Stocks Explode Post-Election

Whether you agree with President-elect Donald Trump’s economic policies or not, one thing is certain: the conclusion of the 2024 U.S. presidential election on Wall Street has unleashed the “animal spirits.” To be fair, stocks have been on a tear since the bear market lows of 2022, boosted by a falling inflation rate, AI/data center spending, and a dovish federal reserve board. That said, whether it was because of more business-friendly policy expectations, less uncertainty, or a combination of both, the recent election threw gas on the fire.

Unleashing the Animal Spirits

You don’t have to look far to notice that the animal spirits are alive and well on Wall Street. Bitcoin and bitcoin proxies like MicroStrategy (MSTR) have gone on rampages higher. In fact, Bitcoin has flipped silver from a market cap perspective. Meanwhile,Tesla (TSLA) just capped its biggest 5-day rally in four years, the lagging ARK Innovation ETF (ARKK) soared 16% in a week, and small caps have clawed their way back to all-time highs after a multi-year drought. Presently, the market is in risk-on mode, and risk-takers are being rewarded handsomely. Below are 2 “spec” meme stocks to consider:

BuzzFeed

BuzzFeed (BZFD) is a left-leaning media organization recognized for crafting engaging content that often goes viral. The media platform combines pop culture trends and current events infused with humor and casual conversation styles that resonate with a younger demographic. BuzzFeed also delves into journalism, news coverage, and video content creation.

Vivek Takes a BuzzFeed Stake

BZFD has struggled since 2021, falling from nearly $60 to under a dollar at one point. However, former Republican presidential nominee, entrepreneur, and future Trump administration cabinet member Vivek Ramaswamy has injected life into the company by taking ~9% stake. In a letter to the BZFD board, Ramaswamy said, “BuzzFeed has lost its way. I own your stock because I believe BuzzFeed can still become a more valuable company than at its initial listing, but this requires a major shift in strategy.”

If anyone can turn around BZFD, it’s Ramaswamy. “Old media”, particularly left-wing media, has been losing viewership, with the latest evidence being Comcast (CMCSA) putting MSNBC up for sale. If Ramaswamy can inject some balance into it, it may have a positive impact. Ramaswamy is a best-selling author with strong connections to “new media” juggernauts like Tucker Carlson.

BZFD Breakout

After coiling for several weeks, BZFD shares are breaking out.

Image Source: TradingView

GameStop

GameStop (GME) is the leading video game retailer, offering the best selection of new and pre-owned video gaming consoles, accessories, and video game titles, in both physical and digital formats.

GME: The Original Meme Stock

Though GameStop is known for being a video game retailer, on Wall Street, its claim to fame is being the king of the meme stocks and speculation. GME has rewarded investors with several short squeezes in its history, most notably the 1600% one-month gain in early 2021. While many investors may scoff at GME’s fundamentals, the meme mania has real-world benefits on the company.

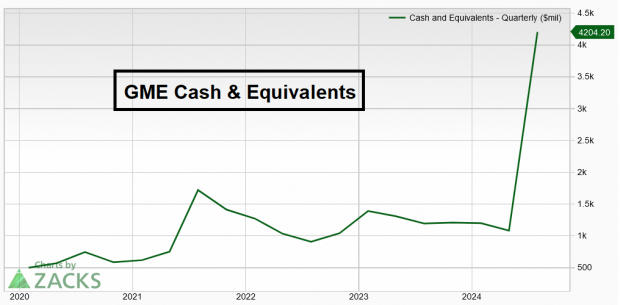

GameStop’s Massive Cash Hoard

Normally, when a stock becomes a meme stock, it has no net benefit when it eventually crashes down. However, GME’s management team has been savvy and sold millions of shares worth of the stock the last few times it spiked. Now, GME has a massive cash hoard.

Image Source: Zacks Investment Research

The company’s massive cash position gives GME the flexibility to invest back into its business, expand into other businesses, pay a special dividend, etc.

Bottom Line

The U.S. election set off the animal spirits on Wall Street. With meme stocks in vogue, GME and BZFD are two stocks with bullish catalysts worth considering.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Comcast Corporation (CMCSA) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

ARK Innovation ETF (ARKK): ETF Research Reports

BuzzFeed, Inc. (BZFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.