The rapidly growing adoption of artificial intelligence (AI) has given shares of many companies a big boost in the past couple of years, and that's not surprising as this technology is expected to impact the global economy in a big way.

According to management consultancy giant PwC, generative AI could contribute a whopping $15.7 trillion to the global economy by 2030 by driving productivity gains and product enhancements that will lead to improved consumer demand. Not surprisingly, several companies are trying to make the most of this opportunity by integrating AI-focused offerings into their products and services.

The good part is that many of these companies have witnessed a nice bump in their businesses thanks to AI, a trend that's likely to continue considering that the technology is currently in its early phases of growth. That's the reason why buying and holding on to solid AI stocks for a long time to come could turn out to be a smart move. Such a strategy will allow investors to capitalize on this disruptive trend while also benefiting from the power of compounding.

This article considers two AI stocks that seem a good fit for investors looking to build a million-dollar portfolio. AI adoption is already having a positive impact on both these companies, and they could deliver outstanding gains to investors in the long run thanks to the lucrative markets they operate in.

1. Palantir Technologies

Software platforms provider Palantir Technologies (NYSE: PLTR) went public just over four years ago in September 2020. The stock has shot up a remarkable 544% since then (as of this writing), with most of the gains arriving since last year.

Someone who invested $1,000 in Palantir stock when it went public would be sitting on more than $6,400 right now. More importantly, this red-hot stock has room for more growth in the long run as it has started benefiting from the booming demand for AI software platforms.

The company's revenue in the third quarter of 2024 increased 30% year over year to $726 million, along with a 43% increase in adjusted earnings to $0.10 per share. Palantir's growth has kicked into a higher gear as the company's top line increased at a slower pace of 17% in the same quarter last year. The solid demand for Palantir's Artificial Intelligence Platform (AIP), which allows users to integrate generative AI solutions into their operations to make them more effective, is playing a central role in driving this accelerated growth.

Palantir CEO Alex Karp said in his recent shareholder letter that AIP has "transformed our business." The robust demand for this AI software platform led to impressive growth in the company's customer base and deal size. For instance, Palantir's customer count increased by 39% year over year in Q3, an improvement over the 34% jump it witnessed in the same quarter last year.

Additionally, the company closed 104 deals valued at $1 million or more in the previous quarter, up from 80 in the same quarter last year. This combination of an increase in the company's customer count along with the bigger deals that it is signing allowed Palantir to build a sizable revenue pipeline.

The company's remaining deal value at the end of the previous quarter was $4.5 billion, up by 22% from the prior year. This metric refers to the "total remaining value of contracts as of the end of the reporting period." Meanwhile, Palantir's existing customers are also increasing their use of the company's services. This is evident from the net-dollar retention rate of 118% in Q3, a nice jump from the 107% reading in the same period last year.

Palantir said this metric is calculated by dividing the trailing-12-month revenue at the end of a quarter by the trailing-12-month revenue recognized in the year-ago period by those same customers. So, a reading surpassing 100% suggests that Palantir's existing customers are spending more on its offerings. This also explains why Palantir's adjusted operating margin has jumped by 11 percentage points in the first nine months of 2024 to 37%, leading to outstanding growth in its earnings.

More importantly, market research firm International Data Corporation (IDC) estimates that the AI software platforms market could hit $153 billion in revenue in 2028 from just $28 billion last year. So, there is still a lot of room for Palantir to achieve further growth in its revenue and earnings in the long run. This is why investors looking to buy an AI stock that could help them construct a million-dollar portfolio can still consider this software specialist before it flies higher.

2. Arm Holdings

British technology company Arm Holdings (NASDAQ: ARM) went public in September last year, and its shares have more than doubled since then, with outstanding gains of 102% as of this writing. However, a closer look at the company's business model will show that it still has a lot of upside to offer.

After all, Arm's intellectual property (IP) is used by chipmakers and original equipment manufacturers (OEMs) to design chips. Arm licenses its chip designs to customers for a fee and also receives a royalty from them for each chip manufactured and sold using its IP. The good part is that Arm enjoys healthy market share across multiple semiconductor end markets.

For instance, the company says 99% of smartphone application processors are manufactured using its designs. What's worth noting here is that even though the smartphone market has been growing at a slow pace, Arm's royalty revenue from this segment has been rising at a nice clip. More specifically, Arm's smartphone royalty revenue increased 40% year over year in Q3 2024, significantly outpacing the mid-single-digit jump in smartphone shipments during the same period.

Arm management pointed out that the stronger growth in smartphone royalty revenue was driven by the growing adoption of its Armv9 architecture, which carries a higher royalty rate over the previous architecture. Armv9 now accounts for 25% of Arm's total royalty revenue, suggesting that it still has a lot of room for growth in the future.

A big reason why Armv9 adoption should gain momentum is because the company designed this architecture to tackle AI workloads. This explains why the architecture has been used by Apple to design the chipset for its AI-capable iPhone 16 lineup. With the demand for generative AI smartphones set to increase at an annual rate of 78% through 2028 to 912 million units at the end of the forecast period, as per IDC, it won't be surprising to see more companies turning to Arm to design their AI chipsets.

Moreover, Arm points out that Armv9 is gaining traction in the cloud computing market as well. Nvidia, for instance, developed its Grace AI CPU (central processing unit) using the Armv9 instruction set. Again, this is another area that could drive outstanding growth for Arm as the demand for AI chips is set to grow at an incredible pace in the long run.

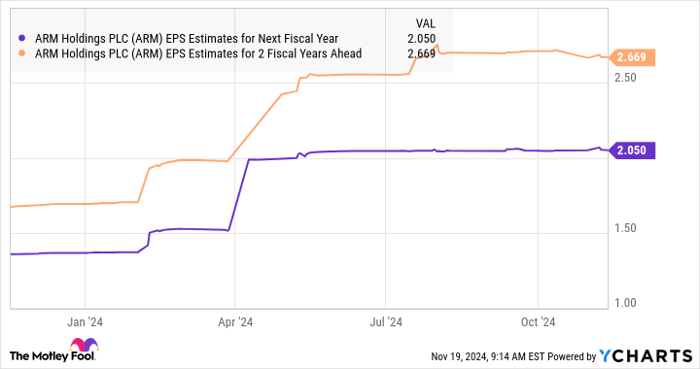

All this explains why analysts are forecasting an acceleration in Arm's earnings growth. The company expects to finish the current fiscal year with $1.55 per share in earnings, which would be a 22% improvement over the previous fiscal year's reading of $1.27 per share. However, the growth forecast for the next couple of years is stronger.

ARM EPS Estimates for Next Fiscal Year data by YCharts.

So, just like Palantir, there is a good chance that Arm could maintain its impressive stock market rally thanks to the healthy AI-fueled growth in its earnings. Also, considering the critical role that Arm plays in the global chip market, it looks like an ideal fit for a million-dollar portfolio because of the business model that has helped it build a solid moat.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $380,291!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,278!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,003!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.