The Q4 earnings season has remained strong with companies from various sectors standing out in this week’s lineup. Notably, as of yesterday, earnings from the S&P 500 members were up 19.2% from Q4 2023.

Able to crush their bottom-line expectations on Thursday, here are two intriguing stocks to keep an eye on in the coming weeks.

Alaska Air Group – ALK

Zacks Rank #1 (Strong Buy)

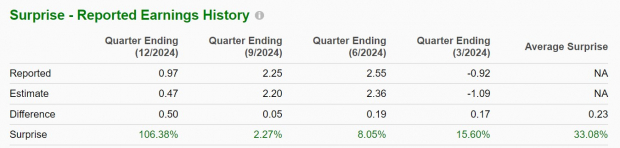

Alaska Air Group ALK stood out in the transportation sector as Q4 EPS of $0.97 blasted estimates of $0.47 a share by 106%. More impressive, this soared from $0.30 per share in the prior-year quarter.

Furthemore, last year’s acquisition of Hawaiian Airlines could be very lucerative with Alaska Air Group stating the integration should start adding to its profits in 2025.

Acquiring Hawaiian Airlines has put the company in a position to take market share from popular regional carriers like Delta Air Lines DAL and Southwest Airlines LUV.

Image Source: Zacks Investment Research

Overall, Alaska Air Group's annual earnings were up 7% in fiscal 2024 to $4.87 per share.

Offering FY25 EPS guidance, Alaska Air Group expects earnings of more than $5.75 a share with the current Zacks Consensus at $5.90 or 21% growth. Plus, Alaska Air Group's EPS is projected to soar another 29% in FY26.

Image Source: Zacks Investment Research

The Travelers Companies – TRV

Zacks Rank #3 (Hold)

Posting a 39% EPS surprise, The Travelers Companies TRV Q4 earnings came in at $9.15 a share compared to expectations of $6.57. This spiked from EPS of $7.01 in the comparative quarter.

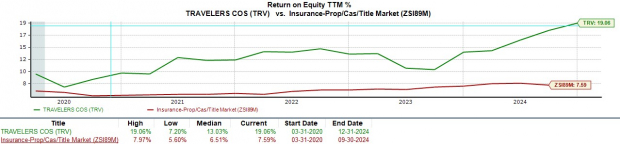

The property casualty insurance giant attributed its strong fiscal year to growth in earned premiums, underwriting probability, and a higher level of net investment income (NII).

Image Source: Zacks Investment Research

Highlighting a 19.2% return on equity, The Travelers Companies' full-year income spiked 64% to more than $5 billion or $21.58 per share versus EPS of $13.13 in 2023. The company also generated its highest level of operating cash flow at $9.1 billion.

Based on Zacks estimates, The Travelers Companies' annual earnings are expected to dip -6% in FY25 but are projected to rebound and rise 9% in FY26 to $22.19 per share.

Image Source: Zacks Investment Research

Bottom Line

Favorable momentum could be ahead for Alaska Air Group and The Travelers Companies stock. To that point, many analysts have started to raise their price targets for ALK and TRV after stellar Q4 earnings.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpThe Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.