The healthcare space has been less intriguing than other areas of the economy with notable stocks like Bristol Myers (BMY), Gilead Sciences (GILD), and Pfizer (PFE) all down sharply this year.

Still, there is no question as to the importance healthcare has to society and a few Zacks Medical sector stocks are starting to stand out at the moment.

Here are two top-rated Medical stocks that investors may want to consider buying right now.

HealthEquity (HQY)

Sporting a Zacks Rank #1 (Strong Buy) HealthEquity’s stock is very attractive at the moment with the company’s outlook starting to brighten.

HealthEquity is a provider of integrated solutions for healthcare account management, health reimbursement arrangements, and flexible spending accounts for health plans, insurance companies, and third-party administrators in the United States.

Image Source: Zacks Investment Research

Standing out among the Zacks Medical Services Industry, HealthEquity’s sales are forecasted be rise 13% in its current fiscal 2024 and jump another 13% in FY25 to $1.1 billion.

Even better, while HealthEquity’s stock has been virtually flat this year there could be more upside ahead as earnings estimate revisions have trended higher over the last quarter.

HealthEquity’s earnings are now expected to climb 35% in FY24 at $1.84 per share compared to EPS of $1.36 in FY23. More impressive, FY25 earnings are projected to soar another 29% at $2.38 per share.

Image Source: Zacks Investment Research

iRadimed (IRMD)

Among the Zacks Medical-Instruments Industry, iRadimed’s stock looks attractive with a Zacks Rank #2 (Buy).

iRadimed provides a broad range of magnetic resonance imaging (MRI) compatible products with earnings estimates remaining higher and supportive of this year’s rally in shares of IRMD.

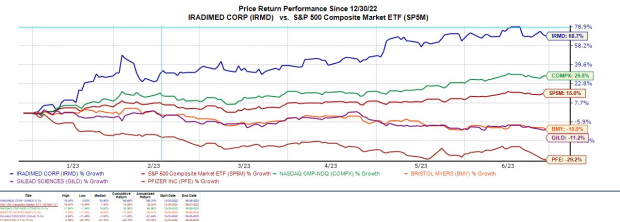

Notably, iRadimed stock has soared +69% YTD to largely outperform the broader indexes and obliterate the Zacks Medical-Instrument Markets’+6%.

This has also crushed the lackluster stock performances of healthcare giants Bristol Myers, Gilead Sciences, and Pfizer.

Image Source: Zacks Investment Research

iRadimed’s earnings are now anticipated to jump 19% this year at $1.31 per share compared to EPS of $1.10 in 2022. Plus, fiscal 2024 earnings are forecasted to rise another 14% at $1.50 per share.

Solid top-line growth is also expected, with sales projected to climb 19% in FY23 and rise another 11% in FY24 to $70.30 million.

Image Source: Zacks Investment Research

Bottom Line

The outlook for these top-rated Zacks Medical sector stocks is very intriguing making them worthy of investors’ consideration. With solid top and bottom-line growth on the horizon for HealthEquity and iRadimed, they are starting to look like viable investments for 2023 and beyond.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

iRadimed Corporation (IRMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.