It's been about 59 years since Warren Buffett took the helm at Berkshire Hathaway. He paid roughly $14.86 per share in 1965 to take control of the holding company. These days, the A-class shares, which have never split, trade for more than $700,000, making Buffett arguably the best stock picker of the past six decades.

Buffett has done a lot more selling than buying lately, but one stock he's enthusiastically accumulated over the past year belongs to America's only satellite radio provider, Sirius XM Holdings (NASDAQ: SIRI). At the end of September, Buffett held over 105 million shares worth about $2.5 billion.

Unfortunately for Buffett and the rest of Berkshire Hathaway's shareholders, Sirius XM stock has been a disaster lately. It's fallen 54% from the end of 2023 through Nov. 19, 2024.

Buying quality stocks when they're underappreciated is a big part of Buffett's successful investing strategy. Here's a look at why the stock has been beaten down, to see if it could be a smart buy at recent prices.

Why Sirius XM stock is way down in 2024

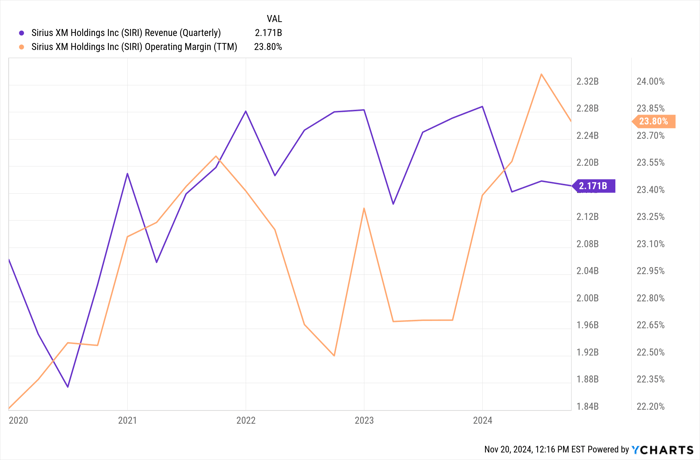

It doesn't take a degree in economics to see that there's a problem over at Sirius XM. Quarterly revenue rose sharply for several years before the COVID-19 pandemic. Unfortunately, sales peaked in late 2021 and have been stagnant or declining since.

The company acquired Pandora in 2019, but it still relies on Sirius XM subscribers for 70% of total revenue. The stock is way down this year because subscription revenue hasn't been so reliable. In the third quarter, subscriber revenue from the Sirius XM segment fell 5% year over year to $1.5 billion.

At the end of September, Sirius XM had 33.2 million subscribers. That's about 800,000 fewer subscribers than it reported at the end of 2021.

Mobile internet infrastructure throughout North America is more robust than it was just a few years ago. The number of folks who can open the Spotify (NYSE: SPOT) application on their new car's touchscreen is also much higher. This could explain why it looks like the audio streaming leader is eating Sirius XM's lunch.

While Sirius XM was losing users, Spotify was gaining them hand over fist. The audio streamer reported third-quarter U.S. revenue that rose 18.6% year over year to $1.6 billion, which is now more than the Sirius XM segment receives from all its subscribers.

Why Buffett loves Sirius XM stock

If you want to use the satellite radio feature that came with your vehicle, Sirius XM is your only option. The company earns some money from advertising, but relatively reliable subscriptions to Pandora and Sirius XM are responsible for more than three-quarters of total revenue.

In addition to an advantage as the only satellite radio provider, Sirius XM has another feature Buffett appreciates: Healthy profit margins.

SIRI Revenue (Quarterly) data by YCharts.

Quarterly revenue may be down, but so are the number of customer service representatives necessary to support a stagnant user base. The well-run company's operating margin over the trailing 12-month period rose to 23.8%.

Berkshire Hathaway doesn't pay a dividend, but Buffett appreciates businesses that do. Sirius XM has raised its payout by 22.9% since the middle of 2022. The stock offers a 4.3% yield at recent prices.

A bargain now?

On the surface, Sirius XM stock looks like a terrific bargain at the low price of 7.95 times trailing 12-month earnings. At such a low multiple, investors could come out miles ahead if profits hold steady over the long run.

Unfortunately, profits available to distribute to investors have been in steep decline. Management expects free cash flow to decline from $1.2 billion in 2023 to approximately $1 billion this year.

Free cash flow is currently sufficient to support the company's dividend, but it's been declining since early 2022. I hate arguing with Buffett, but I'm not sure buying Sirius XM stock is a great idea right now.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 18, 2024

Cory Renauer has positions in Spotify Technology. The Motley Fool has positions in and recommends Berkshire Hathaway and Spotify Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.