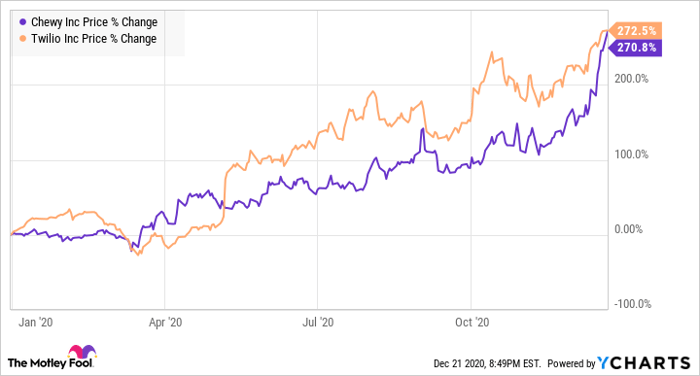

Chewy (NYSE: CHWY) and Twilio (NYSE: TWLO) have set the stock market on fire in 2020, as shares of both companies more than tripled this year thanks to the coronavirus pandemic, which gave their businesses a nice shot in the arm.

While Chewy benefited from a rise in online purchases of pet supplies during the pandemic, Twilio's tailwind came in the form of an acceleration in the adoption of cloud-enabled contact centers.

Let's take a closer look at how the year unfolded for these two high-flyers, and why they look like solid bets for 2021.

Image source: Getty Images.

1. Chewy has stepped on the gas and it can sustain its growth

Chewy started the year on the front foot with solid first-quarter guidance, driven by favorable shopping behavior that led to an increase in purchase size and a sharp increase in customers. In fact, Chewy has seen tremendous growth in its active customer count during the first nine months of the year.

|

Metric |

Q1 2020 |

Q2 2020 |

Q3 2020 |

|---|---|---|---|

|

Active customers (millions) |

15 |

16.6 |

17.8 |

|

Year-over-year growth |

32.6% |

37.9% |

39.8% |

|

Net sales per active customer |

$357 |

$356 |

$363 |

Data source: Chewy quarterly reports.

A combination of higher customer count and an increase in net sales per active customer has helped Chewy clock impressive revenue and margin growth in 2020, as the chart below shows.

CHWY Revenue (TTM) data by YCharts

Chewy is on track to end the year on a high, as the company's guidance for this quarter indicates. It projects year-over-year revenue growth between 43% and 45% this quarter, while full-year sales are expected to land between $7.04 billion to $7.06 billion -- an increase of 45% to 46% over the prior year. That would be better than the 40% revenue growth Chewy achieved in 2019.

Chewy believes that it can keep up this momentum in the new year -- its customer retention rate has spiked 600 basis points so far in 2020. The company doesn't expect to incur additional spending on customer retention in 2021 because the new customers it has acquired this year are likely to continue purchasing in a post-pandemic scenario, as the increase in the average order value suggests.

Chewy's expectation isn't out of place. Online sales of pet products were growing at a much faster pace than physical sales even before the pandemic. For instance, the online pet retail market in the U.S. jumped a whopping 275% in 2018 compared to just 14.4% growth in the physical retail channel, according to third-party estimates.

The good news for Chewy investors is that this market still has a lot of room for growth. The e-commerce channel reportedly accounted for just 13% of pet products sales last year. The share of the online channel is expected to grow to 27% in 2020 and 34% next year, according to asset management firm Needham & Company's estimates.

Chewy has become a major player in this space in 2020. Management pointed out on the second-quarter earnings conference call earlier this year that online sales of pet products are on track to increase $3.9 billion in 2020, as per pet industry data provider Packaged Facts.

Chewy's full-year 2020 guidance suggests that it could add $2.2 billion in revenue this year, cornering a lion's share of the incremental revenue of the overall market and putting itself in a nice position to tap into the long-term opportunity. Throw in the fact that Chewy has been diversifying into new, multibillion-dollar verticals, and this should give investors more reasons to be bullish about this growth stock in the long run.

2. Twilio delivers another fantastic year

Cloud communications specialist Twilio has had another solid year, despite a shaky start. The earnings guidance it issued at the beginning of 2020 was met with lukewarm guidance, but the company has got its act together with terrific growth quarter after quarter.

TWLO Revenue (TTM) data by YCharts

Twilio's revenue shot up 52% year over year in the third quarter of 2020, thanks to a 21% increase in the number of active customer accounts as well as an increase in purchases by existing customers. The company anticipates $450 million to $455 million in revenue this quarter, an increase of 36% to 37% over the prior-year period.

If Twilio hits the midpoint of its fourth-quarter guidance range, its full-year revenue would increase by around 48% compared to 2019 levels. But it won't be surprising to see Twilio exceed its own expectations, as the recently completed acquisition of customer data provider Segment for $3.2 billion is likely to open up additional cross-selling opportunities for the company.

Segment is expected to boost Twilio's market opportunity by $17 billion and add to the terrific momentum the company is already witnessing. That's because the customer data platform market is expected to hit $10 billion in size by 2025, compared to $2.4 billion last year, per a third-party estimate.

Additionally, Twilio now has a new service for its existing customers. This could help Twilio further boost its dollar-based net expansion rate -- a metric that rises when the company's existing customers buy additional offerings or increase their spending on its services. As the chart below shows, Twilio's dollar-based net expansion rate has started creeping up of late, while the number of active customer accounts has moved north consistently.

Data source: Twilio quarterly reports. Chart by author.

The addition of Segment into the mix could lead to further growth in the purchases made by Twilio customers. Segment should also help the company boost its customer base because of the fast-growing market that it operates in.

In all, the addition of a new growth avenue and the growing adoption of cloud contact centers in the wake of the COVID-19 crisis could help Twilio switch into a higher gear and exceed the 30% annual revenue growth rate that it currently expects to clock over the next four years. All of this makes Twilio a tech stock that's worth holding on to, even after a terrific 2020 as the New Year could bring more good news for investors.

10 stocks we like better than Twilio

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Twilio wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Twilio. The Motley Fool recommends Chewy, Inc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.