UFP Technologies (NASDAQ: UFPT) is a "designer and custom manufacturer of comprehensive solutions for medical devices, sterile packaging, and other highly engineered custom products." In layman's terms, UFP Technologies works with medical device manufacturers to develop a wide array of single-use, single-patient devices and components used in the medical technology (medtech) industry.

Serving the booming $500 billion medical device market, the company has delivered total returns in excess of 10,200% since 2000, making it a 103-bagger over that time.

Thanks to this history of success, I took a flyer on UFP and opened a starter position in early 2023 when the company's price-to-earnings (P/E) ratio was only 22 (despite reporting sales growth of 91% in Q3 of 2022).

Since then, UFP's stock has more than doubled -- even after recently dipping 19% from its all-time highs set in September. Despite this sudden spike in share price, I believe there are plenty of reasons for UFP to continue moving higher -- especially over the long term.

Here's why I am planning to make new additions to this winning investment, and why I intend to hold my shares for a long time to come.

How has UFP outpaced the market so far?

In the medtech industry for over 60 years, UFP currently counts 26 of the world's largest 30 medical device manufacturers as customers. These companies bring their ideas to UFP, where they collaboratively design and customize each idea to fit the specific solution needed.

The beauty of this model is that the manufacturers' ideas are self-funded and brought to UFP to check for feasibility and potential production using the company's patents and its (sometimes exclusive) access to certain materials. This model ultimately lets UFP handpick the product ideas that it green-lights, enabling it to focus on higher-margin ideas that are typically single-use, single-patient applications.

To give an example of what this looks like, consider UFP's current four-year, $500 million agreement as a preferred partner with Intuitive Surgical. Working in collaboration with the robotic-assisted surgery (RAS) leader, UFP developed "drapes" for the company's robots to "wear," separating the robot from the instruments used in during surgery while allowing for necessary flexibility.

Now UFP's largest product category, these drapes equal nearly one-third of the company's sales and are positioned to grow stronger, as evidenced by Intuitive Surgical's 13% sales growth rate over the last decade.

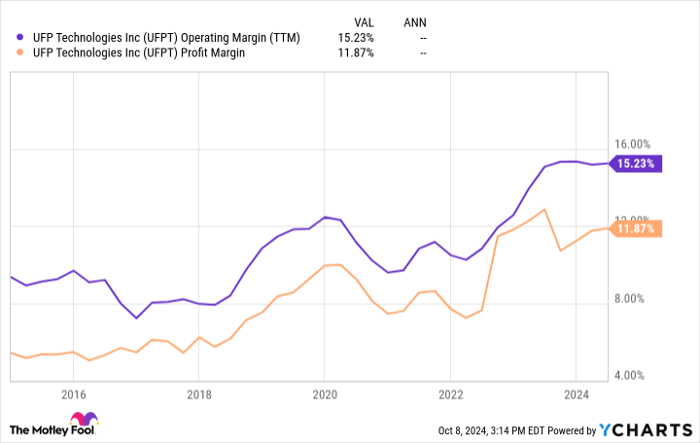

Thanks to long-standing agreements like these with its customers -- and handpicking promising products that it deems worthy of pursuing -- UFP has seen its margin profile improve dramatically over the last few years.

UFPT Operating and Profit Margin (TTM) data by YCharts

Powered by these improving margins, the company's free cash flow (FCF) and net income have grown by 17-fold and 7-fold, respectively, since 2014. This profitability and FCF generation give UFP ample funding to pour into its growth efforts, which primarily come through tuck-in mergers and acquisitions (M&A).

Image source: Getty Images.

Why UFP looks like it could keep beating the market

Not only does UFP's improving profitability give it extra funding for M&A, but early results show that the company is doing an excellent job of integrating acquisitions. With its return on invested capital (ROIC) rising from 8% during the pandemic to 15% today, it is fair to say that the eight acquisitions the company made in the meantime have begun paying immediate dividends.

Focusing on strategic acquisitions that are accretive within the first year, the company aims to add companies that bring new capabilities, geographies, market segments, materials access, or a combination of the four.

One example of UFP leveraging its know-how in the medtech space was its recent acquisition of AJR Enterprises, a manufacturer of patient transfer devices. Since AJR's only customer was Stryker, it was purchased at a deep discount to standard medtech valuations, as private equity companies can't accept the risk of only serving one customer.

However, since Stryker is already a customer of UFP's for patient bedding, this risk doesn't factor in as much for them -- and, if anything, only reinforces the duo's ongoing relationship.

Meanwhile, UFP's 2024 acquisition of Marble Medical gave it access to its first-ever distributorship with 3M, allowing for new stick-to-skin and robotic drape applications. By gaining access to certain materials like this, UFP adds to its ever-widening moat.

With potential competitors facing barriers to entry thanks to UFP's access to exclusive materials, its long list of quality certifications, an extensive patent portfolio, and over 60 years of customer relationships in place, UFP will be hard to disrupt anytime soon.

Over the next three to five years, management expects sales to grow between 12% and 18% -- a potential step up from the 13% annualized growth it saw over the last decade. These expectations, paired with the medtech industry's projected growth of 6% annually through 2032, make me feel comfortable to add to UFP at a lofty 40 times forward earnings.

Ultimately, UFP's ability to expand its margins while reinforcing its moat through tuck-in acquisitions makes it the exact kind of winning investment that I believe will keep on winning. And I don't want to miss an excellent investment waiting for a "perfect" price.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Josh Kohn-Lindquist has positions in Ufp Technologies. The Motley Fool has positions in and recommends Intuitive Surgical. The Motley Fool recommends 3M. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.