwise used traditional metal braces. Align is also growing internationally.

Alongside its clear aligners, Align’s imaging, scanning, and services segment (17% of 2023 sales) helped it expand and improve its ability to work with dentists and orthodontists. This backdrop helped Align thrive while would-be e-commerce competitor SmileDirectClub went bust.

Image Source: Zacks Investment Research

Align’s earnings outlook has remained flat over the last several months helping ALGN earn a Zacks Rank #3 (Hold). Align is projected to expand its sales by 4% in 2024 and 6% in FY25 to $4.25 billion. ALGN is projected to grow its adjusted EPS by 8% in 2024 and 9% in 2025.

Why One of Warren Buffett’s Favorite Stocks is a Must-Buy for 2025

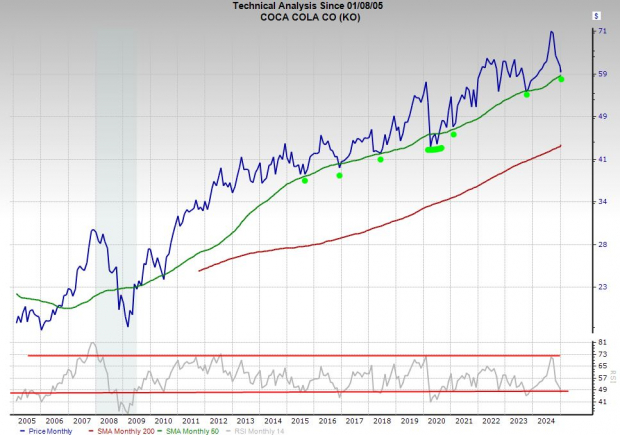

Coca-Cola (KO) stock has tanked 15% since early September after it reached some of its most overbought technical levels of the past two decades. Coca-Cola faces continued inflation challenges alongside many other consumer staples and retail companies.

Rising internal costs and slowing consumer spending are impacting Coca-Cola. Wall Street is also worried about the possible negative impacts the Trump administration and Robert F. Kennedy Jr. might have on processed foods and sugar-heavy beverages.

Image Source: Zacks Investment Research

Thankfully, Coca-Cola has been diversifying beyond sugary sodas for a long time to match changing consumer habits. KO stock is trading right at its 50-month moving average, where it has found support every time it tests that level since the financial crisis.

Valuation-wise, Coca-Cola is trading at a 20% discount to its highs, 11% below its 10-year median, and 8% under the S&P 500 (which KO normally trades at a premium to) at 20.6X forward 12-month earnings.

KO’s dividend yields 3.2% and roughly 75% of the brokerage recommendations Zacks has are “Strong Buys.” Plus, Coca-Cola is one of Warren Buffett’s favorite stocks and a top-five holdings at Berkshire Hathaway.

Part the reason for the long-term bullishness comes from Coca-Cola’s standing as a global brand giant alongside the likes of Mercedes-Benz, McDonald’s, Apple, and others.

Image Source: Zacks Investment Research

The beverage powerhouse’s portfolio includes Gatorade challenger BodyArmor, sparkling water standout Topo Chico, potential Starbucks rival Costa, Fairlife milk, and more beyond its core Coca-Cola and soda brands.

KO is projected to grow its sales by 1% in FY24 and 4% next year to reach nearly $50 billion. Meanwhile, it is expected to expand its adjusted earnings by 6% and 4%, respectively.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

CocaCola Company (The) (KO) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.