After experiencing the worst correction since the 2008 financial crisis, internet stocks are hot again. Many stocks in the industry got way ahead of themselves in the hype of 2021, but now have returned to much more reasonable levels. This creates a fantastic opportunity for discerning investors who are interested in buying technology stocks with solid brands and continued sales growth.

Booking Holdings

Booking Holdings BKNG is one of the largest online travel companies in the world. Through its websites Booking Holdings has agreements with hotels, airlines companies, cruise ships, transport companies and vacation providers, which enable it to accept bookings on their behalf. BKNG operates Booking, Kayak, Agoda, Priceline, OpenTable and several other online booking sites.

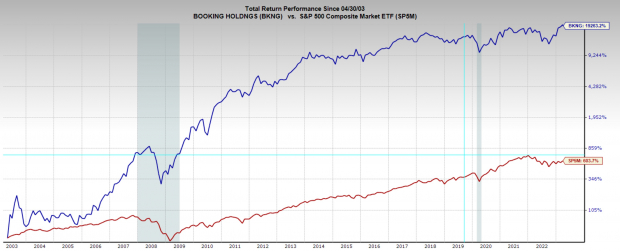

Over the last 10 years Booking Holdings has had a strong performance. Compounding at 13% annually, and returning a total of 247%, the stock has outperformed the broad market.

Image Source: Zacks Investment Research

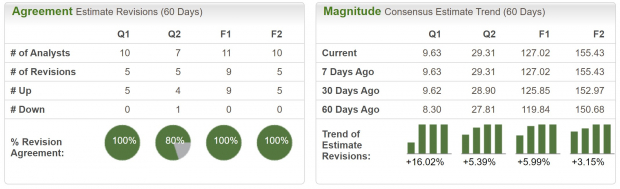

BKNG currently boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Sales and earnings estimates are looking extremely strong and continue to be revised higher. Current quarter sales are expected to grow 35% YoY to $3.6 billion, while current quarter earnings are projected to climb 147% YoY to $9.63 per share.

Analysts have really boosted their estimates for BKNG, and current quarter earnings have been revised 16% higher over the last 60 days. After travel came to a standstill following the Covid-19 pandemic, it looks like domestic and international travel trends are incredibly strong.

Image Source: Zacks Investment Research

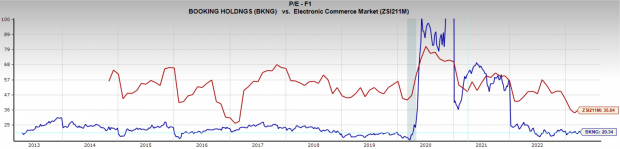

Booking Holdings is trading at a one-year forward earnings multiple of 20x, which is below its 10-year median of 23x, and well below the industry average 37x.

Image Source: Zacks Investment Research

Even though BKNG was one of the early pioneers of internet-based businesses, the company still has tremendous secular tailwinds. People around the world are still shifting to booking travel plans online, and with the explosion of mobile phone users, the trend is even further amplified. Additionally, the bulk of BKNG’s business now comes from international markets, where growth prospects are significantly higher. In many international geographies there is a rapidly growing middle-class that are ready to travel and book online.

Baidu

Baidu BIDU is a China based search engine and diversified technology company. Similar to its American counterpart Alphabet GOOGL, Baidu provides a litany of online services including video, maps, scholar, smart assistant and many others.

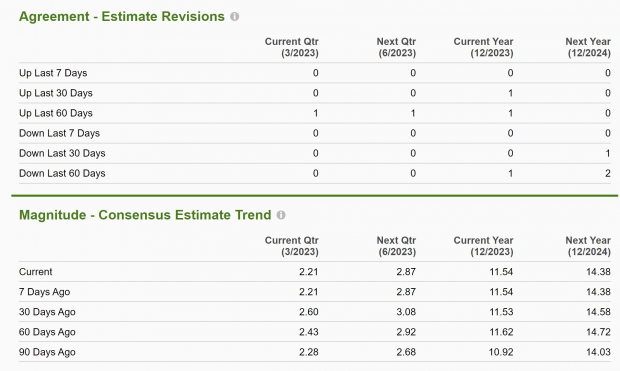

BIDU boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Current quarter sales estimates are tepid, projecting flat YoY growth, but earnings are still expected to jump 46% YoY to $2.60 per share. Current year sales are expected to grow 10% YoY to $20 billion, and earnings are projected to grow 35% to $11.53 per share.

Image Source: Zacks Investment Research

Baidu is trading at a significant discount to its historical valuation. Its one-year forward earnings multiple is 14x, which is well below its 10-year median of 30x, and the industry average of 23x.

BIDU along with many other technology and Chinese stocks has had a very challenging two years. Over that period, it is down -42%. While that may make some investors nervous, it also creates opportunity and is the reason the stock is trading at such a historical discount.

Image Source: Zacks Investment Research

Investing in Chinese equities comes with some additional risk, but if you can stomach it, BIDU is a critical piece of China’s technology infrastructure. The company invests heavily in innovation and is a leader in AI technology.

Free Report: Must-See Hydrogen Stocks

Hydrogen fuel cells are already used to provide efficient, ultra-clean energy to buses, ships and even hospitals. This technology is on the verge of a massive breakthrough, one that could make hydrogen a major source of America's power. It could even totally revolutionize the EV industry.

Zacks has released a special report revealing the 4 stocks experts believe will deliver the biggest gains.

Download Cashing In on Cleaner Energy today, absolutely free.Baidu, Inc. (BIDU) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.